Internet security and content delivery network Cloudflare (NYSE:NET) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 30.5% year on year to $378.6 million. The company expects next quarter's revenue to be around $394 million, in line with analysts' estimates. It made a non-GAAP profit of $0.16 per share, improving from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Cloudflare? Find out by accessing our full research report, it's free.

Cloudflare (NET) Q1 CY2024 Highlights:

- Revenue: $378.6 million vs analyst estimates of $373.4 million (1.4% beat)

- EPS (non-GAAP): $0.16 vs analyst estimates of $0.13 (22.6% beat)

- Revenue Guidance for Q2 CY2024 is $394 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $1.65 billion at the midpoint

- Gross Margin (GAAP): 77.5%, up from 75.7% in the same quarter last year

- Free Cash Flow of $35.61 million, down 29.8% from the previous quarter

- Market Capitalization: $29.91 billion

“The first quarter marked a strong start to the year, as we grew revenue 30% year-over-year to $378.6 million—fueled by a record number of net-new customers year-over-year spending more than $100,000, $500,000, and $1 million with Cloudflare on an annualized basis. I'm incredibly proud of the fact that our team has been able to continue to build our network, service larger and larger customers, and launch entirely new categories of products—including in the AI space—while also remaining disciplined with our gross and operating margins and our free cash flow,” said Matthew Prince, co-founder & CEO of Cloudflare.

Founded by two grad students of Harvard Business School, Cloudflare (NYSE:NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Sales Growth

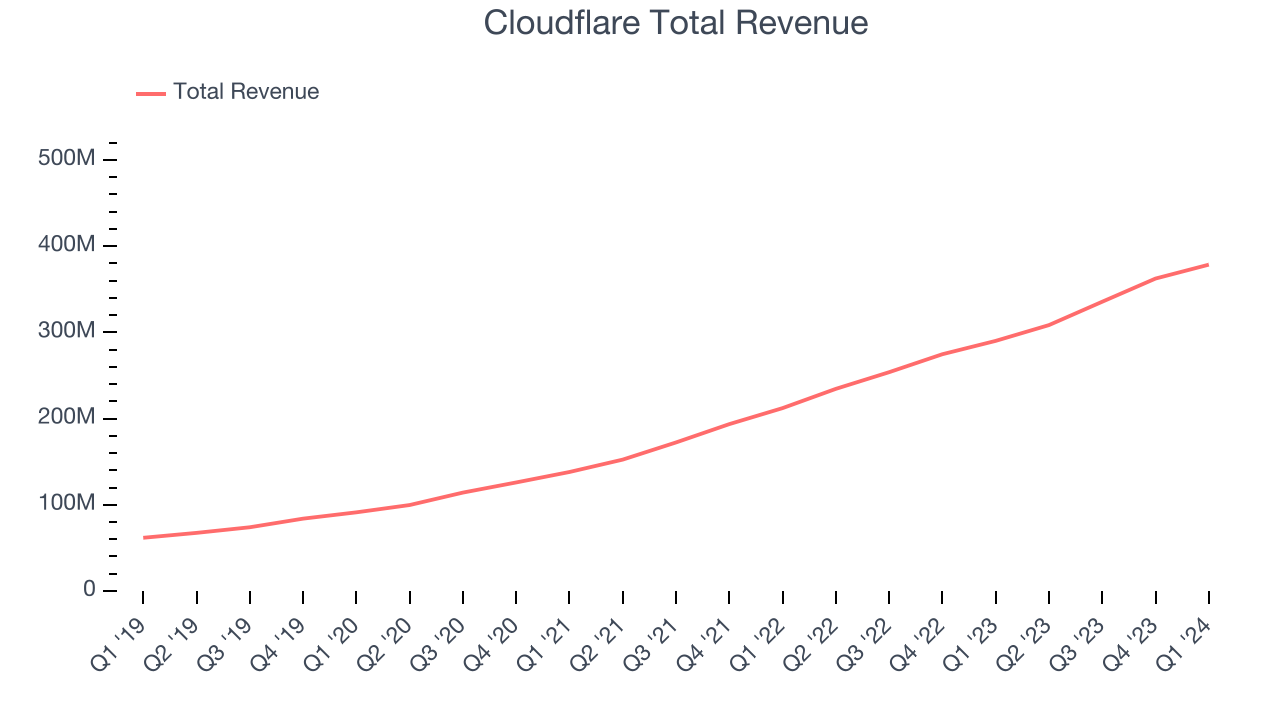

As you can see below, Cloudflare's revenue growth has been impressive over the last three years, growing from $138.1 million in Q1 2021 to $378.6 million this quarter.

Unsurprisingly, this was another great quarter for Cloudflare with revenue up 30.5% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $16.13 million in Q1 compared to $26.87 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Cloudflare is expecting revenue to grow 27.7% year on year to $394 million, slowing down from the 31.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 26.7% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

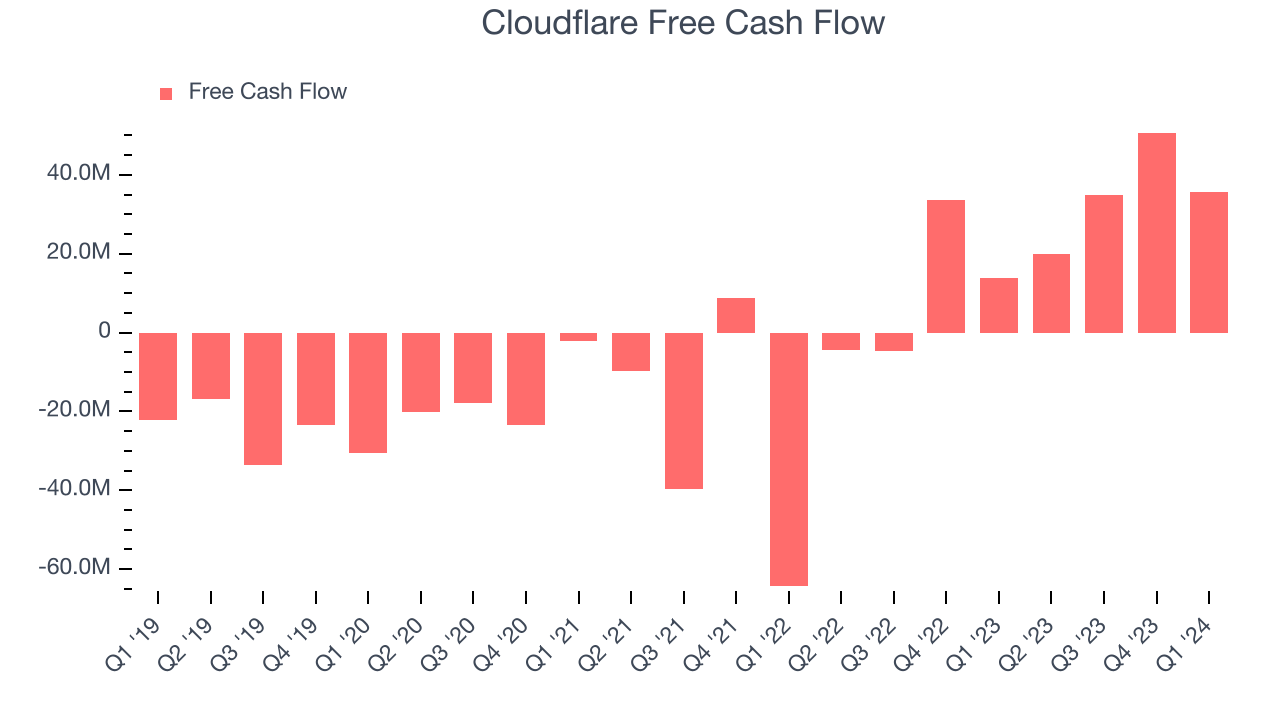

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Cloudflare's free cash flow came in at $35.61 million in Q1, up 156% year on year.

Cloudflare has generated $141.2 million in free cash flow over the last 12 months, or 10.2% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Cloudflare's Q1 Results

It was encouraging to see Cloudflare narrowly top analysts' revenue expectations this quarter and achieve another cash flow positive quarter. On the other hand, its billings (that provide insights into future demand) unfortunately missed analysts' expectations and its full-year revenue guidance was on the lower side of Wall Street's estimates. Overall, this was a mixed quarter for Cloudflare. The company is down 14.3% on the results and currently trades at $76.23 per share.

Cloudflare may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)