Super Micro Computer, Inc.’s SMCI shares have bounced back strongly this year after a weak performance last year. The recent business update has boosted momentum, with investors anticipating no hiccups in the company’s highly-anticipated 10-K filing.

Is now a good time to bet on the Supermicro stock, or should a wait-and-see approach be considered? Let’s find out –

What Bothered SMCI Stock in 2024?

A plethora of discouraging news impacted the Supermicro stock last year. Supermicro was allegedly involved in accounting violations, per a short seller. The DOJ also investigated Supermicro for accounting irregularities.

Supermicro received a non-compliance letter from the Nasdaq, raising the chances of being de-listed from the tech-heavy index. The situation worsened when Supermicro announced a delay in filing its annual 10-K report.

Why is SMCI Stock Gaining This Year?

Things are looking brighter for Supermicro this year as management aims to publish last fiscal year’s 10-K report before Feb. 25. Supermicro’s previous auditor, Ernst & Young, resigned due to management disputes. However, the company now works with reputed accounting firm BDO, ensuring timely SEC report filings.

Supermicro’s encouraging 2026 revenue growth estimates also boosted the stock price. Supermicro CEO Charles Liang expects revenues of $40 billion next year, way above the current consensus of $29.2 billion. The demand for Supermicro’s direct-liquid cooling technology is set to spike next year due to data centers’ heat issues and likely boost sales.

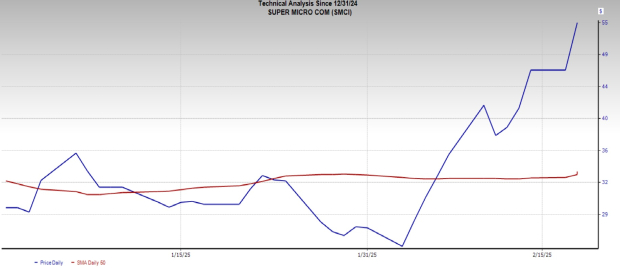

The Supermicro stock has soared 83.5% year to date, breezing past the Computer- Storage Devices industry’s gain of 17.3%. The Supermicro stock is now one of the top-performing stocks on the S&P 500, with its shares trading above the 50-day short-term moving average, indicating an imminent uptrend.

Image Source: Zacks Investment Research

How to Trade SMCI Stock Now

Considering the robust revenue growth and the expected prompt 10-K filings, it is advisable to hold Supermicro stock for gains in the long run. And why not? Supermicro’s synergy with NVIDIA Corporation NVDA through the Blackwell platform has boosted its artificial intelligence (AI) computing power, trimmed operational expenses, and strengthened its market position.

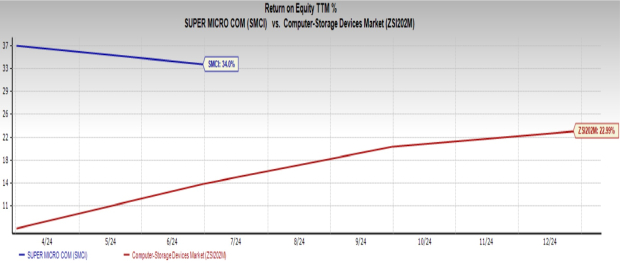

Supermicro also uses energy-efficient technologies in operations, a boon once global environmental regulations tighten. Moreover, Supermicro’s return on equity of 34% is higher than the industry’s 23%, signifying strong profitability.

Image Source: Zacks Investment Research

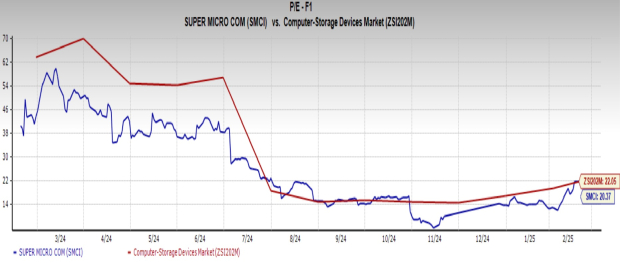

At the same time, the Supermicro stock remains reasonably priced. This is because, per the price/earnings ratio, SMCI trades at 20.3X forward earnings. In comparison, the industry’s forward earnings multiple is 22.05.

Image Source: Zacks Investment Research

However, skeptics doubting Supermicro’s growth story may prefer to wait until Feb. 25 for a better financial insight before betting on the SMCI stock. For now, SMCI stock has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)