Live Cattle (February)

Cattle futures were choppy in Friday’s trade, leaving the technical landscape little changed with a trade that took place within the previous day’s range. Our pivot pocket from 195.72-196.00 sill be the pocket for the Bulls to defend. A failure here and we could see some long liquidation press prices back down to significant support from 192.00-192.70.

Resistance: 199.57-200.00***

Pivot: 195.72–196.00

Support: 194.40-194.85***, 192.00-192.70***

Daily Cattle and Beef Summary

Cutout values were lower on Friday with choice cuts .53 lower to 333.16 and select cuts .39 lower to 319.44. Friday’s slaughter was reported at 115k head, 2k less than the previous week but 4k more than the same day last year. The 5-area average price for live steers came in at 203.67

The CME feeder Cattle Index is down 1.25 to 277.06 with the NBW Real-Time Index showing 276.50 as of this morning, down .30 from yesterday.

Seasonal Tendency Update

(updated 1.21.25)

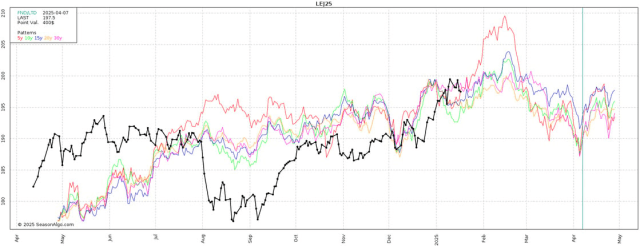

Below is a look at historical price averages for April futures on a 5, 10, 15, 20, and 30 year time frames (Past performance is not necessarily indicative of future results).

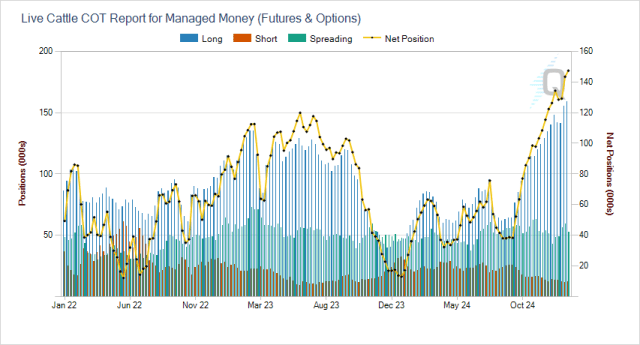

Commitment of Traders Update

Friday’s Commitment of Traders report showed Funds were net buyers of about 4k contracts, expanding their net long position to 147,421. Within a stone’s throw of the record 152,634.

Feeder Cattle (March)

Feeder cattle have been choppy over the last week, trading in about a $5 range from 265ish-270ish. A breakout above or below this recent range could spark another leg in that direction. With Funds very lopsided long, the higher velocity risk is likely on a breakdown below support.

There have been multiple reports out of Mexico regarding the boarder reopening for cattle trade, but we have yet to see any definitive statement from the USDA>

Resistance: 270.05-271.00*

Pivot: 266.75-267.75

Support: 263.00-263.27**, 260.075-260.70****

Seasonal Tendency Update

(updated 1.21.25)

Below is a look at historical price averages for March futures on a 5, 10, 15, 20, and 30 year time frames (Past performance is not necessarily indicative of future results).

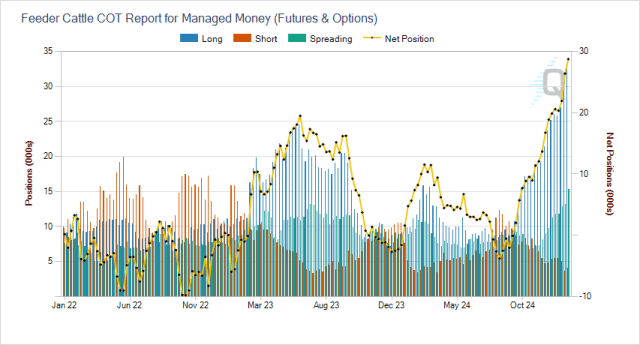

Commitment of Traders Report

Friday’s Commitment of Traders report showed Funds were net buyers of about 2.500 contracts, expanding their net long position to another new record, 28,749. The 3-year chart of fund positioning below speaks for itself.

Stay ahead of the herd!

Subscribe to our daily Livestock Roundup for exclusive insights into Feeder Cattle, Live Cattle, and Lean Hogs. Get access to our proprietary trading levels and actionable market biases delivered straight to your inbox—every day.

Sign Up for Free Futures Market Research – Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)