1 | One Big Surprise

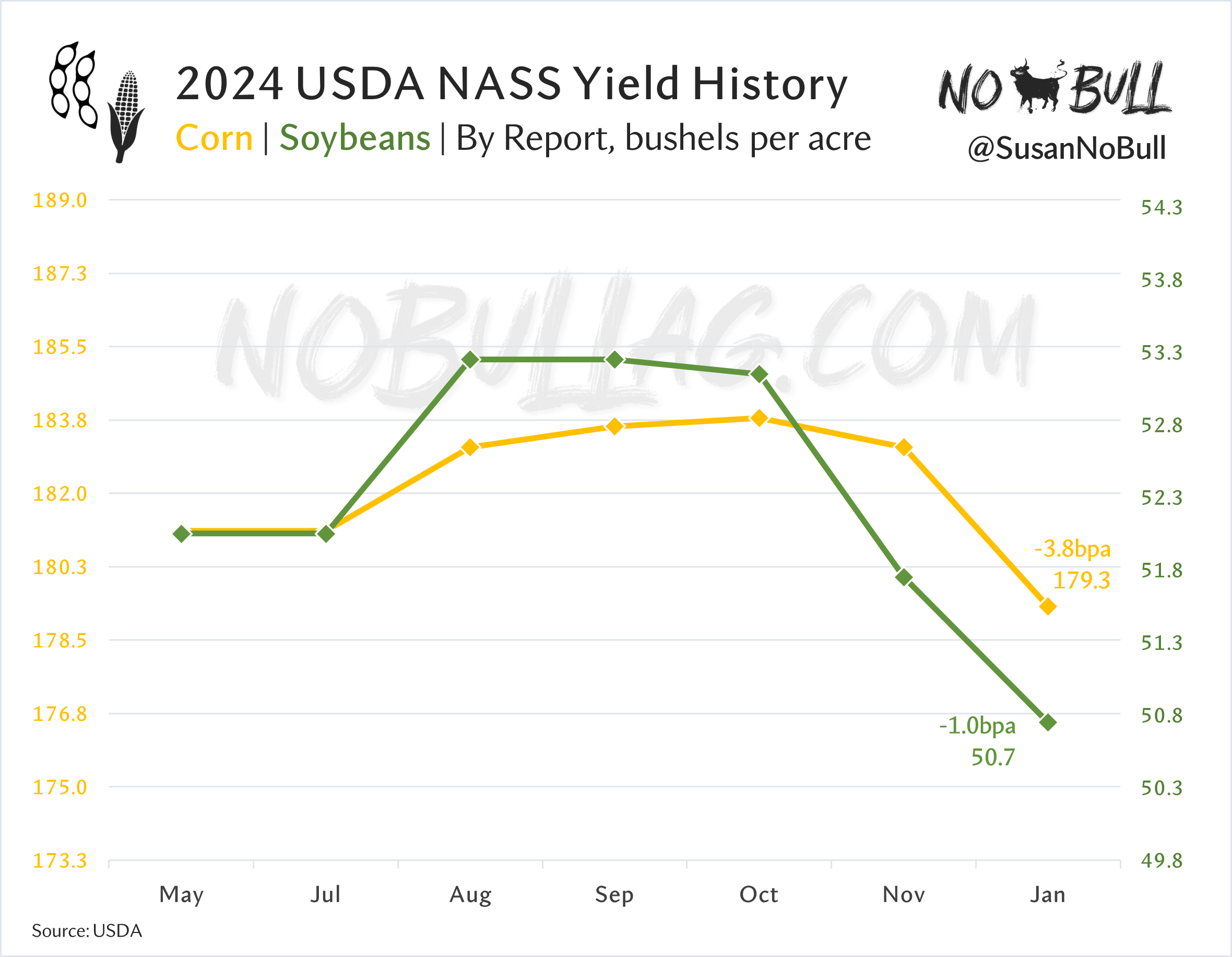

The biggest surprise of USDA's January data dump was a notable decline in both corn and soybean yield for the U.S. 2024 crop, falling well below pre-report estimates and marking two of the largest Nov-to-Jan drops on record.

2024 final corn yield fell 3.8bpa month-on-month to 179.3 while beans lost a full bushel an acre, down to 50.7bpa.

This marks the second yield reduction in a row for corn, down 4.5bpa (2.4%) total from October's 183.8bpa print.

Soybeans have seen reductions the last three reports, falling 2.5bpa (4.7%) from the high water mark - a would-be record 53.2bpa in September.

2 | King Corn

Even with Friday’s big cut, 2024 yield is still a record high at 179.3, beating 2023 by 2bpa.

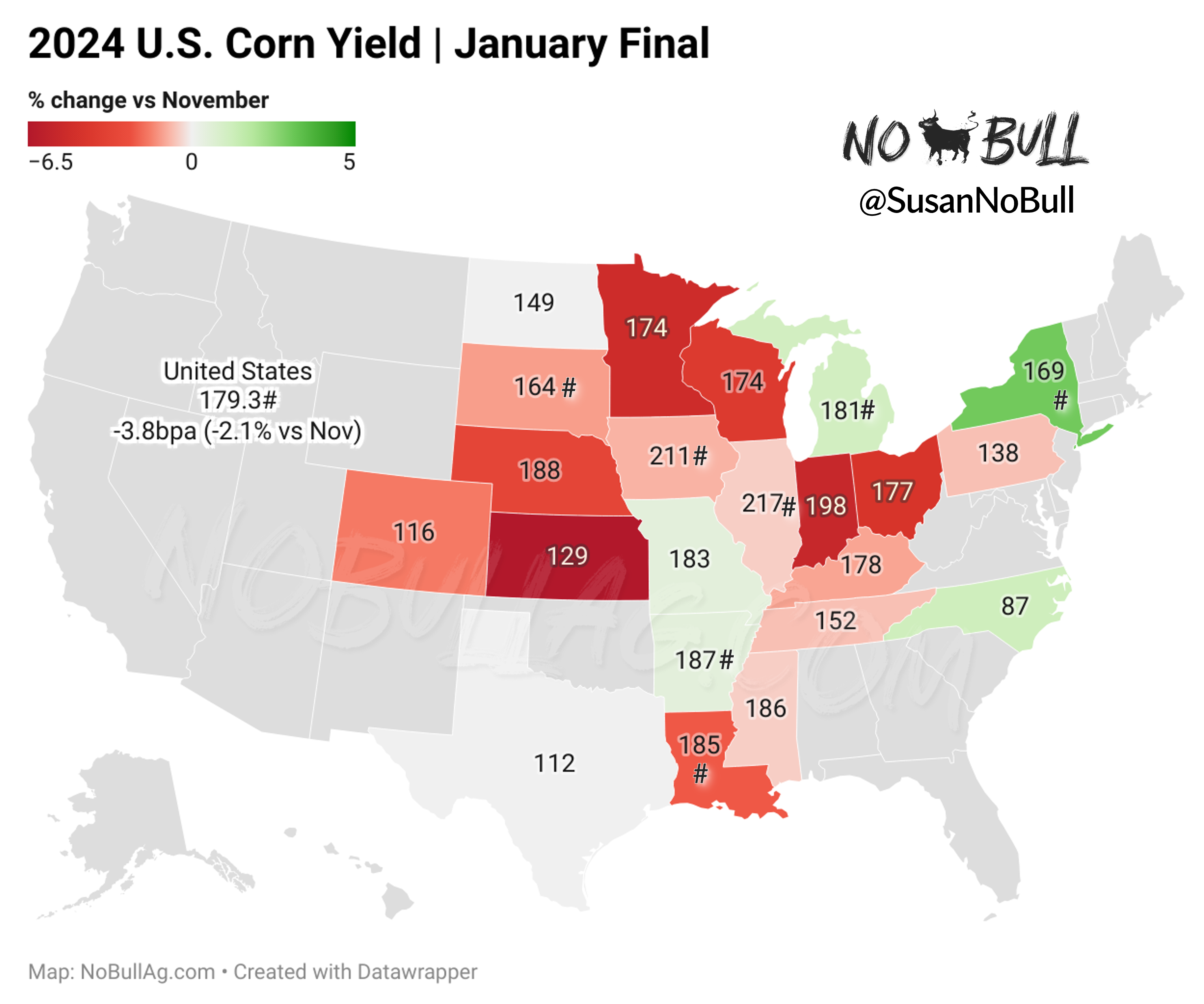

Several states saw records, including Illinois at 217 (-1 from Nov) and Iowa at 211 (-2 from Nov).

An incredible 14 of the top 20 producing states saw yield reductions from November:

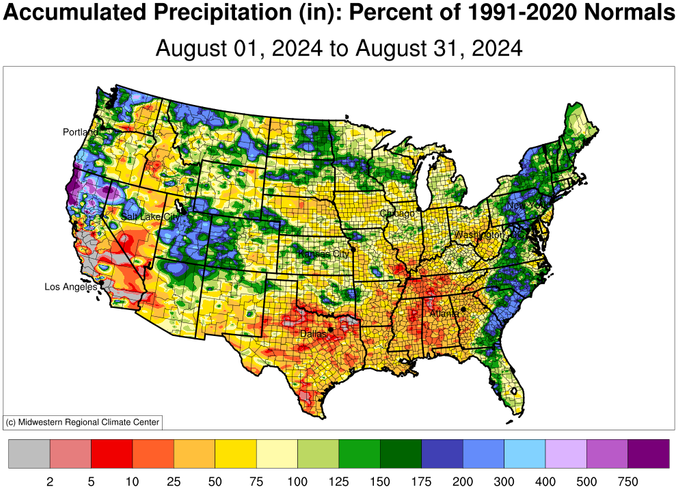

Looks like USDA’s data finally caught up with August’s dry weather and an abnormally dry 2024 crop:

3 | Traffic Jam

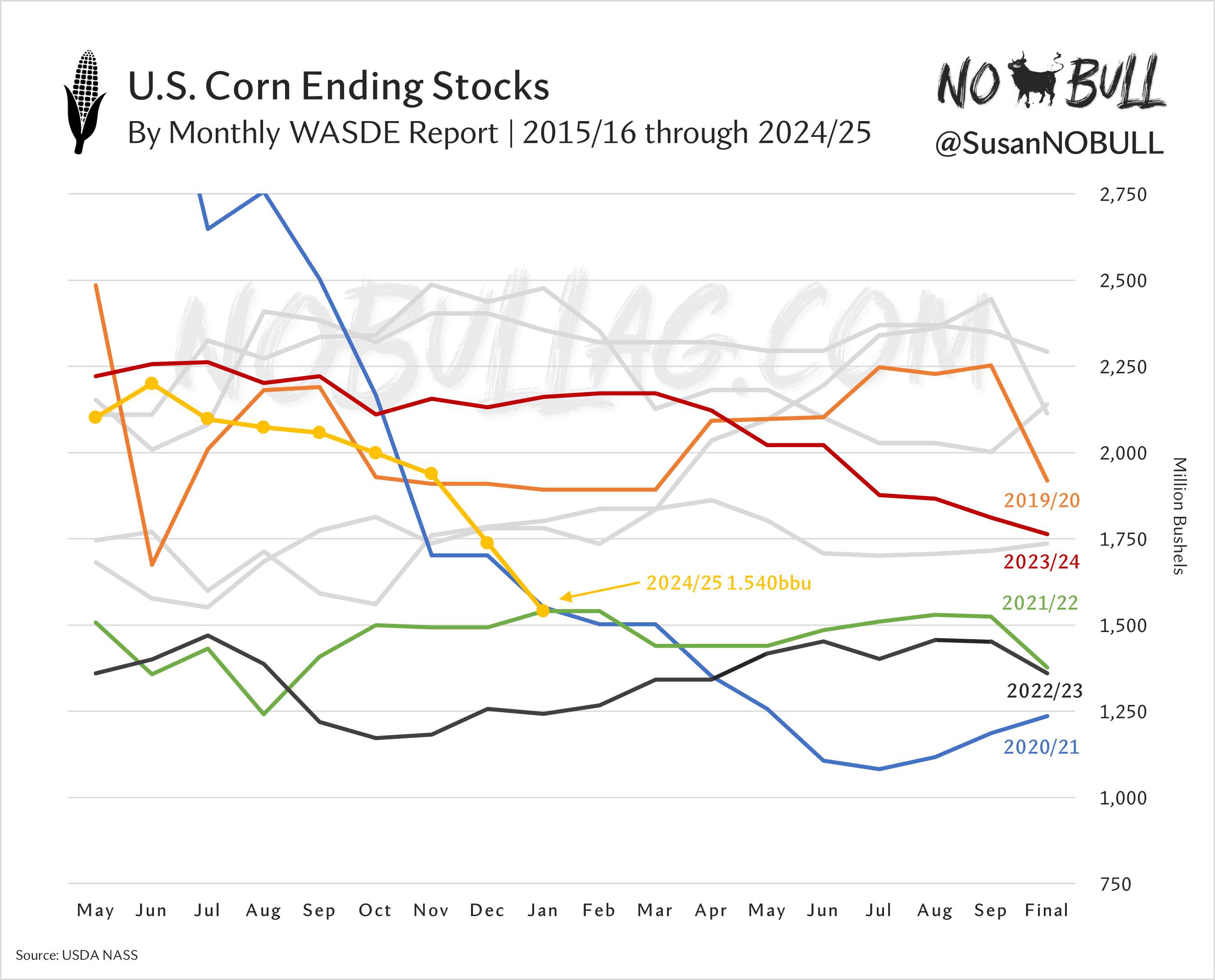

The large drop in corn yield shaved 276 million bushels off 2024 production, making way for a notable drop in 2024/25 ending stocks with less supply on hand.

At 1.540 billion bushels, January's stocks print was down nearly 200 million bushels month-on-month and makes USDA's 7th consecutive ending stocks cut.

Interesting to note 2024/25's ending stocks forecast now sits in a traffic jam with 2020/21 and 2021/22 which were both at similar levels at this point in each of their respective marketing years.

4 | Good news, bad news

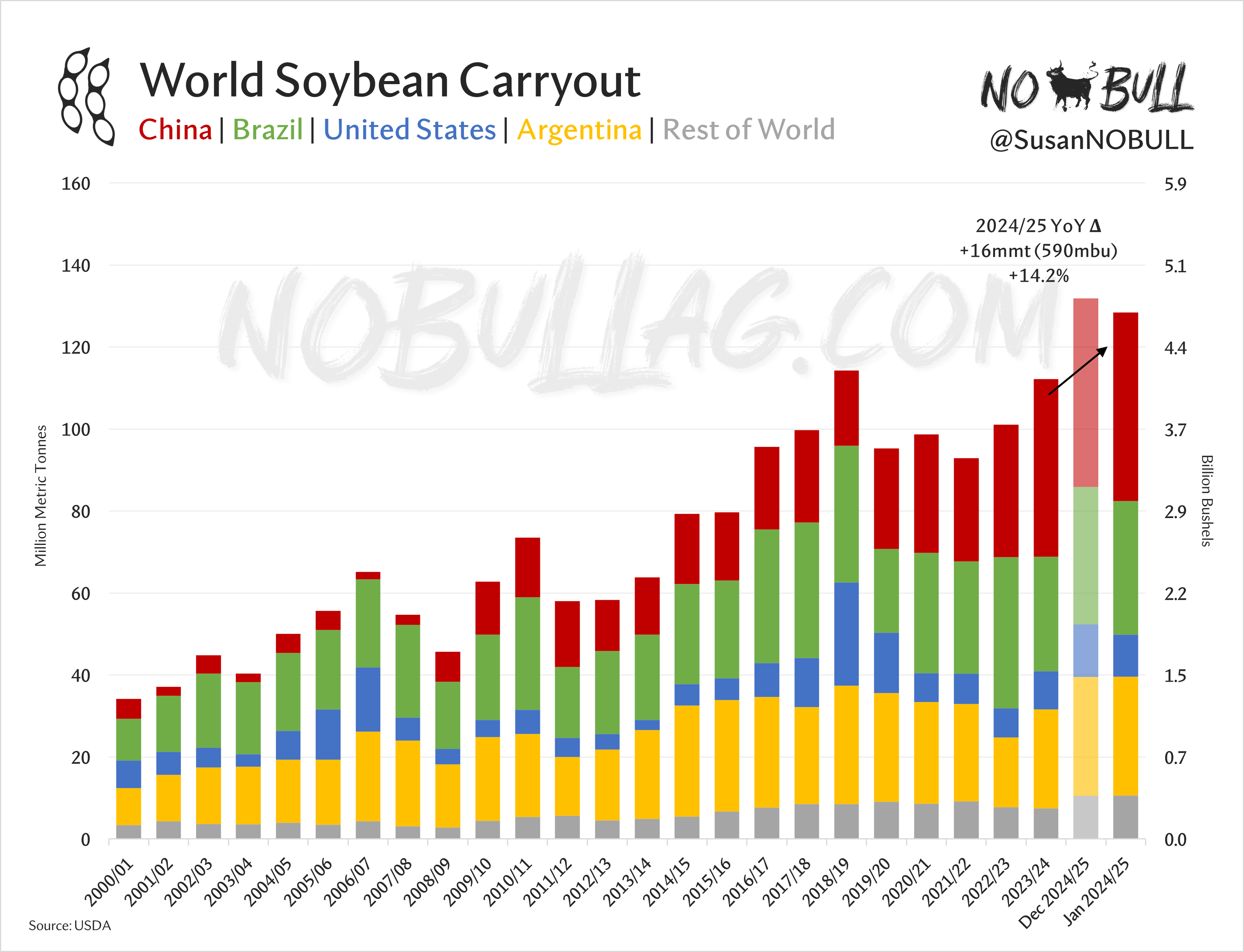

The good news is U.S. soybean carryout saw an unexpected 90 million bushel (2.5mmt) drop at 380 million bushels, marking a new low for the marketing year. This, in combination with a 1mmt increase in Brazil crush dropped 2024/25 world soybean carryout by 3.5mmt (130mbu).

The bad news is world bean carryout is still a record by a mile:

5 | A currency conundrum

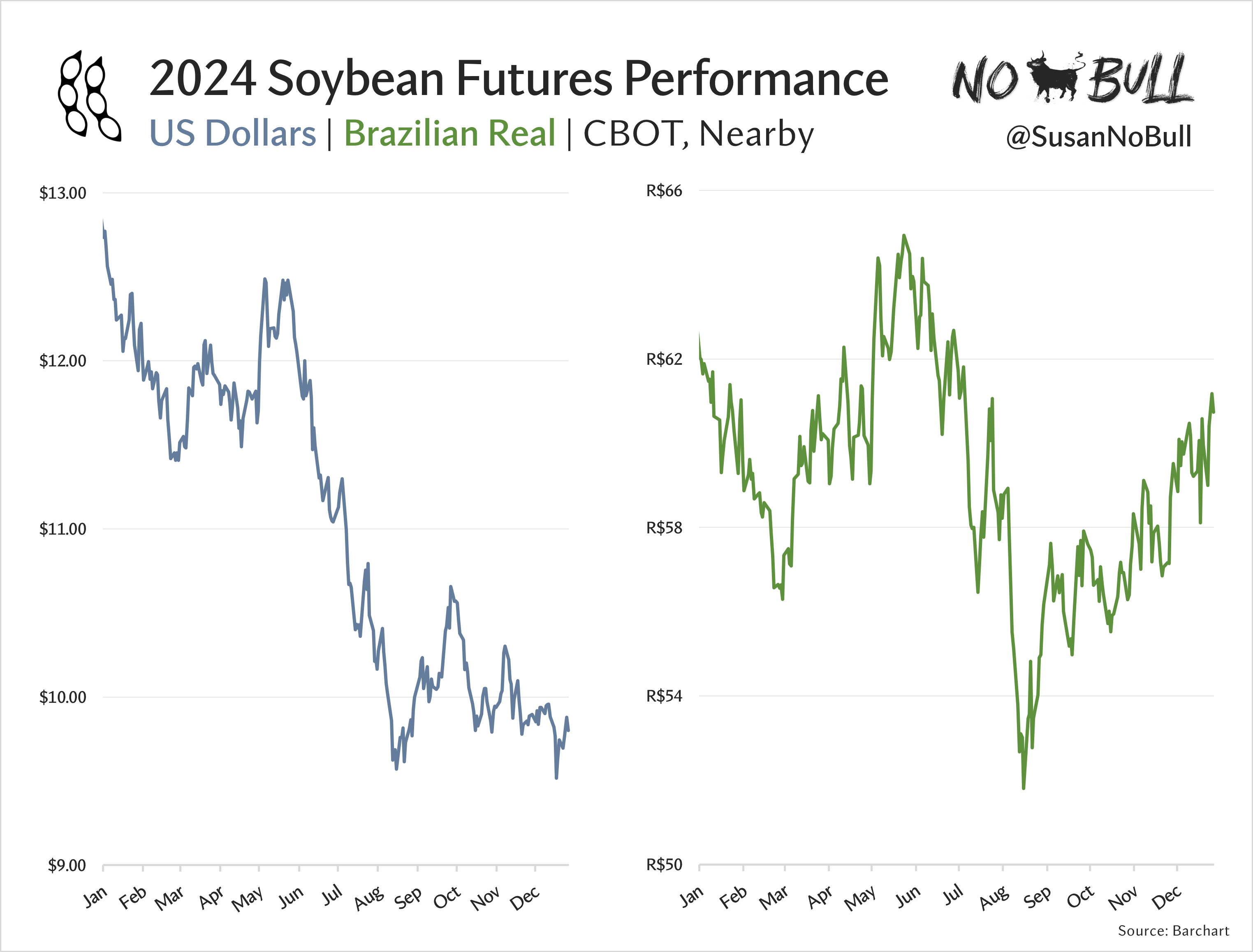

One of the more frustrating aspect of 2024 was the more-than $3 fall in the soybean market, as nearby futures fell from $13 to less than $10 over the course of 12 short months.

Even more frustrating is the fact that 85% of those board losses were mitigated for the Brazilian producer as the depreciation of Brazil's real all-but outpaced soybean futures' declines.

In reals, front-month soybeans were down a mere 45 cents on the year…

For the full version of this update or to subscribe, visit NoBullAg.Substack.com.