Abercrombie & Fitch Co. ANF is scheduled to report third-quarter fiscal 2024 results on Nov 26, before the opening bell.

The Zacks Consensus Estimate for ANF’s fiscal third-quarter revenues is pegged at $1.2 billion, suggesting 11.8% growth from that reported in the year-ago quarter. For fiscal third-quarter earnings, the consensus mark is pegged at $2.32 per share, implying a 26.8% increase from the $1.83 reported in the year-ago quarter. The consensus estimate for earnings has moved up by a penny in the past 30 days.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

In the last reported quarter, Abercrombie's earnings beat the consensus estimate by 16.8%. Moreover, ANF has delivered an earnings surprise of 28%, on average, in the trailing four quarters.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model conclusively predicts an earnings beat for Abercrombie this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Abercrombie currently has an Earnings ESP of +4.59% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Trends Leading Up to ANF’s Q3 Results

ANF has been gaining from continued momentum in the Abercrombie brand, improvement in the Hollister brand and store-optimization efforts. The company has noted that its efforts to improve the positioning of the Hollister brand have been paying off. Investments across stores, digital and technology via its Always Forward Plan bode well.

The company's third-quarter fiscal 2024 results are anticipated to reflect the strength of its brands and robust demand for products that resonate with customers. Management is focused on curating trend-right merchandise, strengthening customer relationships through marketing, advancing digital commerce and efficiently managing expenses.

On the last reported quarter’s earnings call, management expected to benefit from brand strength, driven by its focus on delivering high-quality, on-trend assortments for new and retained customers across regions and brands. It has also been focused on making investments across stores, digital and technology, which are slated to strengthen the company’s performance in the forward quarters.

Abercrombie anticipates third-quarter fiscal 2024 consolidated net sales to increase in the low-double digits from the $1.06 billion reported in the year-ago period. The operating margin is expected to be 13-14%, suggesting an increase from the operating margin of 13.1% delivered in third-quarter fiscal 2023.

Our model predicts third-quarter fiscal 2024 total revenues to increase 10.1% year over year. We expect sales for the Abercrombie brand to grow 12.4%. Sales for Hollister are expected to improve 7.7%.

We note that Abercrombie has been witnessing favorable margin trends, driven by lower freight and raw material expenses, and improved average unit retail (AUR). This has been boosting the company’s gross and operating margins.

For the third quarter of fiscal 2024, ANF projected an operating margin of 13-14%, implying an increase from the operating margin of 13.1% delivered in third-quarter fiscal 2023. This growth is expected to have been backed by a higher gross margin rate on continued benefits from cotton prices, improved AUR and modest expense leverage. We expect an adjusted operating margin of 13.4% for the fiscal third quarter, suggesting a year-over-year rise of 30 bps. Our model predicts the gross margin to remain flat year over year at 64.9% in the fiscal third quarter.

However, Abercrombie has been witnessing elevated operating costs on higher technology expenses and incentive-based compensation. Additionally, inflation and increased investment for the 2025 Always Forward Plan initiatives are likely to have been concerning in the to-be-reported quarter. Our model estimates a year-over-year increase of 10.3% in adjusted operating expenses for the fiscal third quarter.

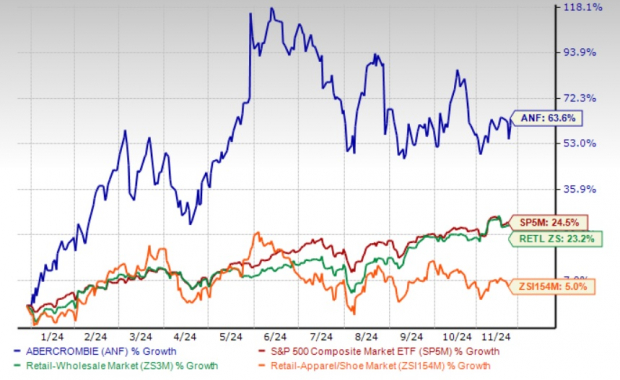

ANF’s Price Performance & Valuation

Abercrombie’s shares have exhibited an uptrend in the year-to-date period, leaving behind its industry peers and the Zacks Retail-Wholesale sector. Year to date, the New Albany, OH-based company’s shares have risen 63.6%, outperforming the industry and the sector’s growth of 5% and 23.2%, respectively. The company has also lagged the S&P 500’s rally of 24.5%.

ANF’s One-Year Price Performance

Image Source: Zacks Investment Research

The Abercrombie stock has rallied ahead, leaving arch-rival American Eagle AEO struggling with an 18.6% decline in the same period. Also, ANF’s stability stands out against competitors like Urban Outfitters’ URBN 4.6% gain and The Gap Inc.’s GAP 19.2% rise in the year-to-date period.

At the current price of $141.57, ANF trades at a 28.1% discount to its 52-week high of $196.99. It also trades at a 96.3% premium to its 52-week low mark of $72.13.

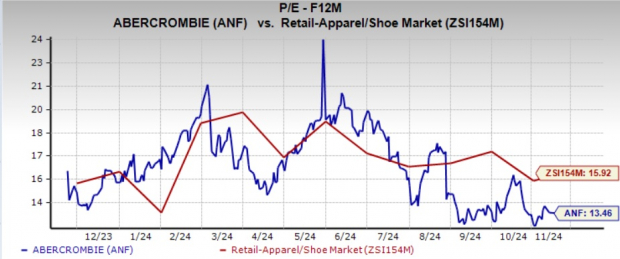

From the valuation standpoint, ANF trades at a forward 12-month P/E multiple of 13.46X, lower than the industry average of 15.92X and the S&P 500’s average of 22.28X. Abercrombie’s valuation appears attractive at this level.

Image Source: Zacks Investment Research

Investment Thesis

Abercrombie has achieved remarkable success in recent years, fueled by its steadfast dedication to offering premium, high-quality casual apparel for men, women, and children. Its rebranding efforts, particularly targeting millennials with a focus on jeans, have boosted sales across all brands, especially the Abercrombie brand.

ANF has bolstered its market position by leveraging favorable fashion trends through digital initiatives and effective strategies, including store optimization. These efforts have driven strong financial performance, marked by notable growth in sales and profitability. Abercrombie's strategic transformation has paved the way for sustainable long-term growth, positioning the company to capitalize on market trends, sustain its momentum and deliver value to shareholders.

Conclusion

Regardless of Abercrombie's stock performance after the third-quarter fiscal 2024 results, it will remain a strong long-term investment option due to its solid fundamentals. The company's financial stability and operational efficiency are reflected in its core metrics. With initiatives like rebranding, digital expansion and store optimization, Abercrombie is well-positioned for sustained growth. These factors make the stock appealing even ahead of the fiscal third-quarter results.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

The Gap, Inc. (GAP): Free Stock Analysis Report

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Oracle%20Corp_%20logo%20on%20phone-by%20WonderPix%20via%20Shutterstock.jpg)