The past week or so have been rough for Microsoft (NASDAQ:MSFT). The company's massive investment in artificial intelligence (AI) infrastructure came under scrutiny following Chinese start-up DeepSeek's revelation that it has developed AI models at a fraction of the cost that the tech giant has spent so far. This sent Microsoft shares into a tailspin.

Microsoft stock came under more pressure following the release of results for its fiscal 2025's second quarter (ended Dec. 31, 2024) on Jan. 29. Though the company beat Wall Street's earnings and revenue expectations easily, its revenue guidance for the current quarter was lower than what analysts were expecting.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

All this explains why Microsoft stock is down more than 5% since Jan. 27, when DeepSeek's news rocked the AI world. But is this an opportunity for savvy investors to buy this Magnificent Seven stock on the dip? Let's find out.

AI is driving tremendous growth in Microsoft's cloud business

Microsoft's revenue rose 12% year over year in the previous quarter, with the company's cloud business playing a central role in driving this double-digit growth. It recorded a 19% year-over-year increase in revenue from the Intelligent Cloud business. Microsoft's Azure cloud services got a boost of 13 percentage points from the fast-growing demand for AI applications that the company has been offering on its platform.

The company points out that it witnessed a whopping 157% jump in AI services revenue last quarter, exceeding its expectations. However, the tech giant faced constraints as "demand continued to be higher than our available capacity." As a result, the 31% jump in Azure revenue fell slightly below analysts' expectations.

However, investors will do well to take a closer look at the bigger picture. The demand for Microsoft's AI offerings is so solid that the company has been witnessing a major uptick in contract sizes and bookings. It saw a terrific jump of 67% in commercial bookings during the quarter on the back of "Azure commitments from OpenAI." That number is significantly higher than the 17% increase in commercial bookings in the year-ago period.

As commercial bookings refer to the new contracts signed by Microsoft with large customers, the impressive jump in this metric bodes well for the company's future. Microsoft's robust future revenue pipeline is also evident from its remaining performance obligations (RPO) of $298 billion in the previous quarter. This metric, which refers to the total value of the company's contracts that will be fulfilled in the future and recognized as revenue, increased by 34% from the year-ago period.

Not surprisingly, Microsoft is going to ramp up its infrastructure spending as it strives to fulfill these contracts in the future, which should ideally lead to an acceleration in growth going forward. The company allocated $22.6 billion toward capital expenditure last quarter, which was above the $20.95 billion consensus estimate.

Microsoft points out that "more than half of our cloud and AI-related spend was on long-lived assets that will support monetization over the next 15 years and beyond." The company's remaining spending on cloud and AI infrastructure is directed toward server infrastructure such as graphics processing units (GPUs) and central processing units (CPUs), as it rushes to fulfill the massive RPO it is sitting on.

This also explains why Microsoft's earnings grew at a slower pace than its revenue last quarter. However, the good part is that Microsoft is expecting its AI capacity to match demand by the end of the current fiscal year, owing to the substantial increase in its capital expenses. That should pave the way for stronger growth going forward.

Is the stock worth buying now?

We have already seen that Microsoft has a massive backlog of contracts. In fact, the size of its RPO is higher than the $254 billion revenue that the company has generated in the past 12 months. It won't be surprising to see Microsoft's RPO growth accelerating in the future. The cloud AI services market is expected to clock almost 40% annual growth through 2030, according to Grand View Research.

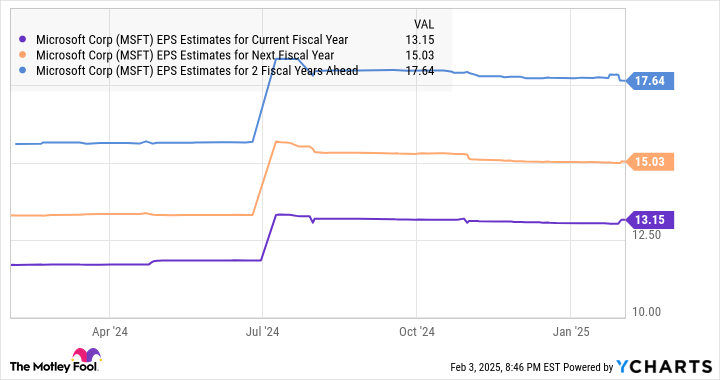

All of the above tell us why analysts are expecting Microsoft's earnings growth to step on the gas following an 11% jump in its bottom line in fiscal 2025 to $13.15 per share.

MSFT EPS Estimates for Current Fiscal Year data by YCharts.

The chart above points toward an increase of 14% and 17% in Microsoft's earnings over the next two fiscal years. That's why it may be a good idea to buy this stock following its recent pullback, as it is trading at 33 times earnings right now, which is in line with the tech-laden Nasdaq-100 index's earnings multiple.

A potential improvement in Microsoft's earnings growth thanks to its ability to tap the huge addressable opportunity in the cloud-based AI services market points toward a bright future for this AI stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $333,669!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,168!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $547,748!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)