Walmart (WMT) will release its fourth-quarter fiscal 2026 results on Thursday, Feb. 19. Despite macro and tariff-related headwinds, the world’s largest retailer has consistently delivered solid financial results, which have boosted its share price.

Walmart shares have climbed more than 16% since the start of the year and are up roughly 26% over the past three months. The rally reflects the company’s ability to drive traffic, protect earnings, and leverage its scale across both brick-and-mortar and e-commerce channels.

However, the recent surge has pushed technical indicators into stretched territory ahead of earnings. The stock’s 14-period Relative Strength Index (RSI) is hovering over 77, notably above the 70 level that typically signals overbought conditions.

Moreover, options markets are currently pricing in a 5.8% swing in either direction following the earnings release for contracts expiring Feb. 27. That implied swing is above the average post-earnings move of roughly 4.9% over the past four quarters. Historically, Walmart shares have fallen in two of the past four earnings reactions.

Walmart Q4: Strong Growth across Businesses to Support Earnings

Walmart entered Q4 with solid operating momentum. The retailer’s healthy inventory levels, value pricing, convenience, and assortment breadth position it to deliver solid growth in the fourth quarter.

WMT’s revenue growth is expected to be supported by strength across both domestic and international operations, as well as continued expansion in e-commerce. In the U.S., comparable sales are projected to rise, driven by higher store and online traffic. Digital performance could once again remain solid, driven by pickup and delivery services and advertising.

Internationally, the momentum is likely to be sustained. Higher transaction counts and rising unit volumes are expected to lift results across multiple markets, enabling Walmart to continue capturing market share. E-commerce momentum remains particularly strong in India and China.

Advertising has emerged as a structurally higher-margin growth driver. Walmart Connect in the U.S., excluding VIZIO, is expected to sustain momentum as advertiser counts rise, including participation from third-party marketplace sellers. Internationally, advertising growth is being led by Flipkart.

Membership income is another key contributor. Enterprise-wide membership revenue is expected to increase, driven primarily by international gains, especially at Sam’s Club China. In the U.S., Walmart+ continues to post double-digit growth in membership income. These recurring revenue streams diversify income and support margin expansion.

For the fourth quarter, management has guided to constant currency sales growth of 3.75% to 4.75%. Further, Walmart’s operating income mix is evolving, with a greater contribution from higher-margin segments such as advertising and membership fees. Improved e-commerce economics, particularly in Walmart U.S. and Flipkart, are also enhancing profitability. For Q4, operating income is projected to grow between 8% and 11%, driven largely by growth in advertising and membership income.

Operational investments are beginning to translate into efficiency gains. The company’s supply chain automation initiatives are improving fulfillment economics and reducing cost-to-serve metrics. More than 60% of Walmart U.S. stores now receive freight from automated distribution centers, and over half of its e-commerce fulfillment center volume is automated. These initiatives are increasing unit productivity and supporting margin resilience, even as the merchandise mix remains a modest headwind.

Additional tailwinds for fourth-quarter operating income include the timing shift of Flipkart’s key sales event and the anniversary of prior wage investments at Sam’s Club U.S., both of which should favor year-over-year (YoY) comparisons. While merchandise category mix is expected to weigh slightly on margins, the overall business mix continues to skew toward higher-margin revenue streams.

On the bottom line, Walmart expects adjusted earnings per share (EPS) in the range of $0.67 to $0.72. Wall Street analysts are forecasting EPS of $0.73, representing approximately 10.6% YoY growth. Notably, the retailer has exceeded earnings expectations in three of the past four quarters.

Is WMT Stock a Buy Ahead of Feb. 19?

With continued strength in e-commerce, expanding advertising revenue, increased membership fee income, and operational efficiencies from automation, the company appears well-positioned to deliver strong earnings in the fourth quarter.

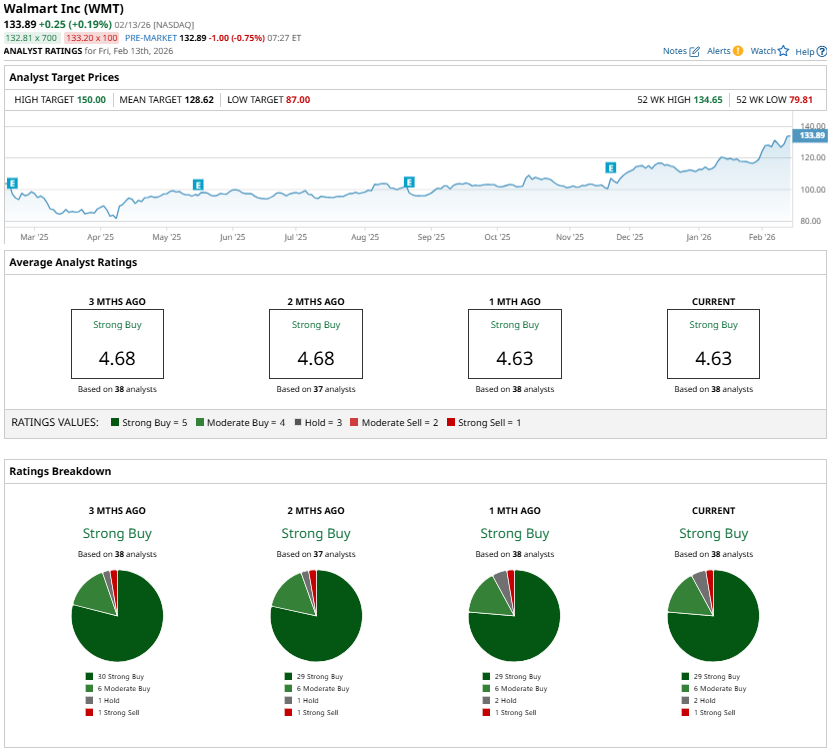

Analysts are bullish about Walmart's stock ahead of its Q4 earnings release, making it an attractive long-term investment. However, with WMT shares rising significantly over the past three months, the stock is trading at a forward price-earnings ratio of 45.5, suggesting it is not a bargain ahead of earnings. Further, analysts project Walmart’s EPS to grow by 11.4% in fiscal 2027, implying that the stock reflects much of the positives.

In short, Walmart could deliver solid growth in Q4, but investors should take caution ahead of its earnings release.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)