As investors near retirement, their financial goals often shift towards prioritizing a steady income stream rather than emphasizing potential capital gains.

This change in focus is particularly relevant for older individuals who are seeking stability and reliable cash flow from their investments.

Utilities stocks have typically paid reasonable dividends, providing defensive investors a steady stream of income.

Thankfully, as sophisticated investors, we can generate an additional income from holding utilities stocks by using options. The strategy is a known as a covered call which involves selling call options against a stock position.

XLU is a broad-based S&P 500 Utilities Sector ETF that currently yields 3.58%, which is higher than the three-year average.

The stock is down 4.8% year-to-date and could be viewed as a value play as well as an income play.

Let’s look at how we can use a covered call option trade to further enhance the yield on XLU.

XLU Covered Call Example

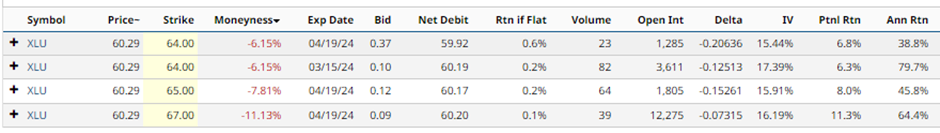

When running the Covered Call Screener for XLU, we find the following results:

Let’s evaluate the first XLU covered call example. Buying 100 shares of XLU would cost $6,029. The April 19, $64-strike call option was trading yesterday around $0.37, generating $37 in premium per contract for covered call sellers.

Selling the call option generates an income of 0.62% in 65 days, equalling around 3.47% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of $64?

If XLU closes above $64 on the expiration date, the shares will be called away at $64, leaving the trader with a total profit of $408 (gain on the shares plus the $37 option premium received). That equates to a 6.8% return, which is 38.8% on an annualized basis.

The company is also due to pay a dividend in March, likely to be around 0.59.

Barchart Technical Opinion

The Barchart Technical Opinion rating is a 72% Sell with a Average short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Implied Volatility

Implied volatility is at 17.54% compared to a 12-month low of 13.23% and a high of 35.30%. Some traders may prefer implied volatility to be higher before starting a covered call trade.

Conclusion

In conclusion, harnessing the income potential of utility stocks combined with a covered call strategy can be a prudent way for investors to secure a steady cash flow during their retirement years.

Utilities stocks are a common component of most investment portfolios and now you know how to generate an income from your XLU position.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)