/EV%20charging%20spot%20by%20Patpitchaya%20via%20iStock.jpg)

Lucid Group (LCID) is having a rough start to the week, down more than 9% this Monday after a Redburn Atlantic downgrade to “Sell” and a price target cut to $1.13. The negative note comes amid ongoing struggles for the electric vehicle (EV) industry, punctuated by the recent bankruptcy of Nikola - and it’s just ahead of Lucid’s upcoming earnings report, which is due out after the close this Tuesday, Feb. 25.

Lucid Group Q4 Earnings Preview

Deliveries for the California-based EV company showed promising signs in Q4 2024, reaching 3,099 vehicles - a substantial 79% year-over-year increase and an 11.4% sequential improvement from Q3. But Lucid continues to face substantial challenges, particularly regarding manufacturing scale limitations and high vehicle production costs.

The company's financial outlook remains a critical concern, with analysts projecting significant cash outflows through 2030 as Lucid scales its mid-size platform production. While the company maintains sufficient liquidity into 2026 and benefits from strong backing through Saudi Arabia's Public Investment Fund, investor sentiment remains cautious due to LCID’s ongoing cash burn and shareholder dilution concerns.

Tuesday night’s upcoming Q4 earnings report is expected to show revenue growth of 34.6% year-over-year to $211.6 million.

What Are Options Traders Pricing in for Lucid Stock?

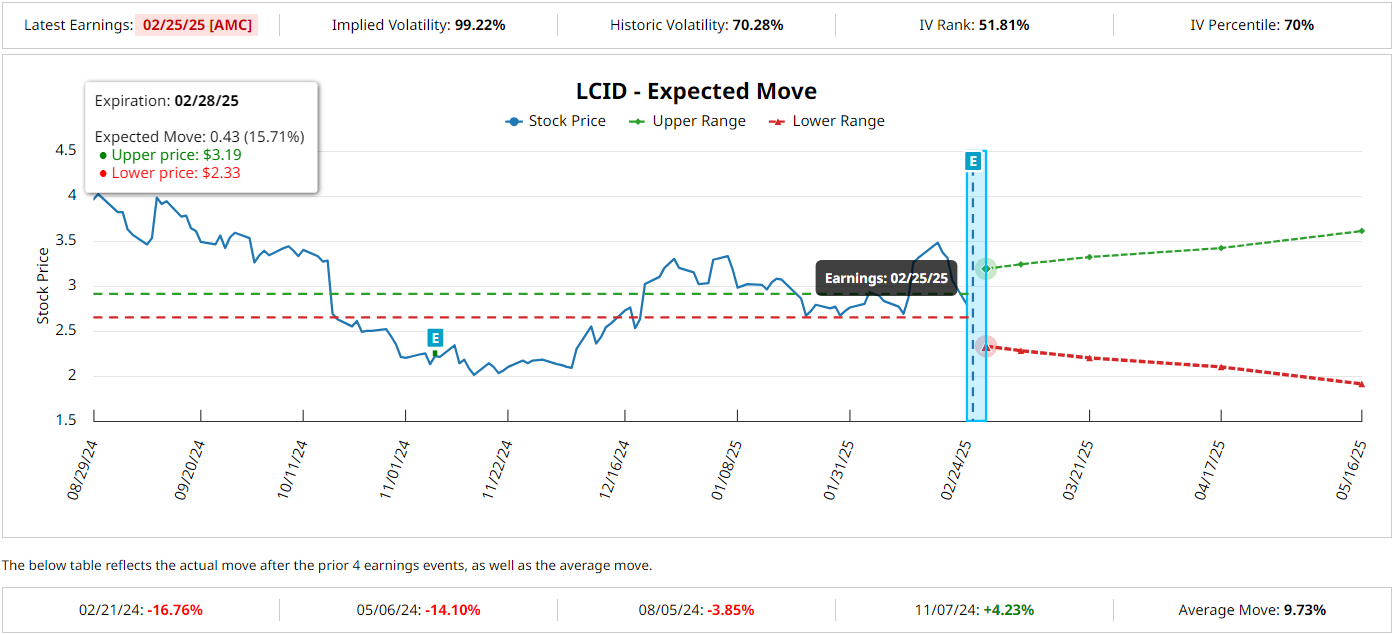

Options traders are bracing for a volatile reaction from LCID after earnings. An at-the-money straddle expiring after the close this Friday is currently pricing in a move of 15.7% in either direction, compared to LCID’s average earnings reaction of 9.73% after its past four quarterly reports.

For the record, a move of that magnitude would be rare for LCID, but not out of the question; the EV stock fell 16.76% in a single day after its February 2024 earnings announcement.

Lucid Stock: Buy, Hold, or Sell?

LCID has a consensus “Hold” rating among analysts, and Redburn Atlantic now has the Street-low price target of $1.13 - which is less than half the stock’s current price. Out of the 11 analysts following Lucid, only two consider it worthy of a “Buy” rating.

Overall, the launch of the new Gravity SUV represents a crucial expansion of Lucid's product lineup, though successful execution of its production ramp-up will be essential for the company's future success. The combination of engineering efficiency advantages and strong Saudi backing provides some stability, but Lucid still needs to demonstrate clear progress toward improved cost efficiency and manufacturing scale to regain investor confidence.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)