This is an important week for the European Central Bank (ECB, and also for traders and investors who are highly focused on the bank’s monetary policy. The bank, for the first time in nearly 20 years, will be doing something they are not forced to do by outside factors, and that is bringing the dovish tone back to their monetary policy with a strong possibility of a first rate cut since COVID

Background

The ECB lowered interest rates during the peak of the COVID crisis to battle the economic storm and restore confidence. While the bank was busy fighting one battle on one side, another war was in the making—the higher inflation problem. After releasing that their dovish monetary policy pushed the inflation reading in the Eurozone to a multidecade high, the ECB quickly revered its position and began the most hawkish intertest rate hike cycle in decades. It took the interest rates to their highest level, and this certainly helped the inflation reading to cool down, and it finally arrived at a level that is closer to the ECB target level of 2%. Now that the eurozone’s data has suggested that the economic situation in the region didn’t go off the rails, the ECB could begin the process of cutting interest rates. However, some investors are nervous about this process, and I think the reason that they are nervous is that they are not paying attention to the details, which is resilience.

The Resilience

Investors do believe that the Eurozone’s economy has shown much stronger resilience as compared to many speculations that called for a deep recession in the region that would last for a long period. However, the economic data confirmed that the economies of the Eurozone are more resilient and investors are more ready to take the risk. One parameter of this could easily be seen by looking at the spread difference between the Italian 5 or 10 year yield and the Sam3 5 or 10 year yield on the German bonds. During times of tension and more political tensions, or, as one can say, when one looks at the lens of economic strength, investors always considered German debt more suitable for their risk appetite due to a more robust economy and less debt. This isn't the same for Italian or even Greek economies, and during times of turbulence, the spreads between the German 2-year yield and the Italian 2-year yield widen significantly. But now that the ECB is on the verge of cutting rates, the calmness among investors can be easily seen by looking at the spread of the two countries bond yields. So, the resilience of economies, both the weak and strong ones, has given the ECB much more leverage, so they can begin the process of cutting rates now if they like.

The Event

On Thursday this week, all eyes will be on the ECB and the Euro. The ECB is widely expected to cut the interest rate by 25 basis points and bring it lower from its multi-decade high of 4.50% to 4.25%. Market players know that the chances of this event unfolding in this manner are very high, and if one looks at the Euro, you could say easily that the EUR-Dollar chart has by far already financed that. So does that mean that the event will be like, Buy the rumour and sell the news? No.

The Important Factor

The most important thing during the upcoming ECB event will be their delivery of the dovish message. Traders must not expect an overly dovish signal from the ECB. Acknowledgement of resilience in the Eurozone economy doesn’t mean a faster pace of interest rate cuts at all. The ECB is going to have a very balanced tone, and traders should not be overly optimistic. This is going to keep the trading session highly interesting.

The Trading Plan

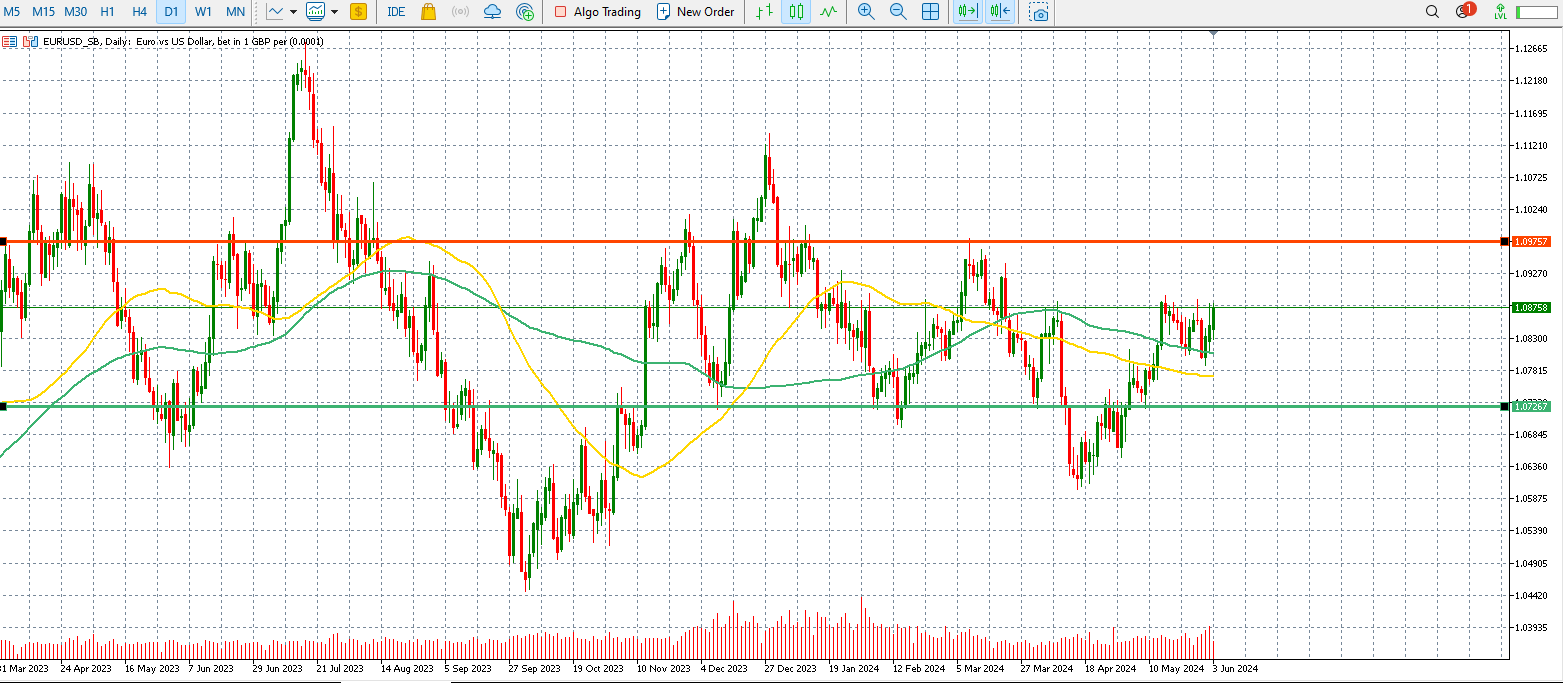

The EUR/USD chart below shows important price points that traders must keep in mind going into the meeting. The red line is the resistance, and the green line is the support. An overly dovish tone could push the price towards the green line, and an overly hawkish tone could push the price towards the red line.

On the date of publication, Naeem Aslam did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)