/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) posted a blockbuster second quarter for fiscal 2026, delivering the kind of revenue acceleration that investors have been waiting to see after several quarters of slowing growth. The market responded quickly, with SMCI stock jumping about 10% during today's trading session as enthusiasm returned around the company’s AI-driven expansion.

The numbers were undeniably strong. Supermicro reported Q2 revenue of $12.68 billion, representing a 123% increase from the same period last year and a 153% jump from the prior quarter. Its top line surpassed Wall Street expectations and was above management’s guidance range of $10 billion to $11 billion.

Part of the quarter’s strength came from the timing of shipments. Revenue included about $1.5 billion in shipments that were delayed from Q1 due to customer readiness issues. Even with that factor, the underlying demand remains robust, driven by the rapid ramp-up of Supermicro’s Rack Scale AI solutions, a segment benefiting from the ongoing surge in AI infrastructure spending despite persistent supply chain constraints across the industry.

Customer demand remains anchored in large global data center operators and enterprise buyers. AI GPU platforms made up the majority of Q2 revenue, reflecting their growing contribution to the company’s overall revenue mix.

Its enterprise channel revenue reached $2 billion, rising 42% year-over-year (YoY) and 29% quarter-over-quarter (QoQ). Meanwhile, the OEM appliance and large data center segment generated $10.7 billion, accounting for roughly 84% of total quarterly revenue. That segment grew 151% from last year and more than tripled sequentially.

Looking ahead, management expects the strong growth trajectory to continue into Q3. Supermicro forecasts net sales of at least $12.3 billion, above analyst projections and implying YoY growth of about 117%.

Despite the headline strength in revenue and better-than-expected forward guidance, investors should be cautious about chasing SMCI stock. The results are impressive, but the company continues to face risks.

SMCI Stock: 3 Key Risks to Consider

Super Micro appears well-positioned to deliver solid YoY revenue growth in Q3, driven by continued strength in its OEM appliance and large data center businesses. Demand from this segment has been a key driver of the company’s recent top-line performance, and management expects this momentum to carry forward.

That said, investors should weigh three important risks alongside the growth outlook. One of the most notable concerns is customer concentration. In the second quarter, its OEM appliance and large data center business delivered solid growth. However, a single large data center customer accounted for roughly 63% of total revenue.

While Super Micro is pursuing larger customers and broader sales opportunities, the current revenue mix suggests that the company remains heavily reliant on only a few major accounts.

Margin trends also warrant caution. Super Micro’s adjusted gross margin is under pressure, declining to 6.4% in Q2, down from 9.5% in Q1. The drop reflects an unfavorable customer and product mix, as well as higher freight and other costs related to the large-scale rollout of new platforms.

Looking ahead, the company expects a modest sequential improvement in Q3, forecasting gross margins up about 30 basis points from Q2 levels. However, the broader picture remains challenging, as the outlook implies a YoY decline of roughly 300 basis points from the 9.7% margin reported in the prior-year period.

Competitive pressures add further challenges. The AI infrastructure market is becoming increasingly crowded, with intense rivalry pushing down average selling prices and further straining profitability. Although Super Micro anticipates benefits from economies of scale and efficiencies from its global manufacturing footprint, the sustained margin pressure remains a key risk.

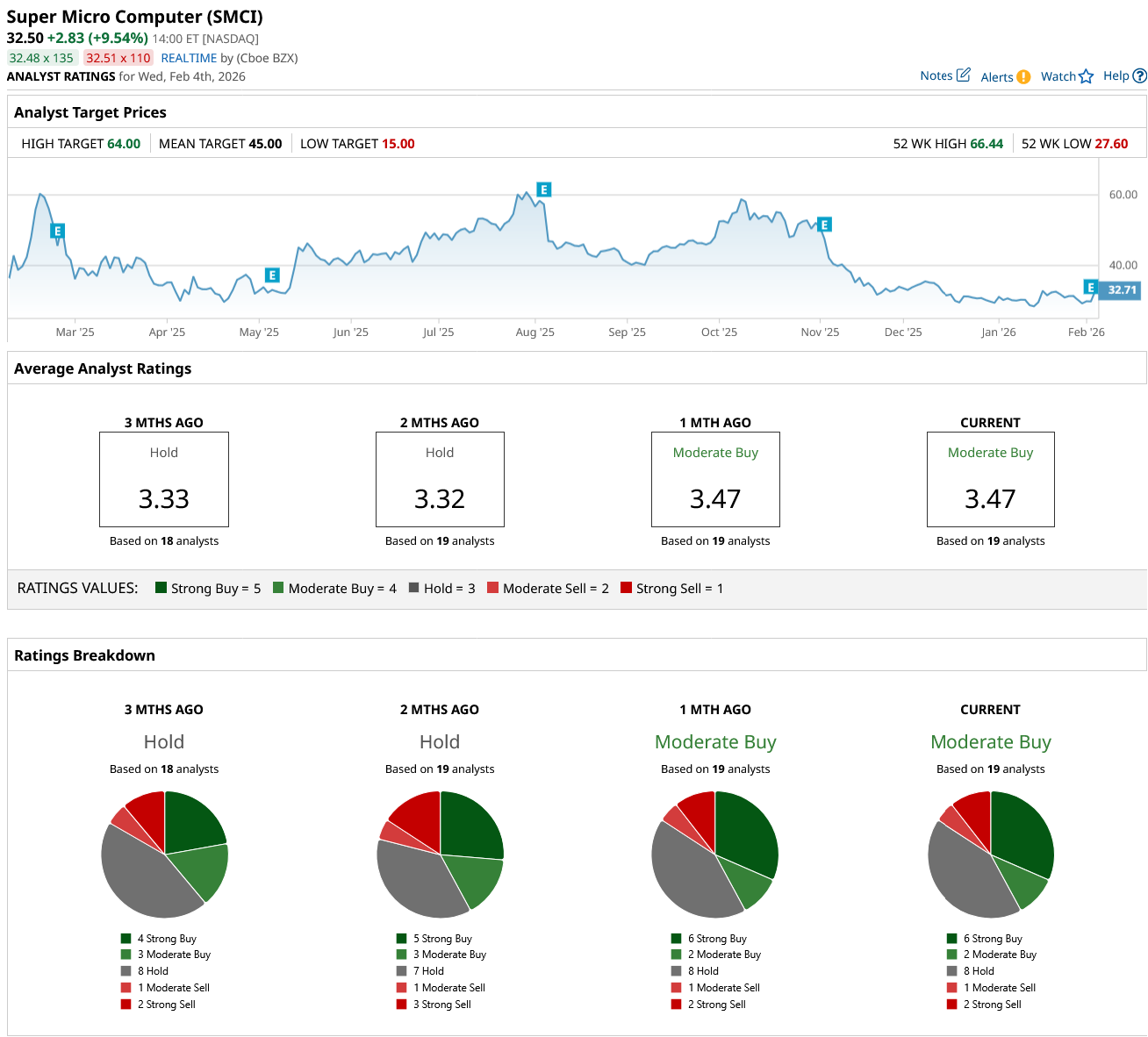

What Analysts Recommend for SMCI Stock

Analysts maintain a “Moderate Buy” consensus rating on SMCI stock. This suggests that, while the outlook is generally positive, not all Wall Street experts are endorsing the stock.

While SMCI’s revenue growth prospects are strong, investors should remain mindful of customer concentration, declining margins, and the highly competitive nature of the AI infrastructure space.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)