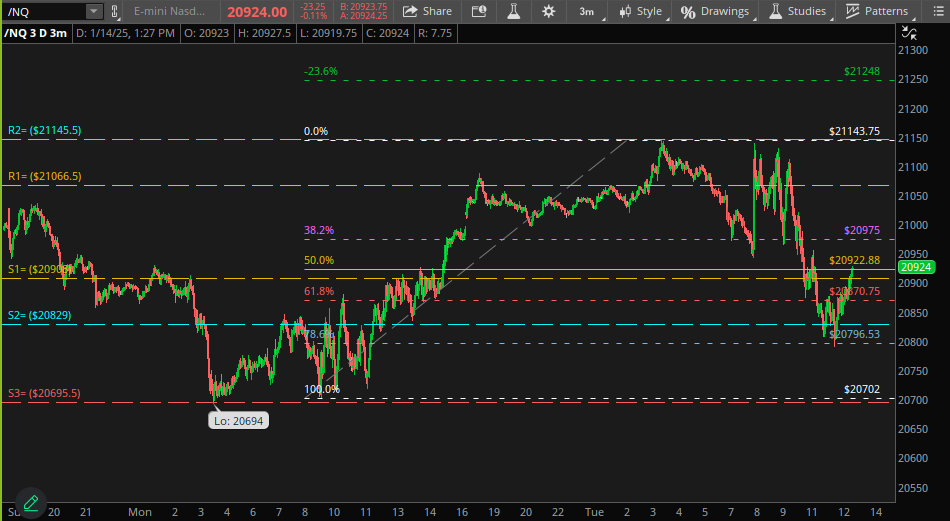

Media outlets are in full swing reporting about the likely impacts of the potential policies likely due out in the initial 100 days of the new Trump administration. Different theorists of the wide-world-of-Trump are engaging in a variety of comments and ideas related to implementation ideas of tariffs and this obviously affects the way the markets move in the short term. Makes one wonder if a constant bid on the VIX is likely the best bet heading into the onset of the new administration. As an illustration, look at the way the indices moved today with futures surging in the premarket on better than expected PPI data and then halfway into the initial balance period just a vertical drop. We technically analyze Nasdaq futures for you intraday futures war mongers:

- Nasdaq futures dipped below but held above the last level of fib support at 20796.50.

- If this price point can hold into today's settlement, and the CPI aligns somewhat with the PPI data, expect 21248 for the Nasdaq futures into tomorrow.

- Below 20694, there are no more long trades.

Chart (NQH25)

These ideas are easily traded with safe options ideas like imbalanced butterflies or even directionally. Come give us a spin, fill out a contact form on our website and watch your trading improve with our precise guidance.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)