Builders FirstSource, Inc. (BLDR) is a building products supplier giant suffering through a rough patch following a boom run between 2020 and 2022, driven by soaring demand for home and multi-family construction and renovations.

Builders FirstSource’s earnings outlook is fading as the housing construction market normalizes.

BLDR Stock Basics

Builders First Source is one of the largest suppliers of building products, prefabricated components, and services to the professional market for new residential construction and remodeling. Builders First Source works with large and small customers via its roughly 570 distribution and manufacturing locations around the country.

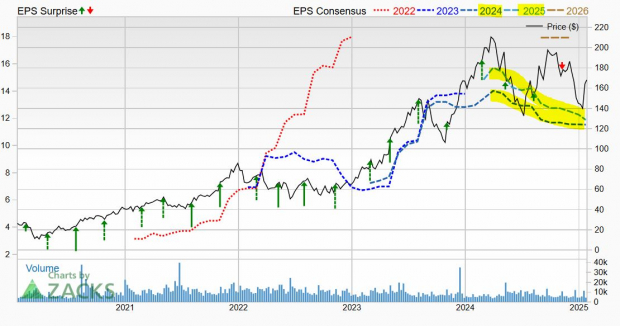

Image Source: Zacks Investment Research

Builders First Source boasts that it works in 90 of the top 100 Metropolitan Statistical Areas.

BLDR grew its sales by 18% in 2020 and then posted a mind-blowing 132% YoY sales expansion in 2021, climbing from $8.56 billion to roughly $20 billion. Builder First Source followed that surge up with another 14% sales growth in 2022.

Image Source: Zacks Investment Research

Builders First Source’s impressive run was driven by the housing boom around the U.S., as well as some acquisitions. The housing construction market has cooled and its 2023 sales fell 25%, with revenue set to slip about 3.5% in 2024. BLDR is projected to bounce back with 6% growth in 2025 and it remains miles above its pre-Covid revenue totals.

Bottom Line on BLDR Stock Right Now

BLDR last quarter said that its profit margin slipped on the back of “ongoing Multi-Family and core organic normalization.” Builders First Source remains a great company and the housing shortage provides wind at its sails over the long haul.

In the short run, Builders First Source’s adjusted earnings are projected to dive 21% in FY24 following a big pullback in 2023.

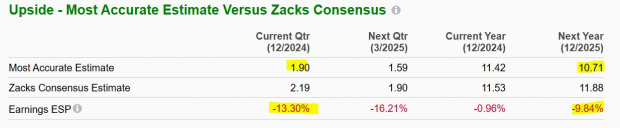

On top of that, its earnings outlook has tanked and its Most Accurate estimate for 2025 came in 10% below its beaten-down consensus. Builders First Source lands a Zacks Rank #5 (Strong Sell) right now. On top of that, its Building Products – Retail space sits in the bottom 22% of over 250 Zacks industries.

Investors interested in Builder First Source might want to wait for it to report its Q4 results and provide guidance on February 20 before they jump in.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)