CAVA Group, Inc. CAVA is slated to release fourth-quarter 2024 results on Feb. 25, after the closing bell.

In the last reported quarter, the company’s earnings beat the Zacks Consensus Estimate by 36.4%. CAVA surpassed earnings estimates in the trailing four quarters. The average surprise in this period is 91.8%, as shown in the chart below.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

CAVA’s Q4 Estimate Revisions

The Zacks Consensus Estimate for fourth-quarter earnings per share (EPS) has been unchanged at 6 cents in the past 90 days. The projected figure indicates a surge of 200% from the year-ago reported EPS of 2 cents. The consensus mark for revenues is pegged at $225.5 million, implying 27.3% year-over-year growth.

What the Zacks Model Unveils for CAVA

Our proven model does not conclusively predict an earnings beat for CAVA this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

CAVA’s Earnings ESP: CAVA currently has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank of CAVA: The company carries a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Influencing CAVA’s Q4 Performance

CAVA’s strong fourth-quarter 2024 performance is expected to have been driven by its ongoing expansion efforts. Recent market entries, including South Florida and additional Midwest regions, have likely strengthened its growth trajectory. The company’s restaurant openings continue to outpace expectations, underscoring the brand's scalability and widespread appeal.

Additionally, its average unit volumes (AUV) have been on an upward trend, reinforcing the success of its expansion strategy. By offering high-quality, Mediterranean-inspired meals at competitive prices, CAVA continues to attract and retain a loyal customer base.

Culinary innovation remains a key differentiator for CAVA. Successful menu additions, such as Garlic Ranch Pita Chips and new steak options, are expected to have contributed to incremental sales while enhancing customer engagement. The company’s ongoing innovation pipeline across various menu categories is expected to have sustained excitement and encouraged repeat visits.

Meanwhile, CAVA’s loyalty program rollout nationwide has been providing a meaningful sales lift. Enhancements to the program have likely strengthened guest relationships, increased visit frequency and driven transaction volumes.

Operational efficiency has been a priority for CAVA, with the company leveraging technology and modern labor models to optimize restaurant performance. Its labor scheduling initiative ensures team members are positioned effectively during peak hours, improving guest experience and boosting sales, particularly in lower-volume locations. Early testing of AI-powered kitchen tools points to improved productivity, greater consistency and faster service times, enhancing the overall dining experience.

The consensus estimate for same-restaurant sales is pegged at 18.3%. CAVA’s restaurant sales are pegged at $223 million, implying 27.4% year-over-year growth.

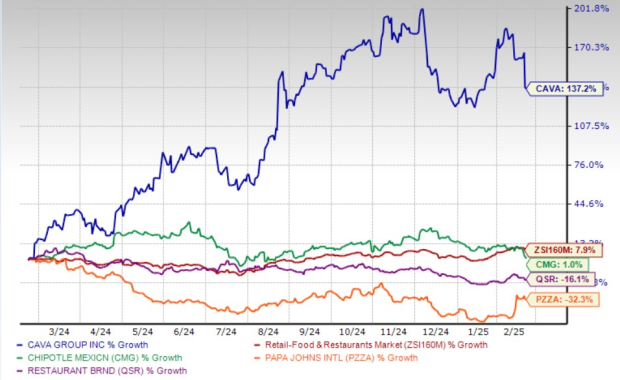

Price Performance & Valuation of CAVA

The CAVA stock has skyrocketed 137.2% over the past year, significantly outperforming its industry peers and the broader market. In the same time frame, CAVA has outperformed other industry players like Chipotle Mexican Grill, Inc. CMG, Domino's Pizza, Inc. DPZ and Restaurant Brands International Inc. QSR.

Price Performance

Image Source: Zacks Investment Research

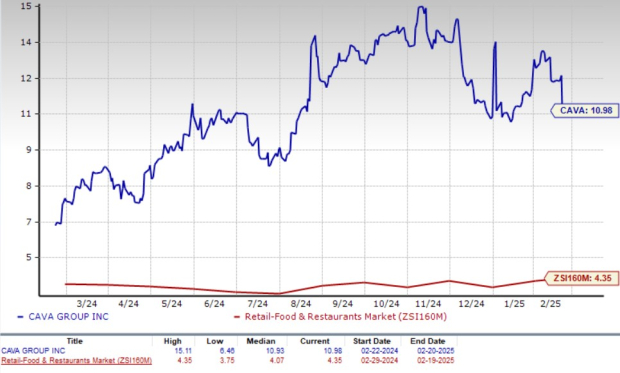

However, in the past three months, the stock has declined 18.2% against the industry’s rise of 2%. Analysts have expressed concerns that CAVA's stock is overvalued. The company is currently valued at a premium compared with its industry on a forward 12-month P/S basis. Its forward 12-month price-to-sales ratio stands at 10.98, significantly higher than the industry and the S&P 500's 5.39.

P/S (F12M)

Image Source: Zacks Investment Research

Investment Thoughts for CAVA

CAVA's impressive growth trajectory, driven by expansion efforts, strong same-restaurant sales and innovative menu offerings, has positioned it as a standout player in the fast-casual dining space. However, despite its solid fundamentals, the stock has faced a sharp decline in recent months, raising concerns about its valuation.

Analysts believe that CAVA is trading at a significant premium compared with its industry peers, making it vulnerable to market corrections. Additionally, the company's current Zacks Rank suggests weaker near-term performance, and investor sentiment appears cautious ahead of its earnings release. While CAVA has demonstrated strong momentum, the recent downtrend and overvaluation concerns indicate that investors should avoid the CAVA stock for now.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Restaurant Brands International Inc. (QSR): Free Stock Analysis Report

CAVA Group, Inc. (CAVA): Free Stock Analysis Report

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)