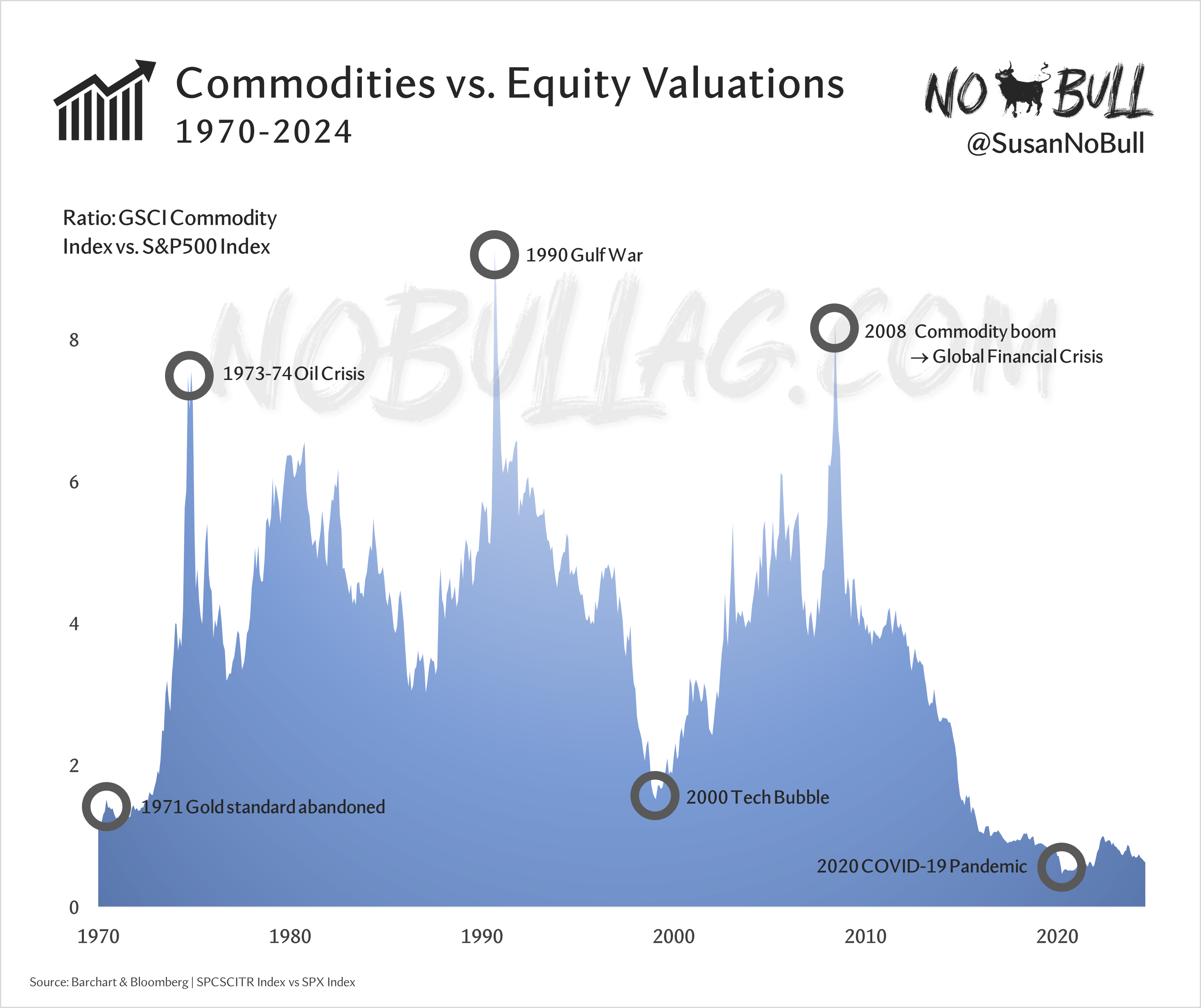

1 | Commodities vs Equities

50+ years of commodities vs. equities in one chart:

Notable events of the past 50+ years:

1971 | Abandonment of the gold standard left its value skyrocketing until 1980

1973-74 | OPEC’s oil embargo against the U.S. during Arab-Israeli War more-than-doubled oil prices

1990 | Gulf War disrupted oil production and supply

2000 | Tech bubble led investors to shift to commodities, surging markets

2008 | Commodities at all-time highs amid emerging market growth, followed by a sharp decline during the Global Financial Crisis

2020 | COVID-19 Pandemic lockdowns slashed commodity demand. Central banks and governments flooded markets with stimulus

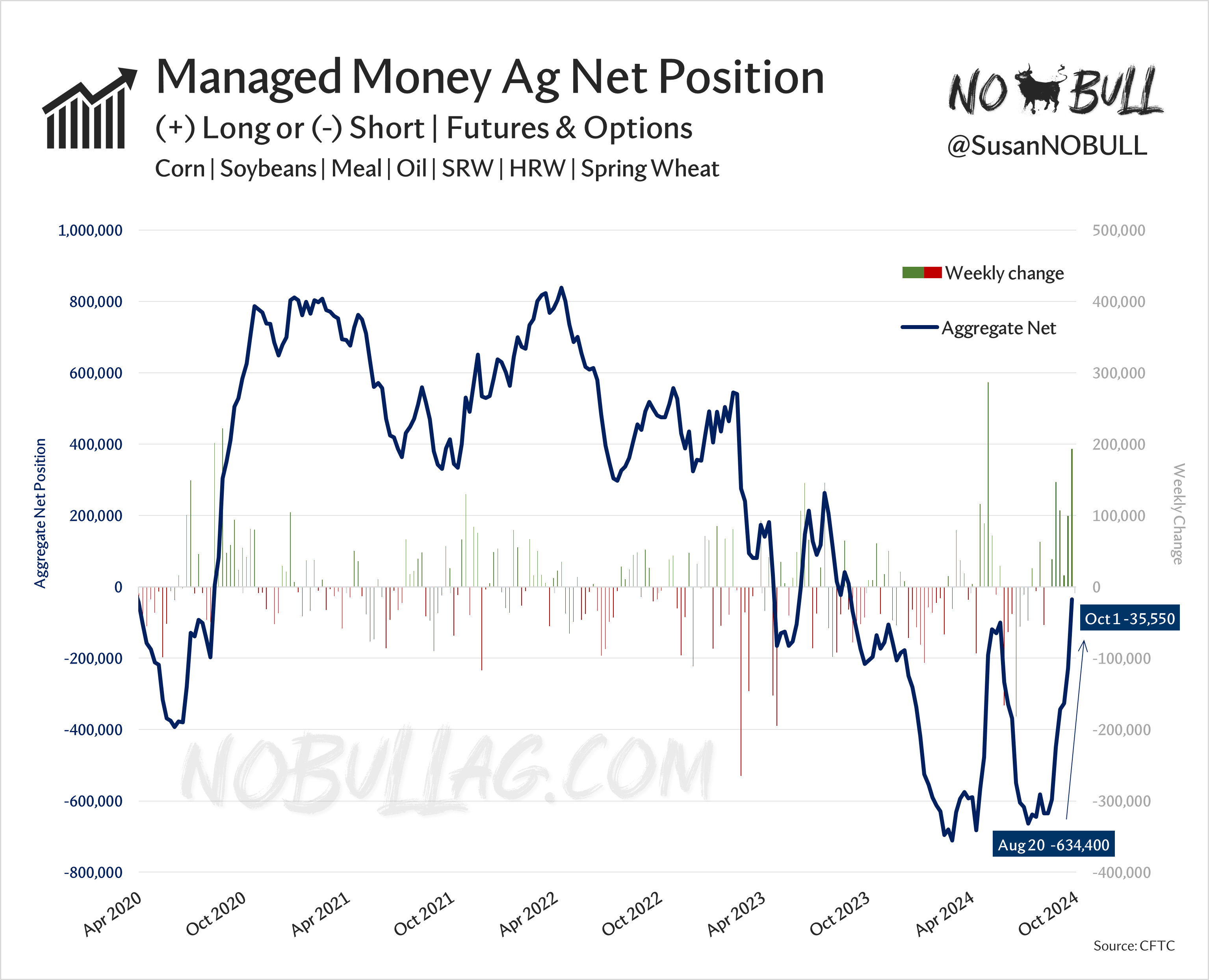

2 | Buy baby, buy!

The week ending Oct 1 was the largest week of buying across ags since early May, lifting the aggregate corn + soy complex + wheat net short to its smallest since September of last year.

Managed money’s net buying streak since late-August has been incredible:

+950 million bushels of corn (more than 50% of 2023/24 ending stocks)

+740 million bushels (more than 2x the 2023/24 carryout)

+10 million tons of meal

+6 billion pounds of soybean oil

+305 million bushels of wheat

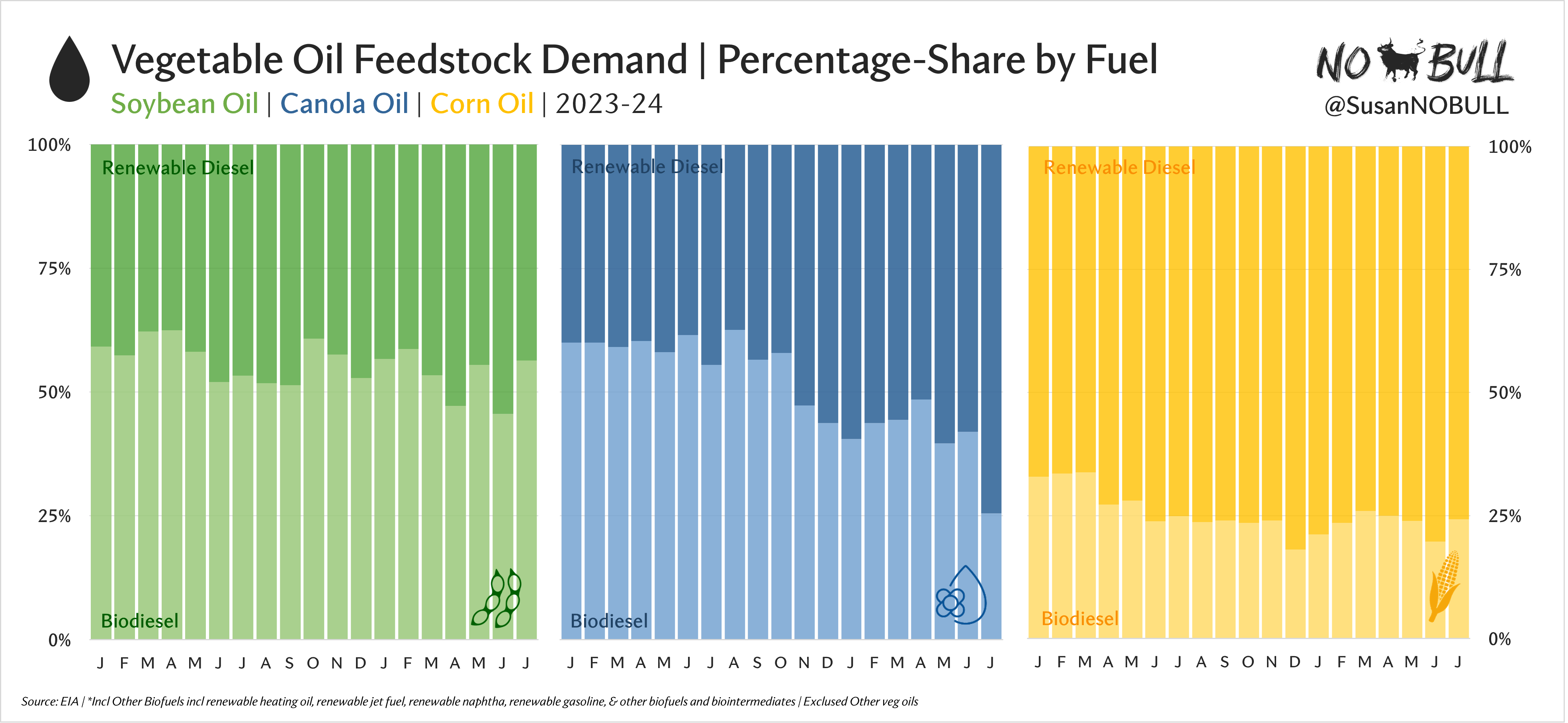

3 | Burn your vegetables

Interesting to compare the three major veg oils used in biomass-based diesel production by fuel.

Soybean oil has long-been favored in biodiesel production while canola oil has seen a consistent climb in renewable diesel demand (lower CI score than soybean oil = more favorable subsidy & better positioned logistically to flow into California’s renewable diesel market).

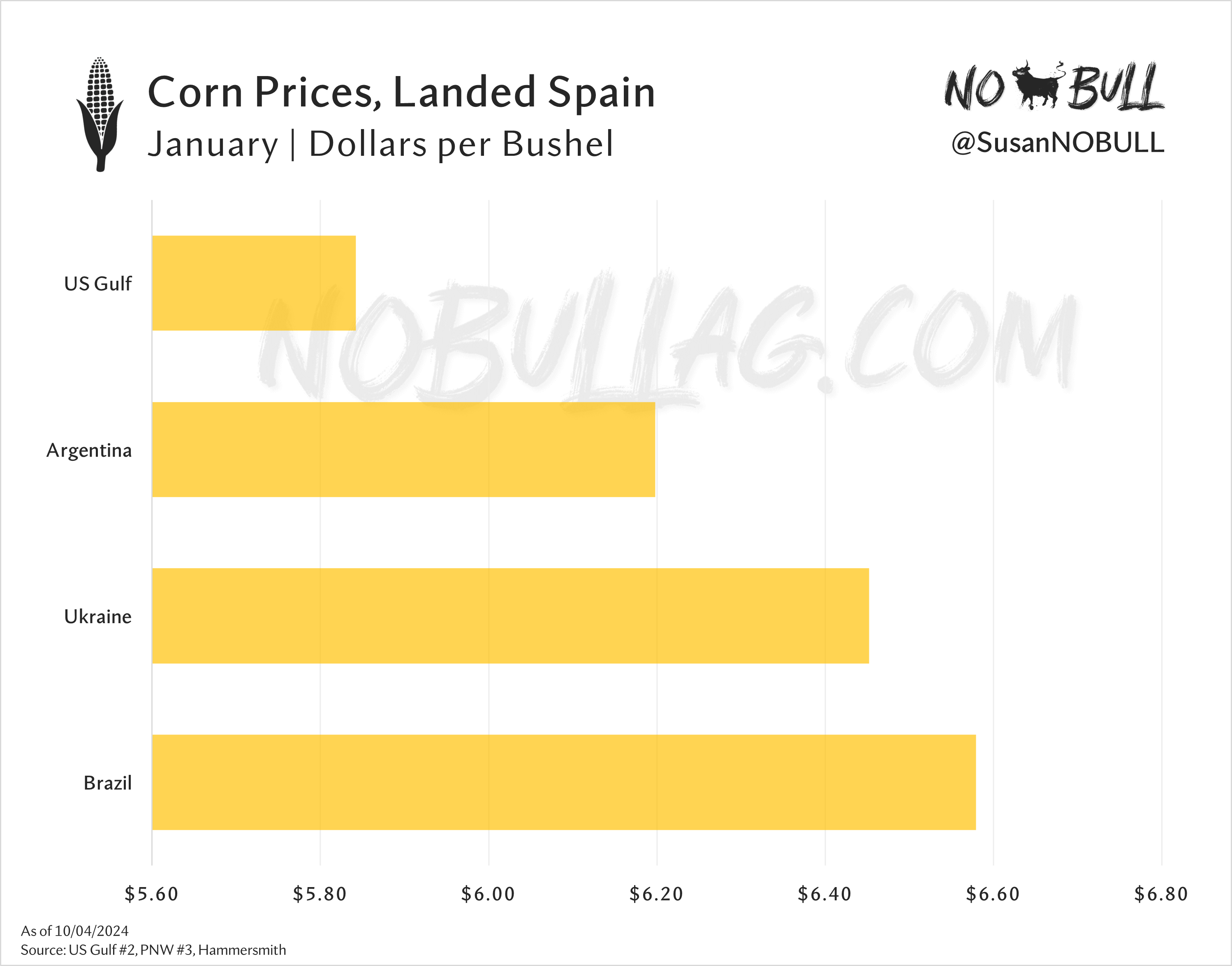

4 | Back in business!

US corn is substantially cheaper than both Brazil and Ukraine, driven by a short crop in Ukraine and decreased 2023/24 production on top of low water creating headwinds for Northern Arc Brazilian exporters.

Low prices eventually cure low prices in the form of new demand - it just takes a while!

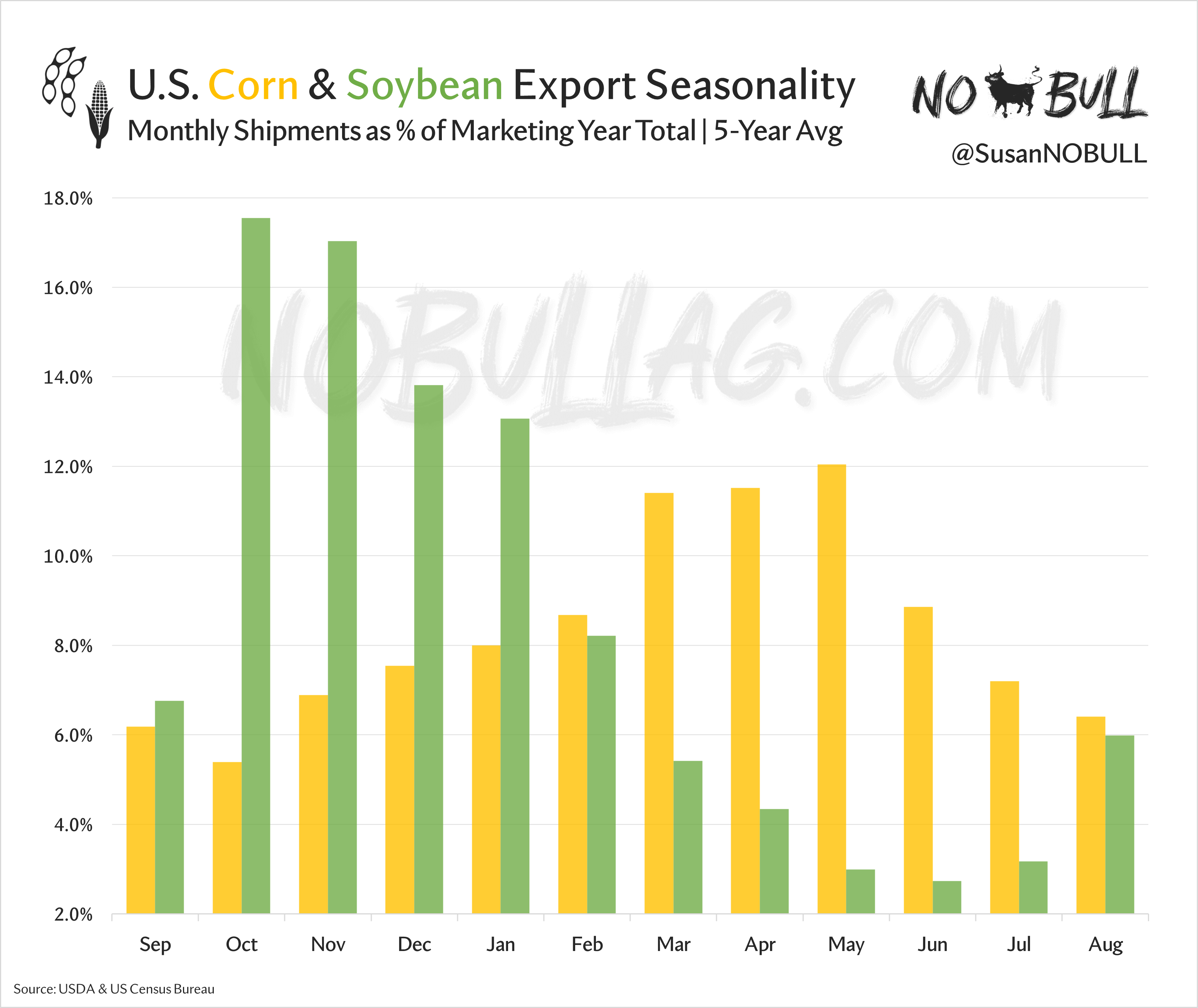

5 | 'Tis the season

Friendly reminder: exports are seasonal!

Soybeans dominate the first half of the marketing year before corn exports ramp up into the winter and spring months:

For the full version of this post or two subscribe, visit NoBullAg.Substack.com.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)