Today's Chart of the Day will be a little different. I know very little about cryptocurrencies and have no idea how to evaluate or compare all the different offerings. I do know it is an asset class I cannot ignore. Whenever I want to begin to enter an asset class or industry I know nothing about I look for mutual funds or ETFs that invest in that arena and let someone else do all the research until I'm more comfortable with own research.

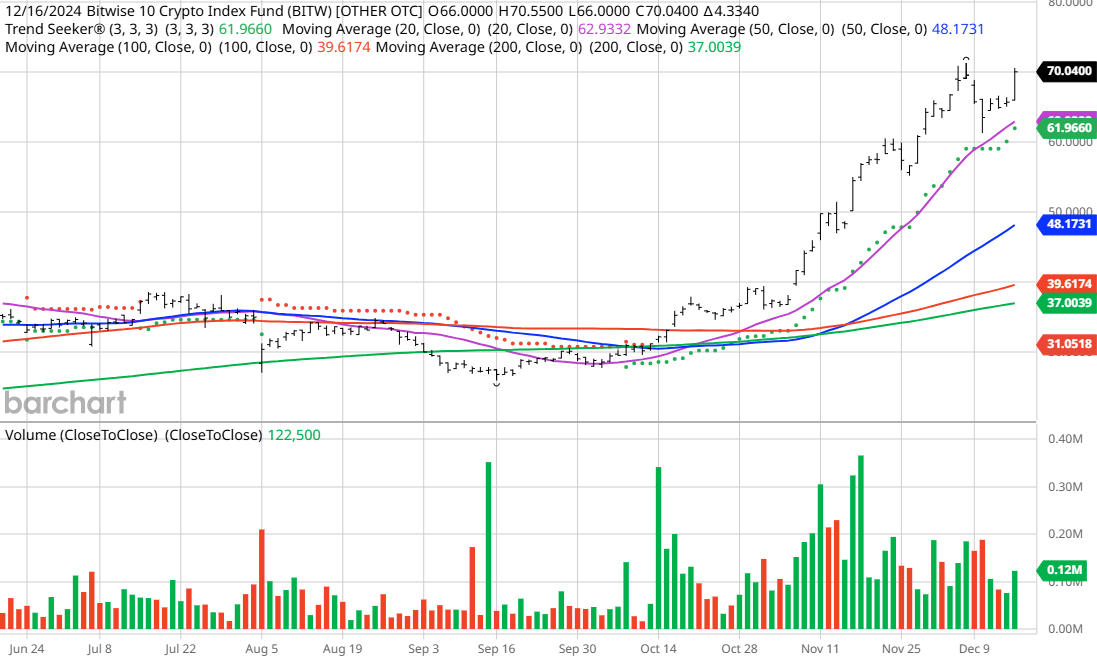

I'm putting my toes into the cryptocurrencies by looking at the Bitwise 10 Crypto Index Fund (BITW). Below is the chart I normally use on Chart of the Day:

BITW Price vs Daily Moving Averages:

BITW seeks to track an index of the 10 largest crypto assets, weighted by market capitalization and screened for certain risks. It includes established giants like Bitcoin and Ethereum, as well as up-and-coming assets. It’s a single point of access to gain exposure to the crypto market, without having to pick winners and losers.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 212.81+ Weighted Alpha

- 215.35% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 28.51% in the last month

- Relative Strength Index 72.84%

- Technical support level at $67.18

- Recently traded at $70.045 with 50 day moving average of $48.17

- 5,780 investors are monitoring this security on Seeking Alpha

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Space%20Technology%20by%20Rini_%20com%20via%20Shutterstock.jpg)