/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) stock is up 7.3% today following the announcement of increased production availability for AI data center server solutions featuring Nvidia's (NVDA) new Blackwell platform. This positive development comes at a crucial time for the company, which is facing ongoing accounting controversies and the risk of delisting from Nasdaq.

SMCI is under pressure to meet a Feb. 25 deadline to file its delayed annual report and other required financial statements, a critical factor in maintaining its status as a Nasdaq-listed entity. Delisting from the exchange would relegate Super Micro Computer stock to over-the-counter status, which would greatly reduce liquidity and demand for the shares.

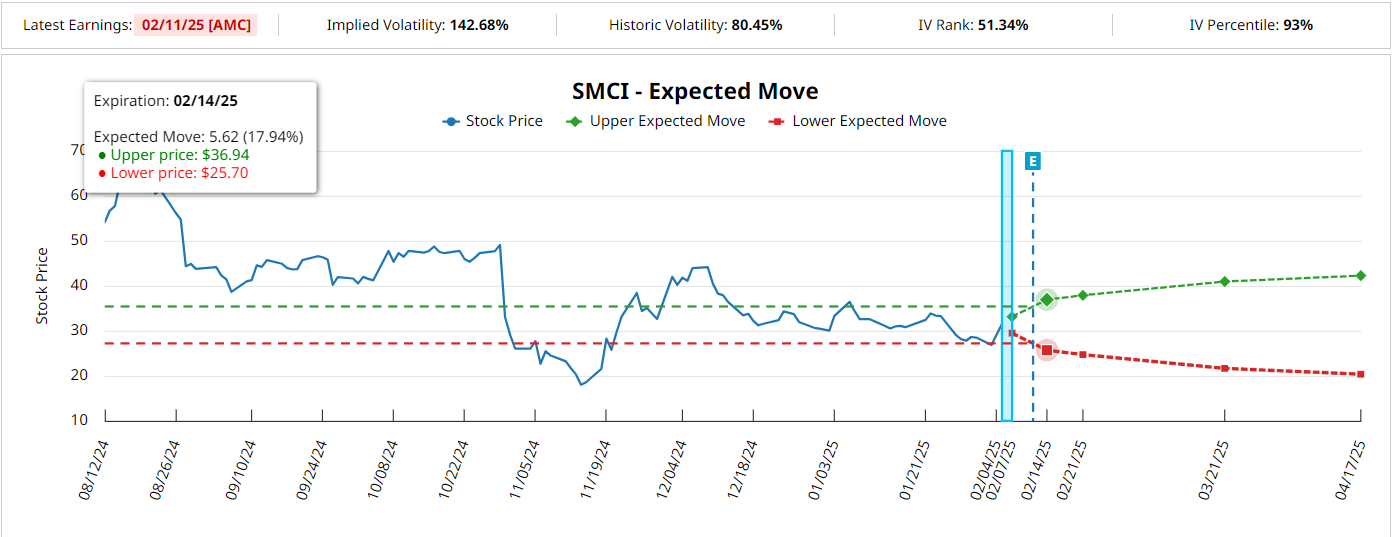

In the meantime, investors are eagerly anticipating the company's fiscal 2025 second-quarter report, which has now been set for release after the close of trading on Tuesday, Feb. 11. Ahead of the event, options traders are pricing in a 17.94% stock move for SMCI, compared to the average post-earnings reaction of 11.01% in either direction over the past four quarters.

Despite today’s rally, Super Micro Computer shares remain down approximately 48.8% over the past six months, pressured by the significant uncertainty regarding the artificial intelligence (AI) server company's financial reporting and governance issues. Adding to the complexity, President Trump's newly announced tariffs on China have yet to be resolved, and have led to concerns about potential supply chain disruptions and increased costs.

Analysts have relatively low conviction on SMCI stock overall, with many awaiting further clarity on the tech company’s audited financial statements. Out of the 13 analysts tracking Super Micro stock, 8 suggest a “Hold.”

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)