/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Rackspace Technology (RXT) shares nearly quadrupled this morning after announcing a strategic partnership with Denver-headquartered Palantir Technologies (PLTR). According to the press release, this partnership aims at integrating Palantir’s Foundry and Artificial Intelligence Platform (AIP) with its managed services, targeting highly regulated industries.

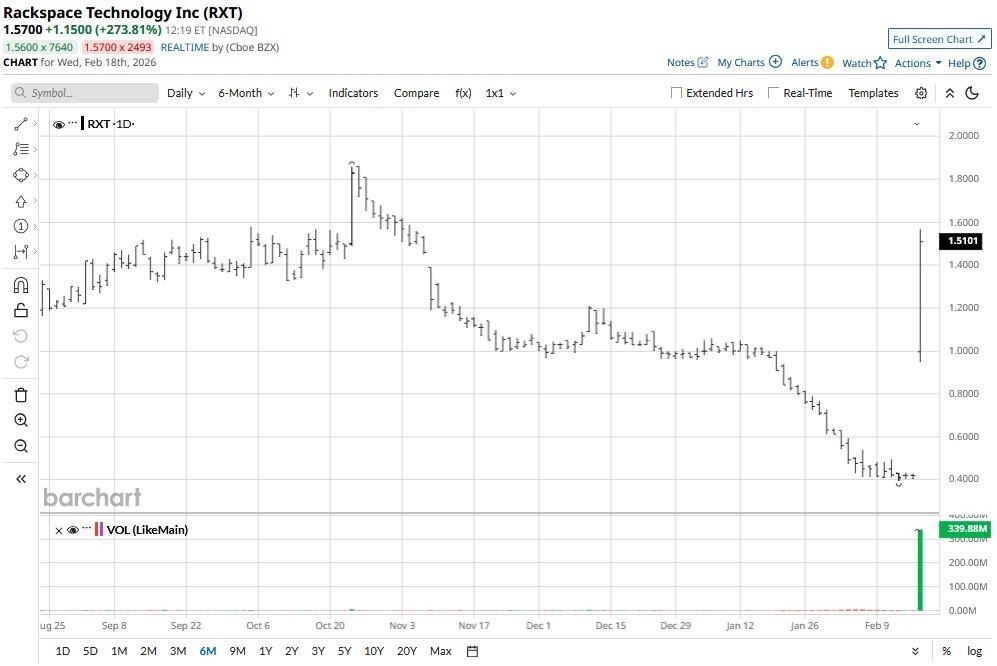

Despite an explosive rally on Wednesday, Rackspace stock remains down about 50% compared to its 52-week high.

Why Palantir News Is Bullish for Rackspace Stock

Investors cheered RXT stock today mostly because the Palantir deal serves as significant validation for the company’s specialized infrastructure.

As it becomes a primary data migration and implementation partner for Palantir, Rackspace is proving it has transitioned from a commodity cloud host to a critical enabler of high-value AI workloads.

For this Nasdaq-listed micro-cap firm, the Palantir announcement is a much-needed catalyst for future growth. The team-up will likely help improve its unit economics by moving the needle on its high-margin professional services and managed operations segments.

Note that Rackspace Technology soared past all of its major moving averages (MAs) this morning, which is further accelerating upward momentum on Feb. 18.

Why RXT Shares Are Still Not Worth Buying

While the headline sure is impressive, chasing the momentum in Rackspace shares today carries substantial risk. Despite the post-announcement surge, RXT is still a penny stock with a history of disappointing shareholders.

Its financials remain under pressure, characterized by a massive debt load — estimated at over $3.0 billion — and a multi-year trend of declining revenue.

RXT’s explosive move on Wednesday is more AI hype than substance. Chasing a low-float name after a vertical spike often leads to significant bag-holding when the initial excitement fades into reality.

Wall Street Recommends Caution on Rackspace

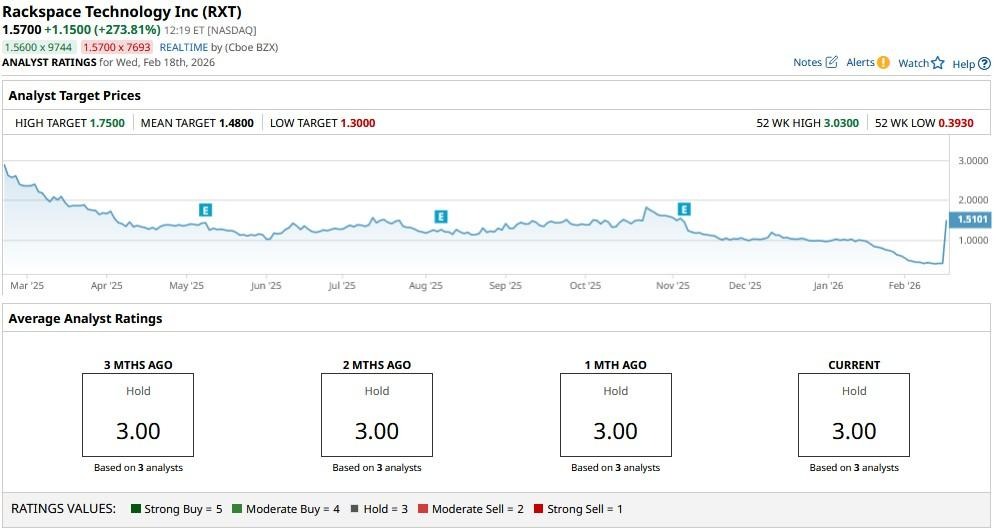

Wall Street analysts also seem to believe that the PLTR-driven rally in Rackspace has gone a bit too far.

According to Barchart, the consensus rating on RXT shares remains at a “Hold,” with the mean target of about $1.48 indicating potential downside of nearly 10% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)