The VanEck BDC Income ETF (BIZD) is currently living out the tension of an anthem from the popular rock band Queen. And it is overdue, owing to what I call the process of “pulling returns forward.” That’s where a good concept in an exchange-traded fund (ETF) is the target of a rush of demand for the theme it invests in — to the point where it cannot possibly keep up with expectations. That leaves a lot of proverbial bag-holders.

While the ETF provides a massive yield, it is operating in the shadow of the SaaS-pocalypse. That name was created just this month, when the market had the sudden realization that artificial intelligence (AI)-driven tools are beginning to cannibalize the enterprise software market, where many business development companies (BDCs) have billions in loans.

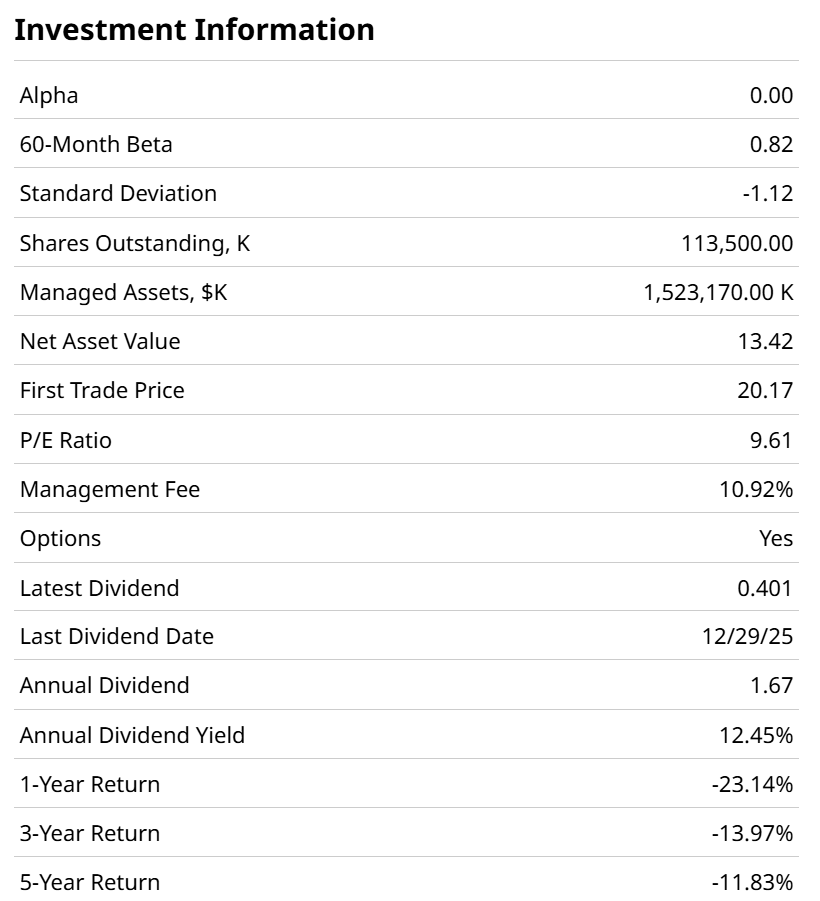

This will likely cause BIZD’s mild beta of 0.82x to skyrocket going forward. And as the table here shows, a 12% yield means little when the fund’s price return annualized roughly that same number, with a minus sign in front of it. And recently, it has been double that, with that same minus sign, over the past 12 months.

BIZD was and is a good idea. This is an intriguing segment of the market. I’d like it better if it didn’t yield so much. Because we know the story, after many market cycles. Investors reach for the shiny double-digit yield and claim they don’t care about downside risk as long as the yield is coming in at 1% a month. Then, it falls in price, and it’s like someone yelled, “Fire!” in a crowded theater.

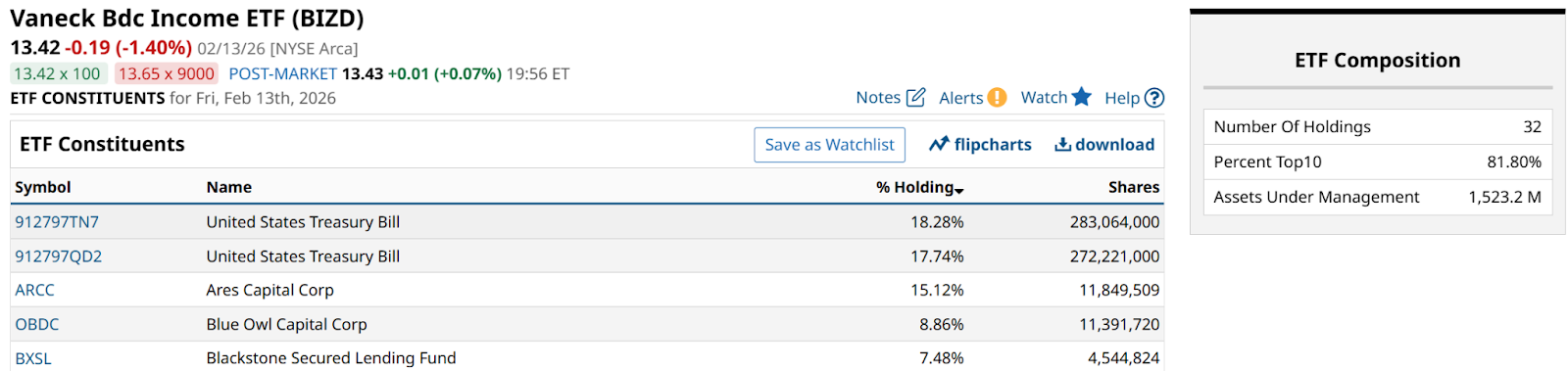

This is compounded by the extreme concentration in BIZD. Again, that’s something I prefer in my ETFs. Five stocks, 82% of assets? Sign me up — in theory. But not in all market climates. And certainly not in this one.

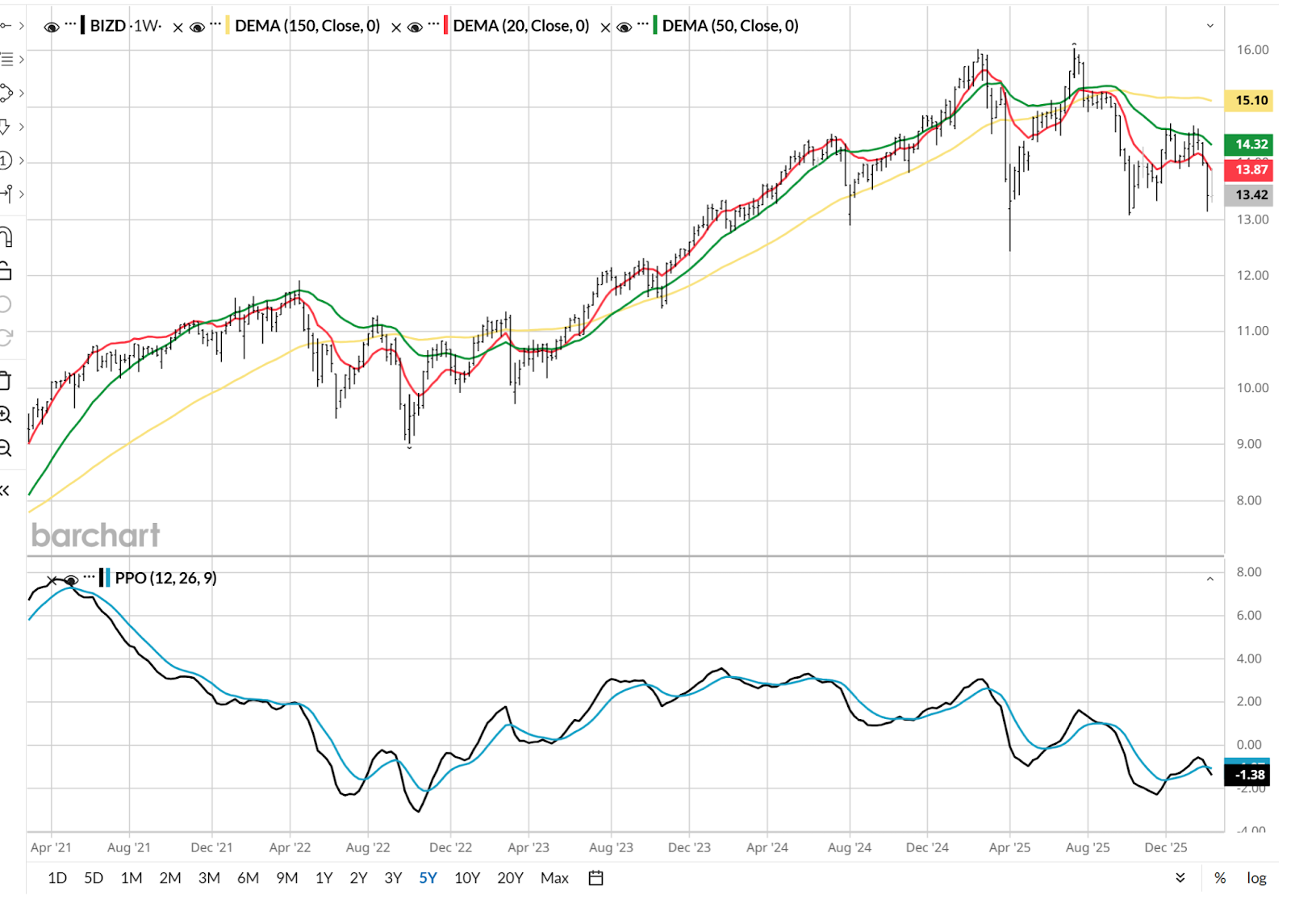

The daily chart shows the rollercoaster ride in BIZD, complete with double top and now at a familiar bottom level. But with no immediate sign of relief, other than the ever-present possibility of a bounce.

This weekly chart looks similar, but perhaps a bit worse. When the 20-day moving average wilts, it's a concern. When the 20-week average starts to fade down, it is next-level trouble.

BIZD acts as a specialized lender to mid-sized private companies, offering investors a bridge to private credit that is usually out of reach. But the recent volatility in early February was triggered by fears that private credit portfolios are too heavily exposed to aging software firms struggling to compete with new AI agents.

Some Hope for a Rebound

BIZD relies on its largest holdings to provide the power to survive this cycle. While recent insider buying at several of its underlying companies suggests management confidence, the threat of an easing interest-rate environment could force yield cuts later in the year.

BDCs benefit from high rates because their loans are mostly floating-rate. But if the expected Kevin Warsh-led Fed cuts rates significantly, the high yields that BIZD fans expect may finally start to crumble.

For investors, BIZD is a real test of nerves. A high-yield play for those willing to wait and see if the hammer falls on the software sector or if private credit can simply rock on.

Some Alternatives To Consider

My preference in this environment? Skip the high payouts, and go for income I can rely on — Treasury ETFs like the BBG 1-3 Month T-Bill SPDR ETF (BIL), the Ishares 0-3 Month Treasury Bond ETF (SGOV), or even the Short Treasury Bond Ishares ETF (SHV). And, I’m starting to look more admiringly at the potential for long-term rates to fall.

If that hammer comes down, long-term bond ETFs the 20+ Year Treas Bond Ishares ETF (TLT) and 10-20 Year Treas Bond Ishares ETF (TLH) could be primed for a nice move as 2026 continues.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)