What look for tomorrow:

Provided by John Thorpe, Senior Broker

Today was a reversal day in a majority of the markets we all follow.

From the Energy Markets giving back some of their gains from the past few trading sessions, to the Precious metals , inching a little higher after a tremendous downward push yesterday.

Soybeans, while still in a strong up trend saw profit taking along with Corn and KC Wheat.

Equities have been struggling to maintain the election rally. The Bond markets slide was halted for a day.

Perhaps all this uncertainty is a result of the anticipation of tomorrow mornings CPI release.

This Economic data point has been one of the most talked about by the voting members of the FED and may portend a shift in policy..

Do keep an eye on changes in the CME FedWatch data (FedFund Futures) tomorrow, this will give traders an insight into future market direction. Higher inflation, leads to higher Bond yields, Higher Yields lead to lower bond prices, and greater hesitancy by the FED to lower rates anytime soon.

Lower CPI numbers are favorable to lower rates in the near term, therefore Higher Equity prices.

Plan your trade and trade your plan.

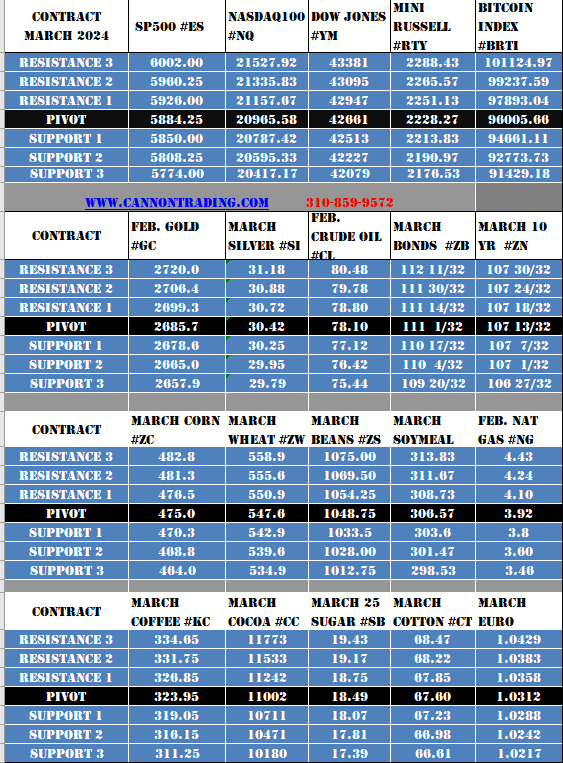

Daily Levels for Jan. 15th 2025

Economic Reports

All times are Eastern Time ( New York)

Good Trading!

Ilan Levy-Mayer, M.B.A

Vice President

Cannon Trading Co, Inc. Est. 1988

www.CannonTrading.com

Toll Free:

800-454-9572![]()

Int'l:

+310-859-9572![]()

Margins / Commissions / Platforms / Professional Traders /Free Demo

Trading commodity futures and options involves a substantial risk of loss.

The information here is of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future results.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)