Alphatec Holdings (ATEC) racked up a 5-day gain of more than 54% last week, led by a nearly 40% spike on Thursday alone after the company reported Q3 earnings. Alphatec’s per-share loss was slightly wider than expected, while revenue of $150.7 million surpassed the consensus, led by a 30% increase in surgical revenue.

New surgeon adoption was up 19% in the quarter, while procedural volume growth climbed 20%.

Looking ahead, Alphatec hiked its full-year revenue guidance to call for growth of 25% to $605 million, with adjusted EBITDA now forecast at $27 million, up from the prior $25.5 million.

A key highlight was Alphatec’s newly inked agreement with Braidwell LP, and Pharmakon Advisors, LP, to expand the company’s existing term loan by $50 million. ATEC also ended Q3 with a cash balance of $81 million, and lowered its free cash use to $21 million for the period.

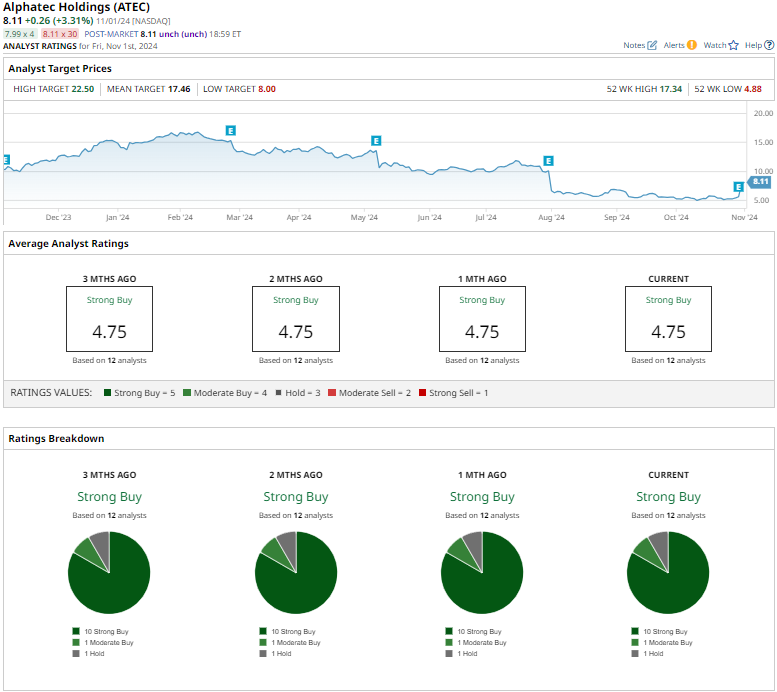

Despite the massive post-earnings rally, ATEC is still down 53% from its year-to-date highs, and trades more than 59% below its 2021 highs. Analysts seem unbothered by the stock's freefall in 2024, with 11 out of 12 ranking the stock a “buy” or better, and the mean price target of $17.46 implying expected upside of more than 115% from Friday’s close.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)