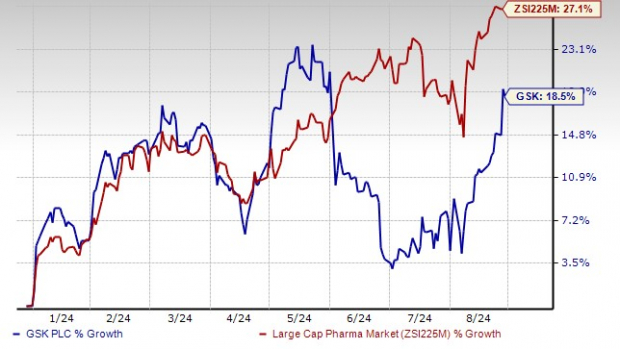

GSK GSK stock has risen 18.5% so far this year compared with an increase of 27.1% for the industry. The stock has also been consistently trading above its 50-day and 200-day moving averages since mid-August.

GSK Stock Movement in 2024 So Far

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

GSK boasts a diversified base and presence in different geographical areas. The spin-off of the Consumer unit in 2022 has allowed it to focus on drug development. In July 2022, GSK de-merged its Consumer Healthcare segment into a standalone company. The independent Consumer Healthcare company was named Haleon HLN.

GSK enjoys a strong position in HIV and Vaccines therapeutic areas. It strengthened its presence in oncology/hematology with acquisitions like Sierra Oncology and Tesaro. GSK also boasts a broad vaccine portfolio that targets infectious diseases like meningitis, shingles, flu, polio and many more. While sales are strong in its Specialty Medicines unit, U.S. sales of its key shingles vaccine, Shingrix are slowing down. Let's discuss the aspects in detail to understand how to play GSK’s stock.

GSK Specialty Medicines Unit Sales Driving Top-Line Growth

GSK is witnessing increased sales growth of its Specialty Medicines unit, particularly reflecting successful new launches in Oncology and long-acting HIV medicines. Sales are rising in all areas, HIV, Immunology/Respiratory as well as Oncology.

GSK’s key products like Nucala (severe eosinophilic asthma), Trelegy Ellipta (three medicines in a single inhaler to treat COPD), Juluca (dolutegravir+ rilpivirine once-daily, single pill for HIV) and Dovato (dolutegravir + lamivudine in a single tablet for HIV) have witnessed considerable success and have become key drivers of top-line growth. New long-acting HIV medicines, Cabenuva and Apretude, as well as new oncology drugs Jemperli and Ojjaara, are witnessing strong patient demand and contributing to top-line growth. On the second-quarter conference call, GSK raised its growth expectation for 2024 for the Specialty Medicines segment from a low double-digit percentage to a mid-to-high teens percentage at CER. However, growth in the second half is expected to be lower due to a tough year-over-year sales comparison.

GSK’s Promising Pipeline

Promising candidates in late-stage development include gepotidacin (uncomplicated urinary tract infection [UTI] and urogenital gonorrhoea), bepirovirsen (chronic hepatitis B), depemokimab (severe eosinophilic asthma, eosinophilic granulomatosis with polyangiitis, hypereosinophilic syndrome and chronic rhinosinusitis with nasal polyps), tebipenem (complicated UTIs) and camlipixant (refractory chronic cough). Its pentavalent MenABCWY meningococcal vaccine is under review with the FDA, with a decision expected on Feb 14, 2025. GSK is also focused on developing innovative ultra-long-acting HIV regimens for treatment and prevention, which can extend the dosing intervals of the injections. GSK expects sales from its new long-acting regimens to be around £2 billion by 2026.

GSK is also working on expanding the label of marketed products like Nucala, Zejula and Jemperli into additional indications. GSK plans to prioritize the development of novel medicines to treat blood and women's cancers.

GSK plans to launch more than 20 new products/line extensions by 2026, with more than 10 having blockbuster potential.

GSK’s Vaccine Sales Slowing Down as Shingrix U.S. Sales Fall

GSK’s Vaccine sales declined 2% in the United States in the first half of 2024, mainly due to declining sales of Shingrix. U.S. sales of Shingrix declined 19% in the first half of 2024 due to changes in retail vaccine prioritization due to a new Medicare rule, effective from January 2024, which changed how pharmacies process reimbursements from payers. Lower demand due to challenges activating harder-to-reach consumers also hurt U.S. sales. Shingrix sales in the United States are expected to remain soft in the second half.

Revised recommendations for Respiratory Syncytial Virus (RSV) vaccinations issued in June 2024 by the US Advisory Committee on Immunization Practices (ACIP) are expected to hurt sales of GSK’s RSV vaccine Arexvy, which was launched in 2023 for all adults over the age of 60 and approved by the FDA for adults 50–59 years old in June 2024.

In June, the ACIP recommended the use of Arexvy for all adults aged 75 and above. However, for adults aged 60-74, the ACIP recommended the vaccine only for those who are at increased risk of severe RSV disease. The ACIP also postponed a vote in adults aged 50-59. GSK expects minimal sales of Arexvy in the 50-59 group in 2024 and also sales in the 60-74 group will be affected by ACIP’s recommendation.

On the second-quarter conference call, the company lowered its Vaccine sales growth expectations from a range of high single-digit to low double-digit percentage to a range of low to mid-single-digit percentage at CER in 2024.

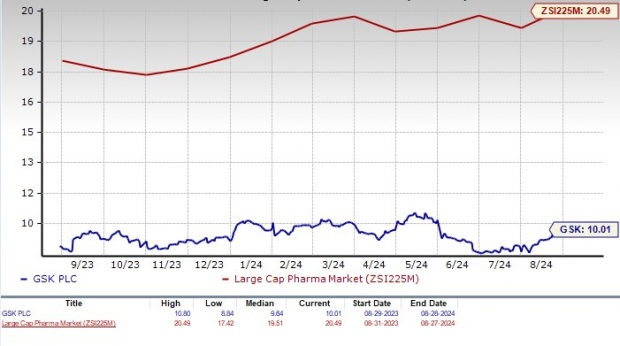

GSK’s Attractive Valuation & Rising Estimates

GSK’s stock is trading at an attractive valuation relative to the industry. Going by the price/earnings ratio, the company shares currently trade at 10.01 on a forward 12-month basis, lower than 20.49 for the industry. The stock is much cheaper than other large drugmakers like Eli Lilly LLY and Novo Nordisk NVO.

GSK Stock Valuation

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

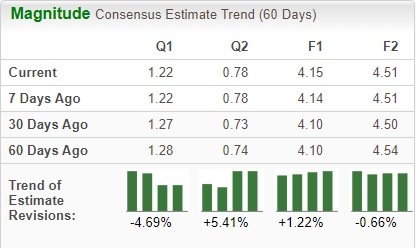

The Zacks Consensus Estimate for earnings has risen from $4.10 to $4.15 per share for 2024 and from $4.50 to $4.51 per share for 2025 over the past 30 days.

Estimates for GSK Rise

Image Source: Zacks Investment Research

Conclusion

GSK has its share of problems. Competitive pressure on HIV and respiratory drugs has risen. The dolutegravir HIV franchise patent expires in the 2028-2029 period, and U.S. sales of Shingrix are slowing down. The Zantac litigations are also an overhang.

Sales and profits are expected to be lower in the second half of 2024. Management expects growth in the second half of 2024 to be impacted by the annualization of product launches and stocking impacts, particularly for the company’s Vaccines and oncology products. Sales in the second half of 2023 benefited from newly launched products like Arexvy and oncology drugs.

Nonetheless, GSK expects sales to grow in the range of 7-9% at a constant exchange rate (CER) and earnings to increase between 10% and 12% in 2024, both raised from the prior expectations on the second-quarter conference call. For the five-year period till 2026, GSK expects to record more than 7% sales growth. By 2031, it expects sales to be more than £38 billion.

Consistently rising earnings estimates clearly highlight analysts’ optimistic outlook for further growth. GSK’s cheap valuation, reasonable stock price appreciation and bright sales and profit growth potential indicate that investors who own this Zacks Rank #3 (Hold) stock should stay invested for now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Buying the stock of this fundamentally strong company at its present reasonable valuation can prove prudent for long-term investors who are interested in buying blue-chip companies.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK): Free Stock Analysis Report

Novo Nordisk A/S (NVO): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Haleon PLC Sponsored ADR (HLN): Free Stock Analysis Report

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)