Howdy market watchers!

It was a frigid week across the country and many parts of the Northern Hemisphere. Record lows were set in many areas while snow cover was present, but limited for full protection from the cold.

Winterkill in winter wheat is in focus given variable snow cover and overall dry conditions going into this polar plunge. Enjoy the snow while it lasts as rising temperatures next week reaching highs near 70 degrees F will spark spring fever. The other factor that could drive the wheat market back higher is the lack of moisture in the next several weeks for the Southern US Plains. The recent snow was welcome moisture, but ultimately will not amount to much at all.

Natural gas surged Tuesday, Wednesday and early session Thursday trading to the highest level since December 2022. This has added premium to urea prices as demand has also increased for spring top-dress application and planting. While nat gas demand has increased as evident from this week’s EIA data showing withdrawal’s larger than expected, larger than last year as well as the 5-year average, rising temperatures next week and more talk of a potential “deal” in the Black Sea region could bring downward pressure to this contract next week. There remains an open chart gap $1.26 lower from the end of January. We should see urea prices come down should that gap be filled in the week/s ahead.

We continue to see negotiations arise globally between the Trump Administration and nearly all notable economies. Europe, in particular, is receiving increased pressure to take a more active role in regional conflicts. It also became clear this week that there is a growing divide between the EU, who backs the Ukraine, and Trump, who is cozying up closer to Putin in recent dialogue. Where all this will end is unclear, but what does seem certain is that the endless billions of US taxpayer dollars flowing to the Ukraine will no longer be the norm unless it starts coming from Europe, which is unlikely.

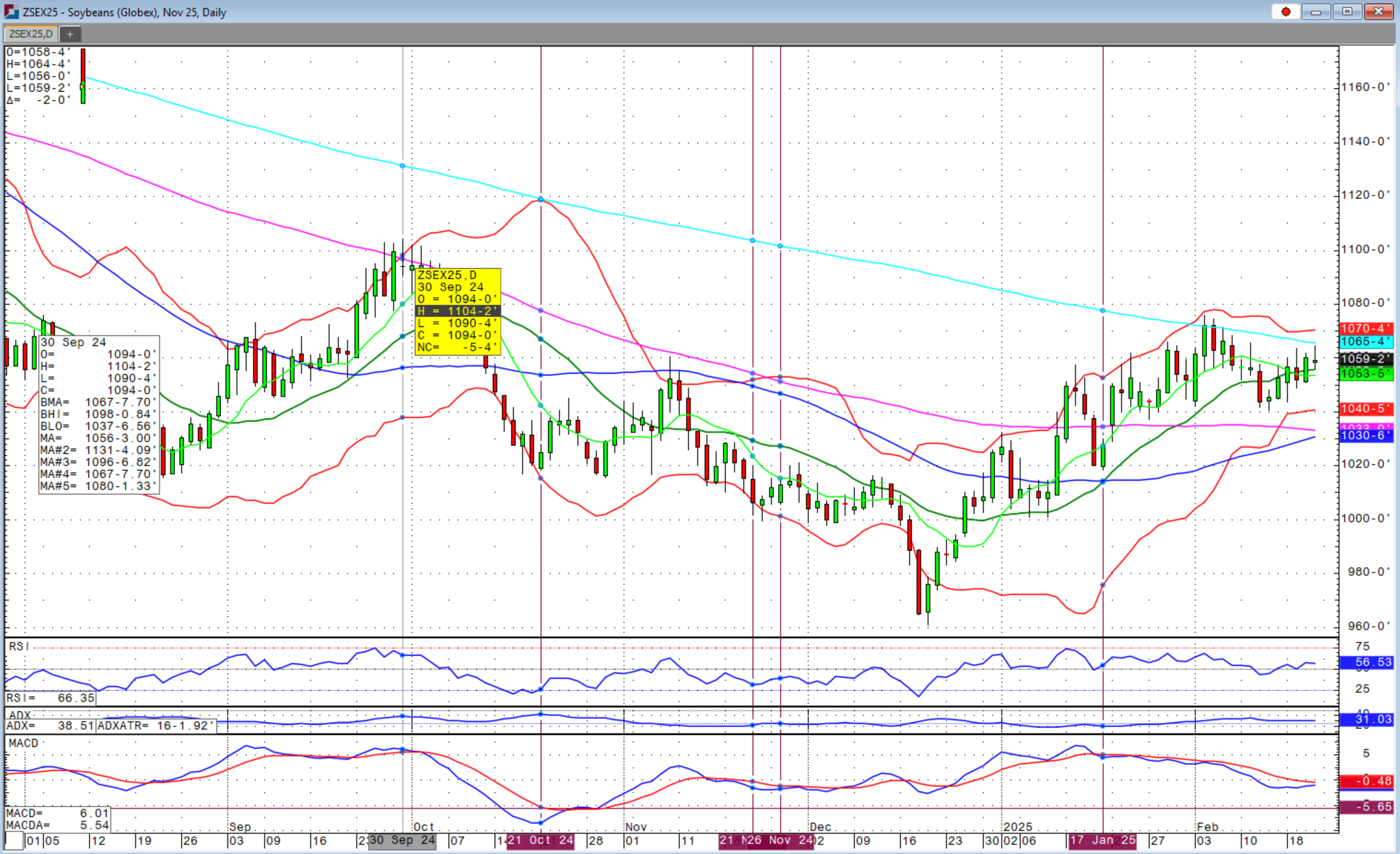

Europe began to push back on US agricultural exports this week banning the import of GMO soybeans given their farmers are unable to use such chemicals. We will see how far this is taken before there is a compromise.

The DOGE efforts spearheaded by Elon Musk continue to plow through the Federal bureaucracy with many proclamations of savings while legal challenges are being raised. This is one of the biggest shake-ups that Washington has seen and I expect there is much more still planned. The status quo is now anything but with a completely new political landscape to navigate.

Internationally, Brazil is the latest country engaging in tariff disputes. The Trump Administration increased tariffs on Brazilian ethanol after the reciprocal policy was announced. Brazil responded with the fact that US tariffs beyond the preferential quota allowance on sugar are far greater than Brazil’s tariffs on imported ethanol. This strategy is of course designed to bring countries to the bargaining table as well as incentivize companies to invest in facilities in the US instead of abroad. However, the effectiveness of such policy also depends on the extent and longevity of the resistance from trade partners, the added cost to imports that could be passed through to US consumers and resilience of the economies involved.

The Dow Jones had its worst day of the year on Friday with selling across healthcare and consumer companies mounting into broader concerns over the strength of consumer spending ahead. The CBOE Volatility Index, the VIX, surged amidst plunging stock indices. More companies will be releasing results next week that will set the tenor for markets leading up to the next Federal Reserve FOMC meeting on March 18th and 19th.

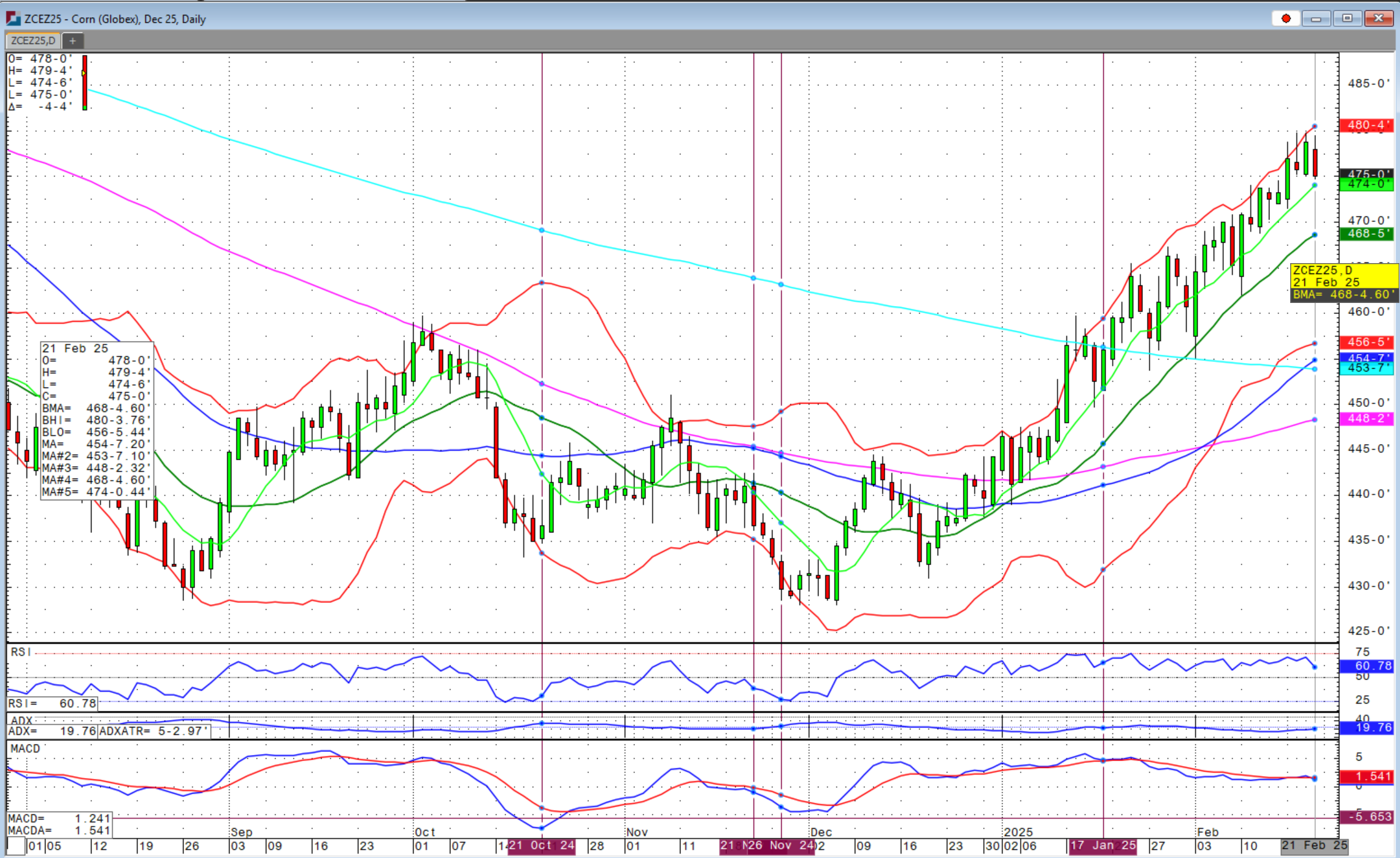

For the grain markets, continued weakening of the US dollar index, that traded to the lowest level on Thursday since December 12th, has provided underlying support. That support and even export demand strength started to give way on Friday as corn sold off with expectations for more acres to be planted versus soybeans. The battle for acres is emerging.

CoBank estimates that US corn acres could increase 4 percent while soybeans could decrease 3.6 percent. We will get another perspective next week from the USDA’s Outlook Forum. If you’re concerned about the impact upcoming reports could have on December corn and November beans, consider short dated put options through May to get past the end of March for around 10 cents.

While South American weather has become more favorable for both corn and soybeans despite some heat, slight cuts by CONAB to the Brazilian soybean crop and chart action seem to suggest we could see some strength in soybeans ahead. Having said that, we do have ending stocks and production at record levels and so the world is by no means low on beans. Trump did mention this week of the potential for a renewed trade deal with China that lifted bean markets. Further news on this topic would be welcome for the bean bulls.

The latest Commitment of Traders (COT) report showed continued short covering by managed money funds in the wheat contracts and additional longs being added to corn while soybean longs have been reduced. This next week's report will likely show selling of corn longs with the selloff late week. Note the COT report shows long/short positions as of that Tuesday's close.

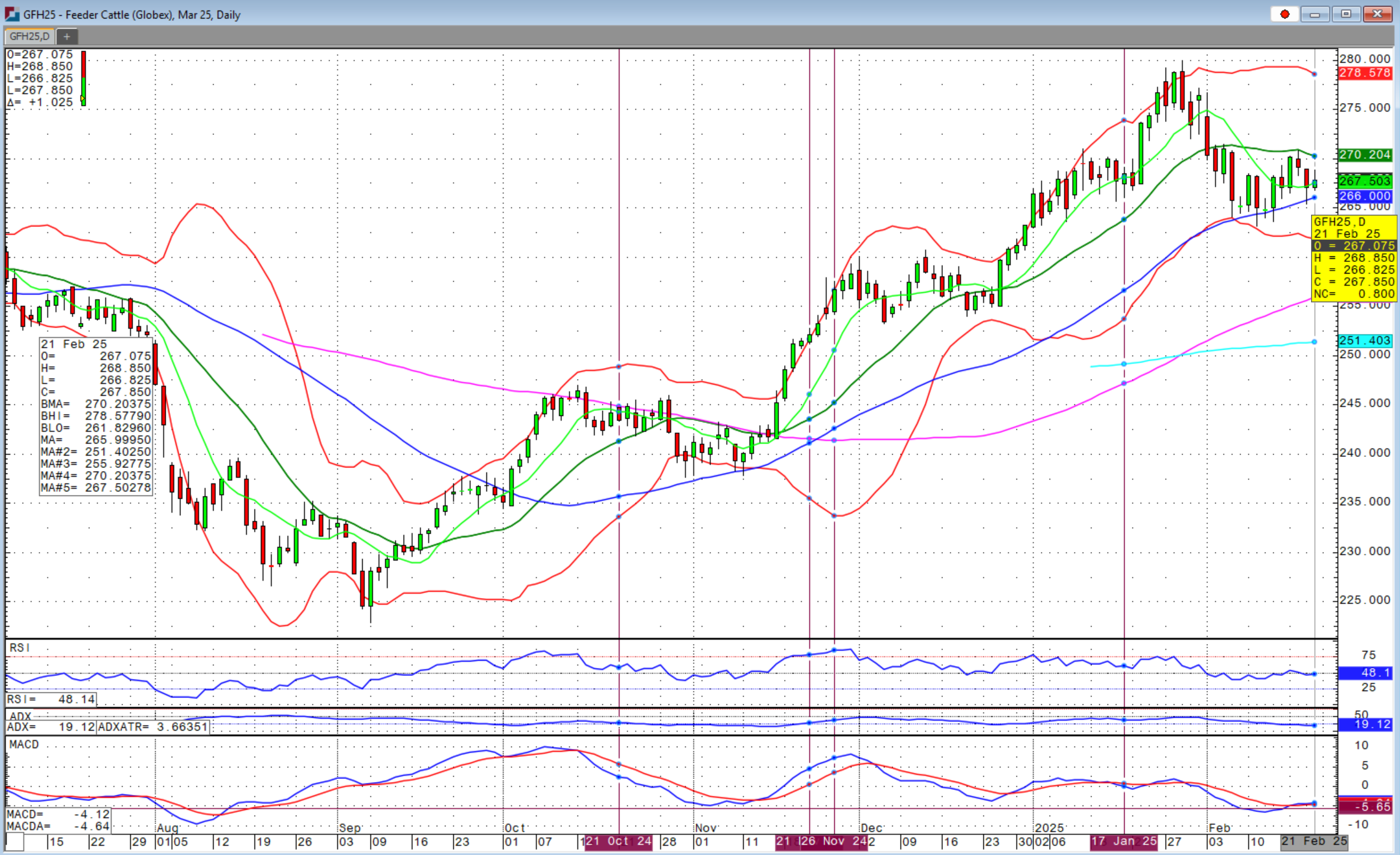

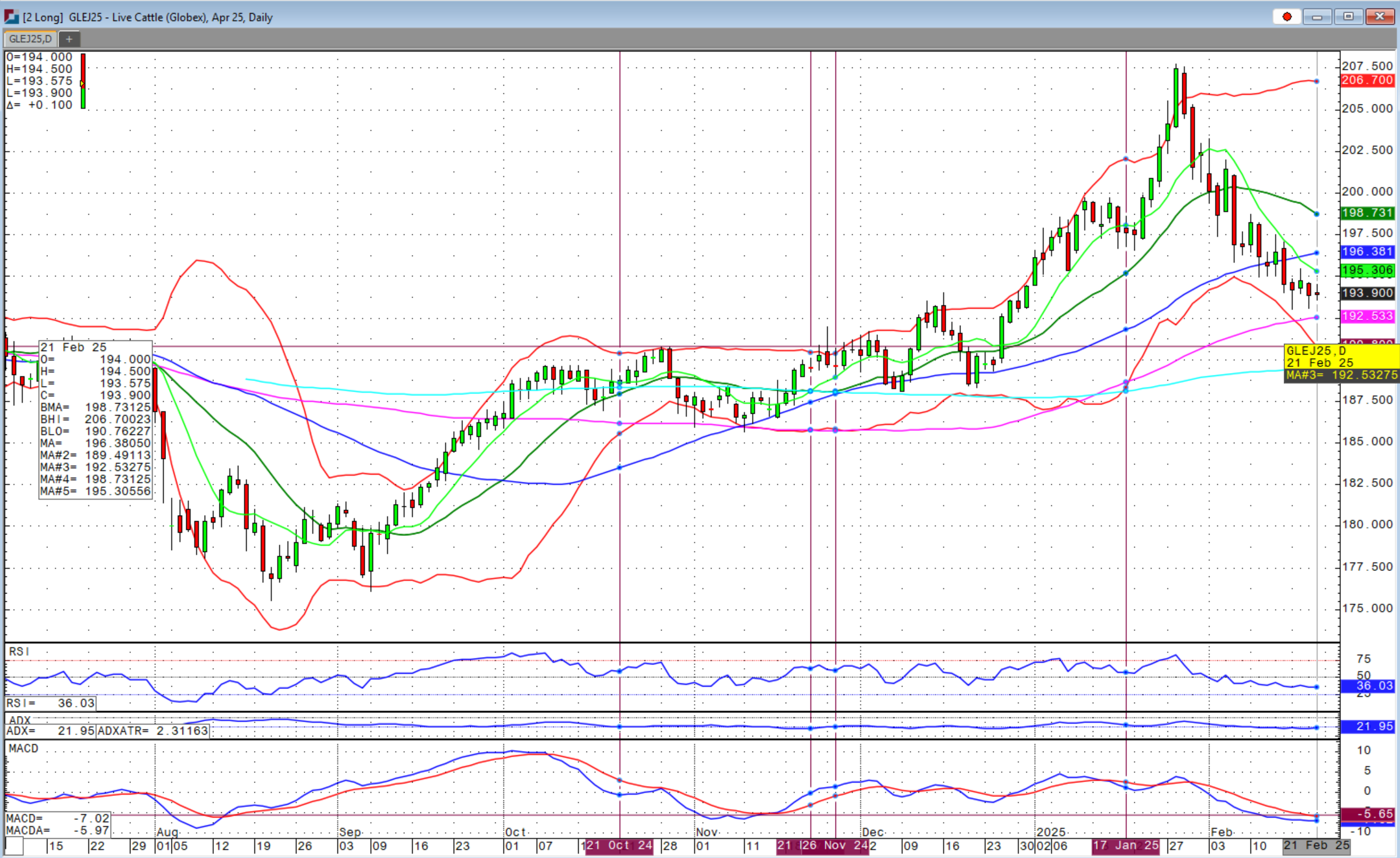

The cattle complex had a sideways to weaker tone this week while lean hogs underwent massive liquidation selling. The sideways congestion was in feeder cattle contracts while the fed cattle futures were lower, largely from last Friday’s selloff. Spring feeder contracts are holding the 50-day moving average so far. If we start getting closes below this level, we will probably see another $8-10 per cwt slippage in feeder futures. October and further out feeder contracts are showing much greater signs of strength closing above their respective 20-day moving averages on Friday.

Another case of screwworms was detected in Mexican cattle this week, but the USDA said they would not close the border.

USDA released its February Cattle-on-Feed report after the close on Friday at 2 PM. Estimates for on-feed were 99.3 percent of last year and came in at 99.2 percent and so in line with trade expectations. Placements came in at 101.7 percent of last year versus trade expectations of 102.2 percent and so lower than anticipated, largely impacted by the prior close of the Mexican border. Marketings came in at 101.4 percent versus 102.1 percent expected and so lower than expected. While the placement number had a bullish tilt, the lower marketings were less desirable.

The broader, macro environment next week will be important directional wind for the cattle market. Fed cattle cash trade this week topped out at $199 in Texas and $200 in Nebraska. We need to see this number start trending higher to support this market. There is potential for a bounce from these oversold levels, but I also think there is more risk of downside than any sustained strength.

The latest COT report showed managed money funds making a new, all-time record for net longs in feeder contracts while we have seen additional selling of the longs for fed cattle contracts.

In fact, if you are light on downside protection, the next rally is a good place to protect it. We are still near $270 per cwt on various feeder contracts and these are excellent levels to capture even though we are off the highs. Come fall of this year, it sure seems we could see some strength and possibly new highs.

There was no LRP on Friday due it being Cattle-on-Feed report day as was the change this past year.

Sidwell Insurance and Sidwell Strategies will be hosting our Spring Client Update meeting at Autry Tech in Enid on Tuesday, February 25th. Call us to RSVP.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)