Plastic packaging and engineered materials manufacturer Berry Global Group (NYSE:BERY) fell short of analysts' expectations in Q2 CY2024, with revenue down 2.1% year on year to $3.16 billion. It made a non-GAAP profit of $2.18 per share, improving from its profit of $1.90 per share in the same quarter last year.

Is now the time to buy Berry Global Group? Find out by accessing our full research report, it's free.

Berry Global Group (BERY) Q2 CY2024 Highlights:

- Revenue: $3.16 billion vs analyst estimates of $3.26 billion (2.9% miss)

- EPS (non-GAAP): $2.18 vs analyst estimates of $2.07 (5.4% beat)

- EPS (non-GAAP) Guidance for the full year is $7.60 at the midpoint, beating analysts' estimates by 1.3%

- Gross Margin (GAAP): 19%, up from 18% in the same quarter last year

- Free Cash Flow of $157 million, up from $49 million in the previous quarter

- Market Capitalization: $7.51 billion

“This announcement is the culmination of a comprehensive review to determine the highest value alternative for Berry shareholders. We believe these two businesses can drive significant value for their respective stakeholders with more focused portfolios, positioning each for greater success. Berry will now become a pure-play leading supplier of innovative, sustainable global packaging solutions and we believe this focus will result in an even more predictable, stable earnings and growth profile for Berry. This proposed transaction is a significant step in the optimization of our portfolio and allows Berry’s management team to be one hundred percent laser-focused on driving consistent long-term growth with a more simplified and aligned portfolio,” stated Kevin Kwilinski, Berry’s CEO.

Founded as Imperial Plastics, Berry Global (NYSE: BERY) is a manufacturer and marketer of plastic packaging products, including containers, bottles, and prescription packaging.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

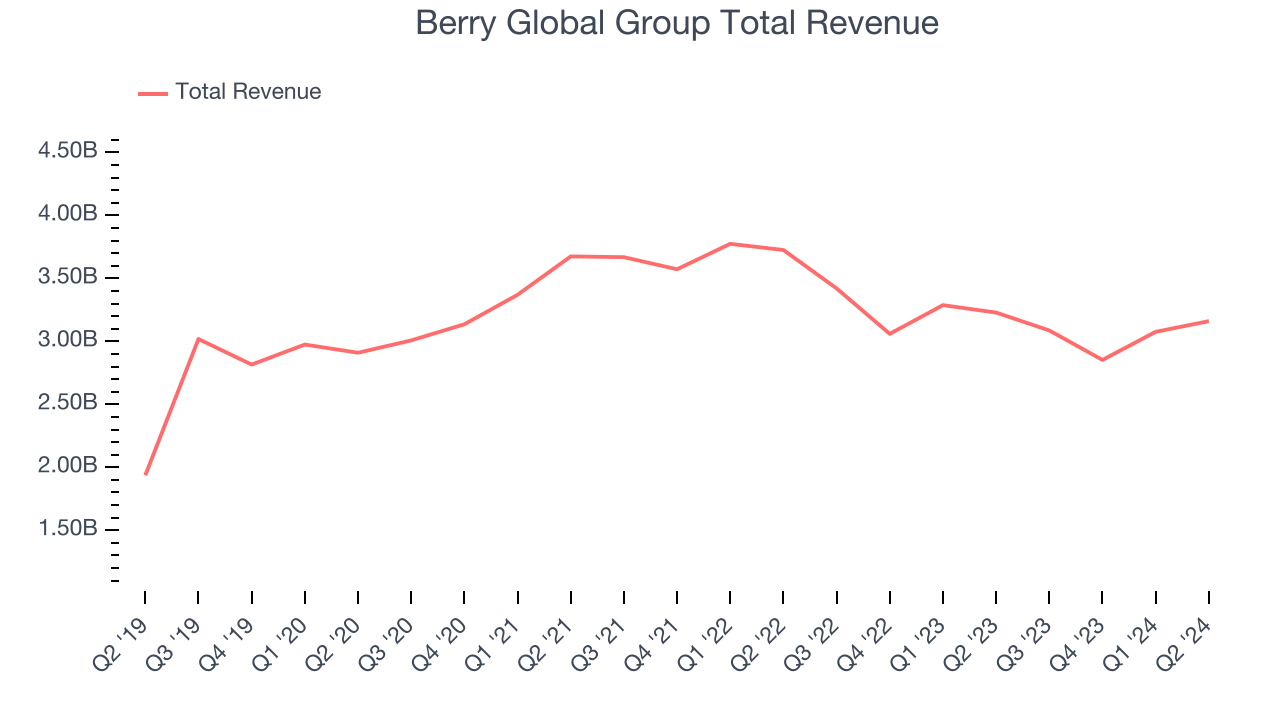

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, Berry Global Group grew its sales at a solid 9% compounded annual growth rate. This shows it was successful in expanding, a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Berry Global Group's recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.1% over the last two years. Berry Global Group isn't alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Berry Global Group missed Wall Street's estimates and reported a rather uninspiring 2.1% year-on-year revenue decline, generating $3.16 billion of revenue. Looking ahead, Wall Street expects sales to grow 3.3% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

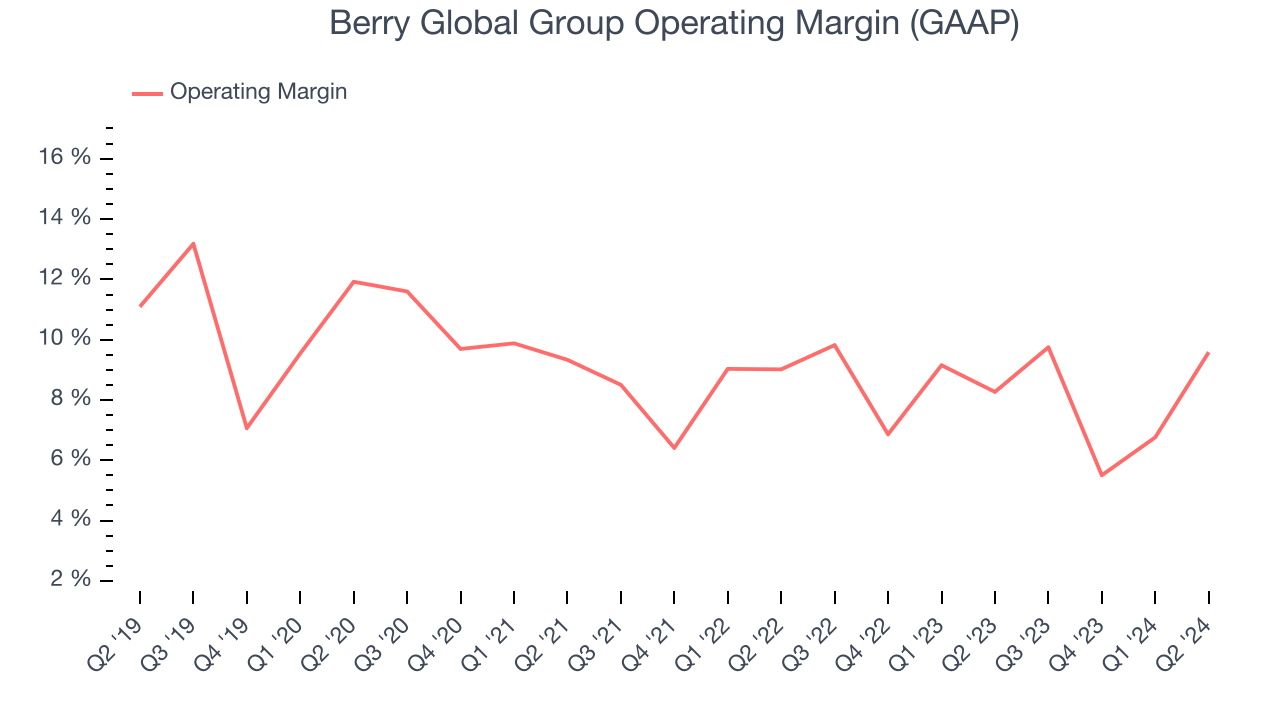

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It's also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Berry Global Group has done a decent job managing its expenses over the last five years. The company has produced an average operating margin of 9%, higher than the broader industrials sector.

Looking at the trend in its profitability, Berry Global Group's annual operating margin decreased by 2.5 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Berry Global Group become more profitable in the future.

This quarter, Berry Global Group generated an operating profit margin of 9.6%, up 1.3 percentage points year on year. This increase was encouraging, and since the company's operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

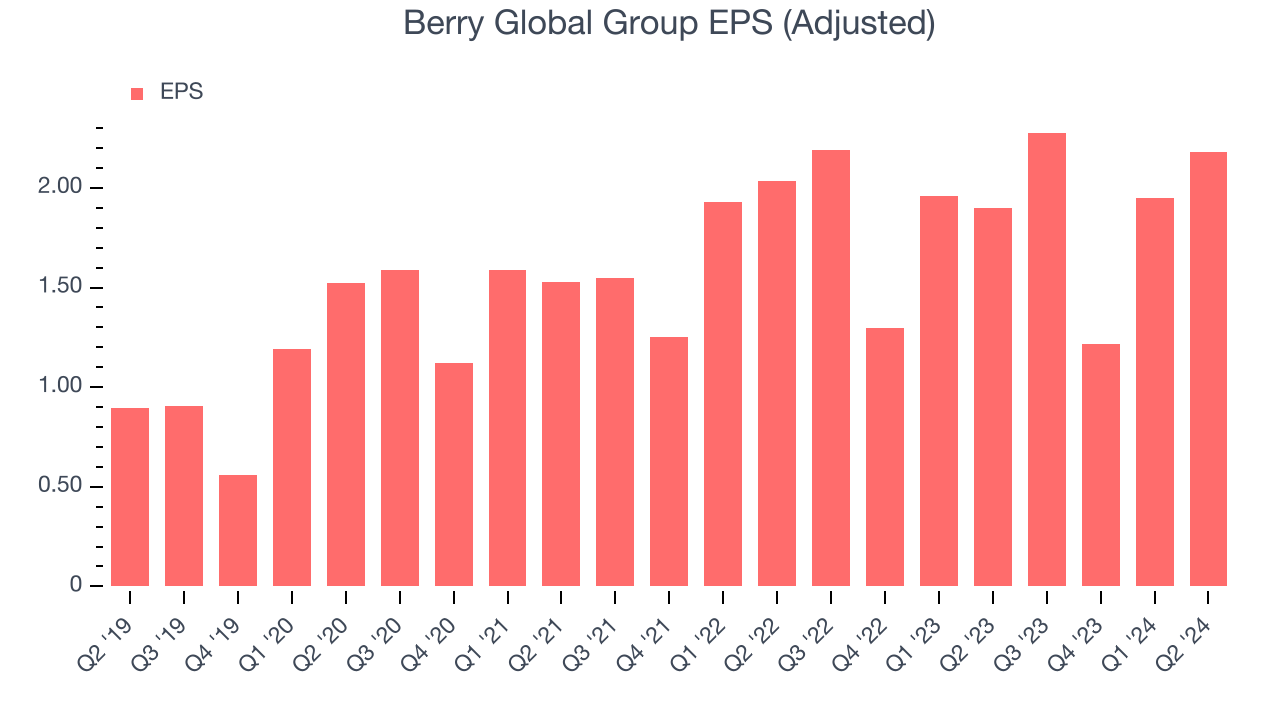

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Berry Global Group's EPS grew at a spectacular 17.5% compounded annual growth rate over the last five years, higher than its 9% annualized revenue growth. However, this alone doesn't tell us much about its day-to-day operations because its operating margin didn't expand.

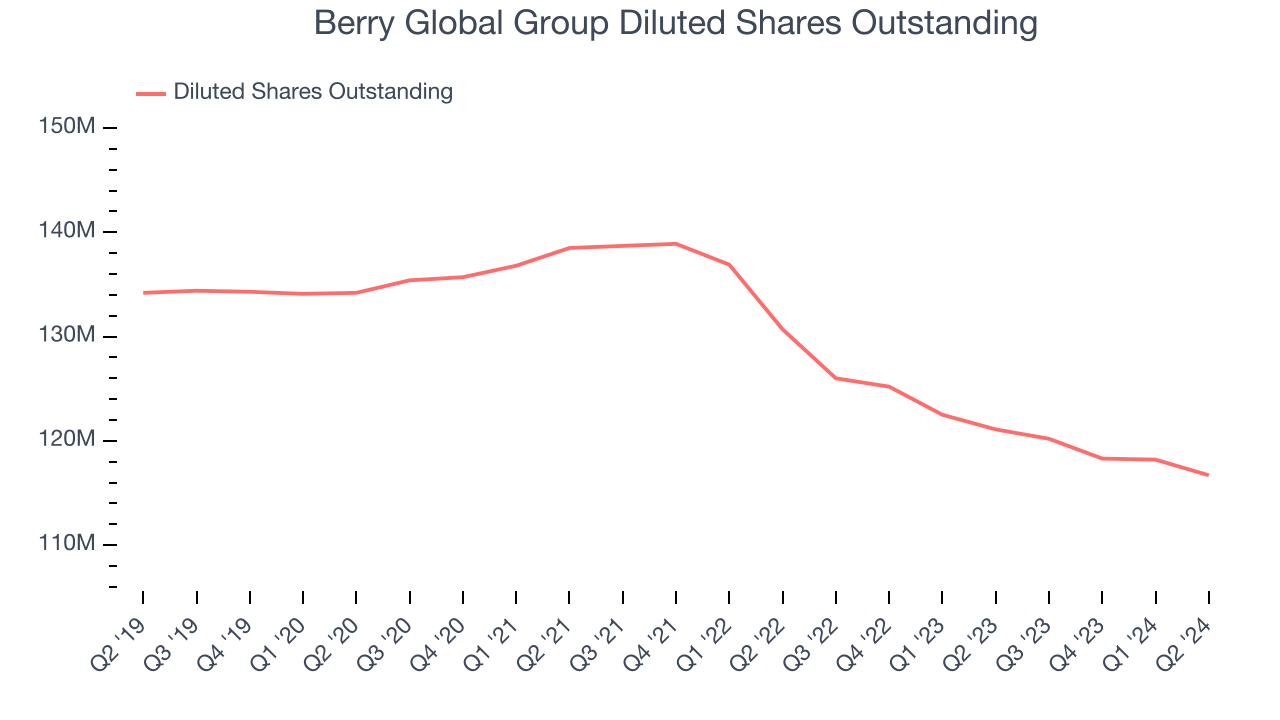

Diving into Berry Global Group's quality of earnings can give us a better understanding of its performance. A five-year view shows that Berry Global Group has repurchased its stock, shrinking its share count by 13%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Berry Global Group, its two-year annual EPS growth of 6.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q2, Berry Global Group reported EPS at $2.18, up from $1.90 in the same quarter last year. This print beat analysts' estimates by 5.4%. Over the next 12 months, Wall Street expects Berry Global Group to grow its earnings. Analysts are projecting its EPS of $7.63 in the last year to climb by 7% to $8.16.

Key Takeaways from Berry Global Group's Q2 Results

It was good to see Berry Global Group beat analysts' EPS expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street's estimates. On the other hand, its revenue unfortunately missed. Overall, this quarter was mixed. The stock remained flat at $65.65 immediately after reporting.

So should you invest in Berry Global Group right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.