The role of dividend-paying stocks in building long-term wealth can't be understated. Over the past century, dividends have consistently represented a substantial portion of total stock-market returns. Yet recent years have seen many high-yield stocks struggling to match the S&P 500's performance, due to the outperformance of a handful of tech heavyweights.

These market dynamics have created compelling opportunities in select dividend-paying companies. Specifically, the current environment has pushed some fundamentally sound businesses into value territory. Here's an overview of two ultra-high-yield dividend stocks that are top buys in 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

Tobacco giant adapts to changing times

Altria Group (NYSE:MO) knows a thing or two about longevity. Through two centuries of business evolution, the company has maintained its market dominance, with flagship brands like Marlboro. Right now, investors can grab shares at an attractive price point, thanks to broader market concerns about declining smoking rates.

Looking at the numbers, Altria's stock trades at just 9.87 times forward earnings, far below the S&P 500's multiple of 24.2. This bargain valuation tells an interesting story. While the market frets over traditional tobacco's future and some of Altria's past missteps (like its cannabis ventures), it's overlooking the company's growing success in products like oral tobacco and nicotine pouches.

Management isn't sitting still in the face of changing consumer habits. Their game plan centers on expanding the company's presence in alternative nicotine products. These new categories are already showing promise, complementing the still-profitable cigarette business with fresh growth opportunities.

The dividend story might be the most compelling part of Altria's investment case. It's yield of 7.8% stands head and shoulders above most S&P 500-listed companies.

Better yet, the payout ratio sits at a comfortable 66.9%, suggesting this generous dividend is built to last. For income seekers, that combination of yield and sustainability is hard to ignore.

Telecom leader positioned for recovery

Verizon Communications (NYSE:VZ) isn't just another phone company. As one of America's largest wireless carriers, it serves millions of customers and operates a network that spans the nation.

The past few years haven't been kind to Verizon's stock price. Heavy spending on network upgrades and fierce competition have weighed on investor sentiment.

But that's where things get interesting. At just 8.44 times forward earnings, Verizon trades like a company in trouble. The market seems fixated on competitive pressures and past capital spending, missing the turning point in Verizon's story. The expensive phase of the 5G network buildout is winding down, and it's starting to show in the numbers.

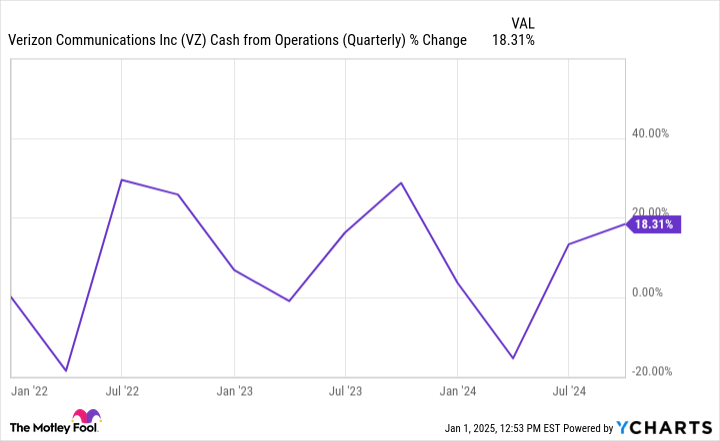

The cash-flow narrative has shifted dramatically in recent years (see graph below). With major network investments in the rearview mirror, Verizon's free cash flow has surged over the prior 36 months. Furthermore, the wireless industry has matured over the past 12 months, and carriers are finally starting to show pricing discipline after years of aggressive promotions.

VZ Cash from Operations (Quarterly) data by YCharts.

For income seekers, Verizon's 6.78% dividend yield turns heads. True, the 115% payout ratio raises eyebrows, but improving cash flow paints a more reassuring picture.

Moreover, the telecom giant's 18-year streak of dividend hikes speaks volumes about its commitment to shareholders. With network spending falling and cash flow rising, Verizon looks well-positioned to maintain its reputation as a reliable dividend payer.

Why buy these two high-yield dividend stocks?

Both Altria and Verizon have fallen out of Wall Street's favor, creating a classic "be greedy when others are fearful" scenario. Their stocks trade at single-digit earnings multiples while offering yields that dwarf the S&P 500's average payout.

But what's truly compelling here isn't just the eye-catching yields. These are market leaders with staying power, not speculative high-yield traps. Each company faces its share of headwinds, yet both have clear paths forward.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $823,000!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 30, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.