Shares of vehicle salvage company Copart (NASDAQ:CPRT) jumped 23.2% in November, according to data provided by S&P Global Market Intelligence. This company is one of the most consistent performers on the stock market, meaning its shareholders rarely sell. Even modestly positive news, therefore, can create far more buyers than sellers. And this seems to be what happened last month.

On Nov. 21, Copart announced financial results for its fiscal first quarter of 2025, ended Oct. 31. Revenue was only up 12% year over year to $1.15 billion. But this was a record number, ahead of expectations, and its best growth rate in a year.

On the bottom line, Copart didn't grow as much. Its Q1 gross profit was only up 10% and its net income only increased by 9%. But this wasn't a problem because analysts had expected as much.

In short, Copart either met or exceeded expectations in its latest quarter, which led to increased price targets from the professional analyst community and sent the stock to all-time highs.

How Copart's business works

When accidents happen or natural disasters strike, insurance companies have work to do. In cases where vehicles are totaled, they turn to companies such as Copart to get rid of junk cars. In its fiscal 2024, 81% of the vehicles sold by Copart came from insurance companies.

Q1 wasn't without its challenges. Back-to-back hurricanes in Florida made it tricky for Copart to efficiently retrieve vehicles. But it still managed to get the job done.

In most cases, Copart doesn't take possession of the junk vehicles, it merely takes care of the logistics of getting them sold on behalf of the insurance companies. For this reason, most of Copart's revenue comes from value-added services, which are high-margin revenue streams.

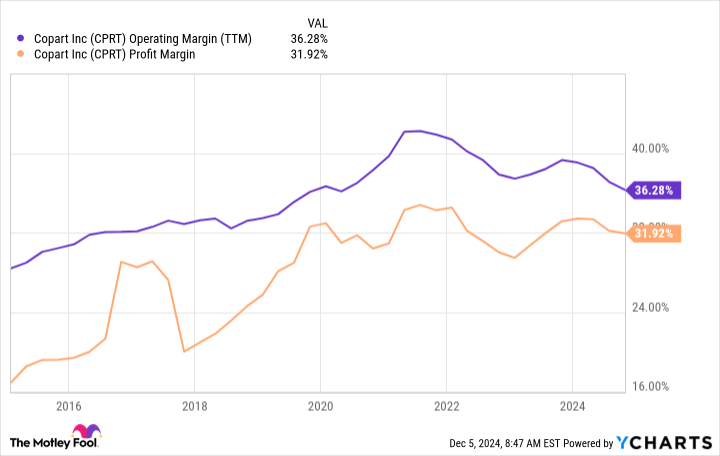

While it's true that its profit margins took a step back in Q1, Copart's margins are so high that a modest step back in a given quarter isn't seen as a major problem.

CPRT Operating Margin (TTM) data by YCharts

Is Copart stock still a buy?

The real question on everyone's mind is whether Copart stock is still a buy at all-time highs. When thinking through the risks to this investment, perhaps the most pressing issue is its valuation. It trades at a price-to-sales (P/S) ratio of 14. It's only traded that high one other time in its long history: in late 2021 right before it plunged about 30%.

The thing is, Copart is one of the most high-quality businesses on the stock market. Even if you bought at the peak valuation in late 2021, you'd still be outperforming the S&P 500. In my opinion, this is one of those companies that makes sense to dollar-cost average a position when the valuation is high and to buy larger stakes when the valuation is attractive.

Investors who avoid Copart stock altogether until it's cheap will likely miss out on market-beating upside for a business with a long history of compounding returns.

Should you invest $1,000 in Copart right now?

Before you buy stock in Copart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Copart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $889,433!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Copart. The Motley Fool has a disclosure policy.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)