Virtu Financial, Inc. VIRT is scheduled to release third-quarter 2024 results on Oct. 24, before the opening bell. The Zacks Consensus Estimate for earnings per share is pegged at 77 cents, which indicates an improvement of 71.1% from the prior-year quarter’s reported number. Growing net trading income in the Market Making and Execution Services segments, coupled with higher commissions and technology services revenues, is expected to have benefited its quarterly performance.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

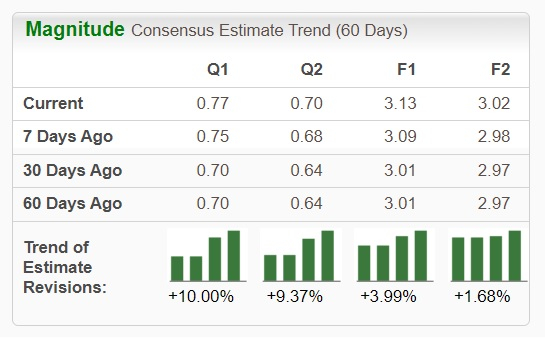

The third-quarter earnings estimates have witnessed three upward revisions against one downward over the past month. During this time, the estimate increased 10%. Meanwhile, the Zacks Consensus Estimate for revenues is pegged at $373 million, indicating 25.2% growth from the year-ago quarter’s reported figure.

Image Source: Zacks Investment Research

Earnings Surprise History of VIRT

Virtu Financial’s bottom line beat the consensus estimate in three of the trailing four quarters and missed the mark once, with the average surprise being 9.87%. This is depicted in the figure below:

What Our Quantitative Model Unveils for VIRT

Our proven model predicts an earnings beat for Virtu Financial this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here.

Earnings ESP: Virtu Financial has an Earnings ESP of +0.97% because the Most Accurate Estimate of 78 cents per share is pegged higher than the Zacks Consensus Estimate of 77 cents. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: VIRT currently carries a Zacks Rank of 2.

Key Factors to Influence VIRT’s Q3 Results

Virtu Financial's top line is expected to have benefited from improved net trading income, higher commissions and technology services revenues along with increased interest and dividends income. The Zacks Consensus Estimate for overall net trading income is $341 million, which indicates a 7.9% rise from the prior year's quarter and matches our estimate.

For commissions and technology services, the consensus estimate is $120.1 million, indicating a 8.9% increase year over year. The Zacks Consensus Estimate for interest and dividends income is pegged at $131.9 million, which implies a 3.3% rise from the year-ago quarter’s figure.

Our forecast for these revenue two components implies an increase of 8.9% and 3.3%, respectively, from the corresponding figures of the prior year.

Trading income in both the Market Making and Execution Services segments are likely to have witnessed year-over-year improvements. The Zacks Consensus Estimate for net trading income in the Market Making segment is pegged at $335.1 million, indicating a 7.9% year-over-year rise. For the Execution Services segment’s net trading income, the consensus mark is pinned at $5.8 million, indicating 4.7% growth from the prior-year quarter’s number.

Virtu Financial’s margins are likely to have suffered a blow due to elevated operating costs, which in turn, are anticipated to have resulted from increased brokerage, exchange, clearance fees and payments for order flow, communication and data processing expenses, as well as interest and dividends expenses. Our estimate for total operating expenses is $506.6 million, which indicates an increase of 3% year over year.

VIRT Stock’s Price Performance & Valuation

Virtu Financial’s shares have gained 59.7% year to date compared with the industry’s 9.8% growth. It has also outperformed the broader Zacks Finance sector’s 18.1% rise and the S&P 500 Index’s 22.7% increase in the said time frame.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Now, let us look at the value Virtu Financial offers investors at current levels.

The company is cheaply priced compared with the industry average. Currently, VIRT is trading at 10.79X forward 12-months earnings, below the industry’s average of 15.16X.

Image Source: Zacks Investment Research

Other Stocks That Warrant a Look

Here are some other companies from the Finance space, which according to our model, have the right combination of elements to beat on earnings this time around:

Hamilton Lane Incorporated HLNE has an Earnings ESP of +0.63% and flaunts a Zacks Rank of 1 currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HLNE’s third-quarter earnings is pegged at $1.06 per share, indicating 19.1% growth from the year-ago quarter’s number. Hamilton Lane’s earnings beat estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 12.72%.

Janus Henderson Group plc JHG has an Earnings ESP of +1.91% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for JHG’s third-quarter earnings is pegged at 79 cents per share, indicating a 23.4% improvement from the year-ago quarter’s reported figure.

Janus Henderson’s earnings beat estimates in the trailing four quarters, the average surprise being 23.13%.

Virtus Investment Partners, Inc. VRTS currently has an Earnings ESP of +0.30% and a Zacks Rank of 2. The Zacks Consensus Estimate for VRTS’ third-quarter earnings is $6.77 per share, indicating 9% growth from the year-ago quarter’s reported figure.

Virtus Investment’s earnings beat estimates in two of the trailing four quarters, matched the mark once and missed the same in the remaining one occasion, the average surprise being 0.49%.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Virtus Investment Partners, Inc. (VRTS): Free Stock Analysis Report

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

Janus Henderson Group plc (JHG): Free Stock Analysis Report

Hamilton Lane Inc. (HLNE): Free Stock Analysis Report

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)