Arm Holdings (ARM) recently delivered strong results for the third quarter of fiscal 2025. Despite surpassing Wall Street expectations, the stock faced selling pressure as investors reacted cautiously to the company’s narrower full-year guidance.

Arm’s decision to narrow its full-year revenue forecast to $3.94 billion to $4.04 billion from the previous range of $3.8 billion to $4.1 billion did not meet investors’ expectations for a raised outlook, particularly given the growing adoption of its chip designs for AI servers and the increasing use of its higher royalty rate Armv9 architecture.

Adding to the concerns is Arm’s lofty valuation. Arm stock has surged over 126.5% in the past year, trading at a forward price-earnings (P/E) ratio of 192.64x and a price-sales multiple of 52.57x. Such high valuation metrics make the stock sensitive to any signs of growth deceleration, which is partly why investors reacted cautiously despite the company’s strong performance.

So, given the post-earnings volatility, is ARM stock a good buy? Let’s break it down.

Q3 Performance Breakdown

Arm posted robust numbers for the third quarter of its fiscal 2025, with total revenue reaching $983 million — surpassing the top end of its guided range. The company’s royalty revenue hit a record $580 million, growing 23% year-over-year and exceeding management expectations. This growth was fueled by continued Armv9 adoption, initial shipments of chips based on its compute subsystems (CSS), and rising revenues from custom silicon in the data center segment.

Royalty revenue from smartphones, data center chips, networking equipment, and automotive sectors met expectations. Meanwhile, the royalty revenue from the Internet of Things (IoT) segment showed signs of recovery after prolonged weakness. Arm’s smartphone-related revenues grew faster than the overall market, boosted by chips based on Armv9 and compute subsystems like MediaTek’s Dimensity 9400.

Licensing revenue also rose by 14% year-over-year to $403 million, exceeding management’s forecasts. The company’s annualized contract value (ACV) increased by 9% year-over-year, slightly below the recent run rate. However, management noted that this growth rate was still ahead of the company’s long-term growth plan.

Arm achieved near-record adjusted operating profits of $442 million, with adjusted earnings per share (EPS) rising to $0.39, surpassing analysts’ forecasts of $0.32 and up from $0.31 in the prior-year quarter.

Growth Catalysts for the Future

Arm remains well-positioned for long-term growth thanks to its foothold in AI, data centers, and custom silicon solutions. Demand for AI technology is driving increased adoption of Arm’s v9 architecture and compute subsystems. The company is also gaining traction with flagship smartphones from OPPO and Vivo, which utilize MediaTek’s Dimensity 9400 system-on-chip built on Arm's CSS technology.

Arm’s partnerships with Amazon (AMZN), Microsoft (MSFT), Google (GOOGL), and Nvidia (NVDA) are bearing fruit in the data center space. AWS revealed that over 50% of its new CPU capacity installed over the past two years was based on Arm’s Graviton processors, with over 90% of its top 1,000 EC2 customers utilizing Graviton.

Looking ahead, the AI boom presents a significant growth opportunity for Arm as demand for compute capacity soars. The company is well-equipped to power AI applications across cloud services, edge computing, and connected devices.

Is Arm Stock a Buy Now?

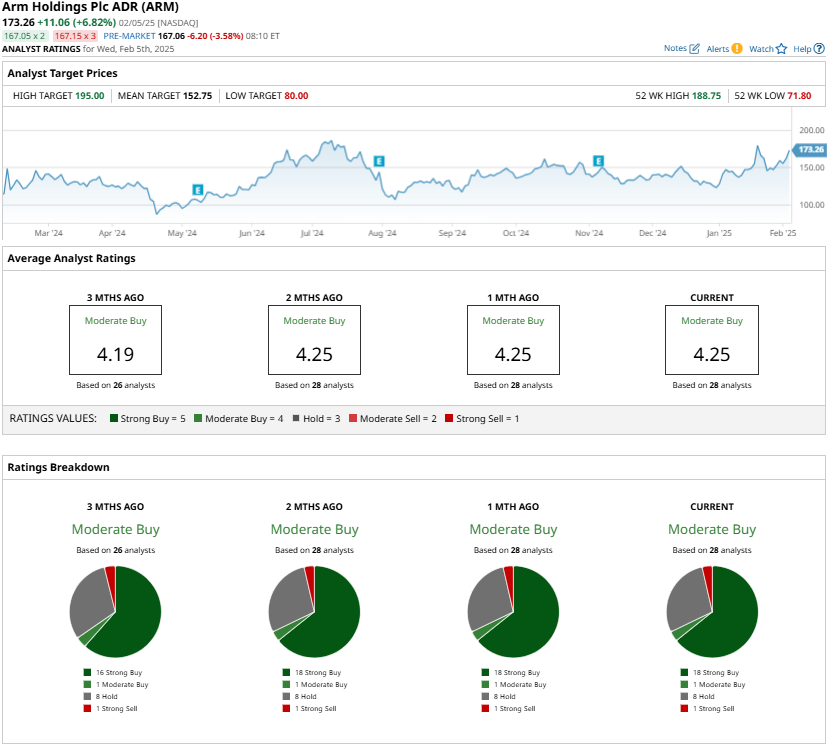

Wall Street analysts remain cautiously optimistic about Arm stock, assigning it a “Moderate Buy” consensus rating. Further, the stock’s high valuation means it remains vulnerable to any signs of a growth slowdown. Still, given Arm’s strong market positioning and long-term growth prospects, any significant dip in its share price presents an attractive buying opportunity for investors with a long-term horizon.

In conclusion, while post-earnings volatility may deter some investors in the short term, Arm is a key player in the rapidly expanding AI and data center ecosystems, making it a compelling stock for long-term investors. However, those wary of high valuations may prefer to watch and wait for a more attractive valuation before jumping in.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)