/Facebook%20-AGqzy-Uj3s4-unsplash.jpg)

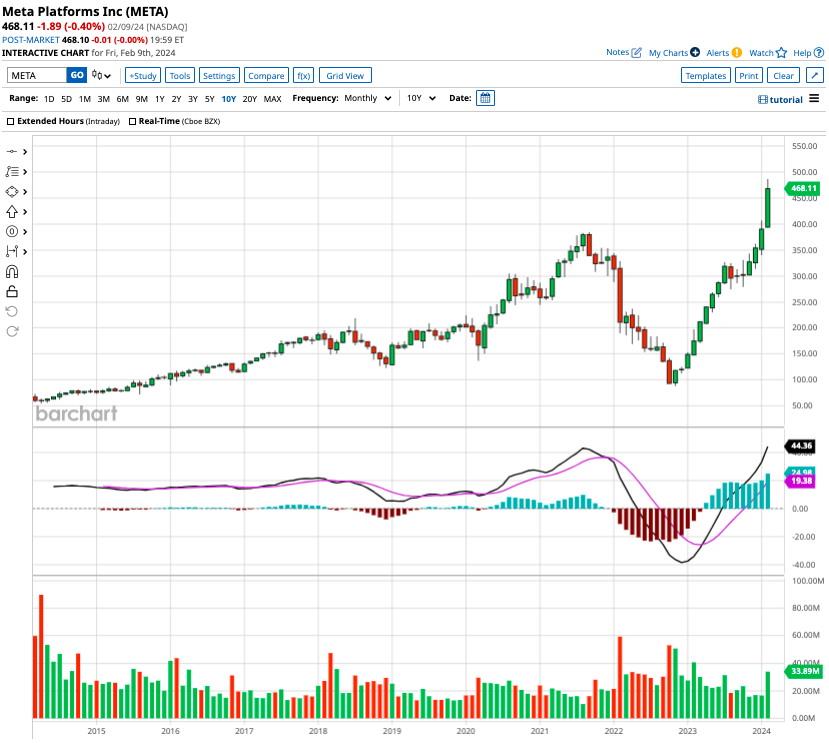

Shares of social media giant Meta Platforms (META) have been on an absolute tear since the start of 2023, rising 289% in this period. Currently valued at $1.2 trillion by market cap, Meta Platforms is among the largest companies globally, supported by strong engagement levels and a wide economic moat.

Meta first touched a trillion-dollar valuation in 2021, but then its stock fell by more than 70% over the next 12 months due to narrowing profit margins, tepid enterprise ad spending, and sluggish revenue growth.

However, the prospect of multiple interest rate cuts in 2024, Meta’s focus on cost optimization, and an improvement in investor sentiment have all driven the rally in META stock in recent months.

Now that it's firmly back in the trillion-dollar club, let’s see how big the company might grow over the next few years.

How Did Meta Stock Perform in Q4 of 2023?

Meta increased its Q4 sales by 25% year over year to $40.1 billion. Comparatively, its operating expenses fell by 8% to $23.7 billion, indicating an operating profit of $16.34 billion. Meta’s expanding revenue base and falling expenses allowed the company to more than double its operating margin to 41% in the last year.

Meta owns and operates several popular social media platforms, such as Facebook, WhatsApp, and Instagram. Its daily active people, or DAP, stood at 3.19 billion in December 2023, up 8% year over year. Comparatively, monthly active people rose 6% to 3.98 billion in the December quarter.

Meta emphasized that its user base across its Family of Apps helped it increase ad impressions by 21% year-over-year as the average price per ad rose 2% in Q4 of 2023. Moreover, in 2023, ad impressions rose by 28% while the average price per ad was down 9% year over year.

Meta pleasantly surprised Wall Street when it announced the company would pay a quarterly dividend of $0.50 per share, indicating a yield of 0.43%.

The company's stellar results and dividend announcement resulted in a 20% gain for Meta stock, adding a record $196 billion to its market cap in a single session.

What's Next for Meta Stock?

Meta expects Q1 sales between $34.5 billion and $37 billion. It also forecasts total expenses for 2024 to range between $94 billion and $99 billion due to higher infrastructure-related costs, rising capital investments, and higher payroll expenses. Meta has forecast 2024 capital expenditures between $30 billion and $37 billion, an increase of 2% at the higher end of its guidance.

While Meta is investing heavily in its Reality Labs business, this segment remains unprofitable. In 2023, Reality Labs reported revenue of $1.89 billion, but its losses were much higher at $16 billion. Meta’s investments in building out the metaverse should provide it with a first-mover advantage in the upcoming decade.

Analysts tracking Meta forecast the tech giant to increase revenue by 20% to $158 billion in 2024 and by 12.5% to $178 billion in 2025. Its adjusted earnings are forecast to rise from $14.87 per share in 2023 to $22.90 per share in 2025. In fact, Wall Street expects Meta’s earnings to expand to $48 per share by 2028.

If the tech stock is valued at 25x forward earnings, Meta should return 150% in the next four years, valuing it at $3 trillion by market cap by the end of 2027.

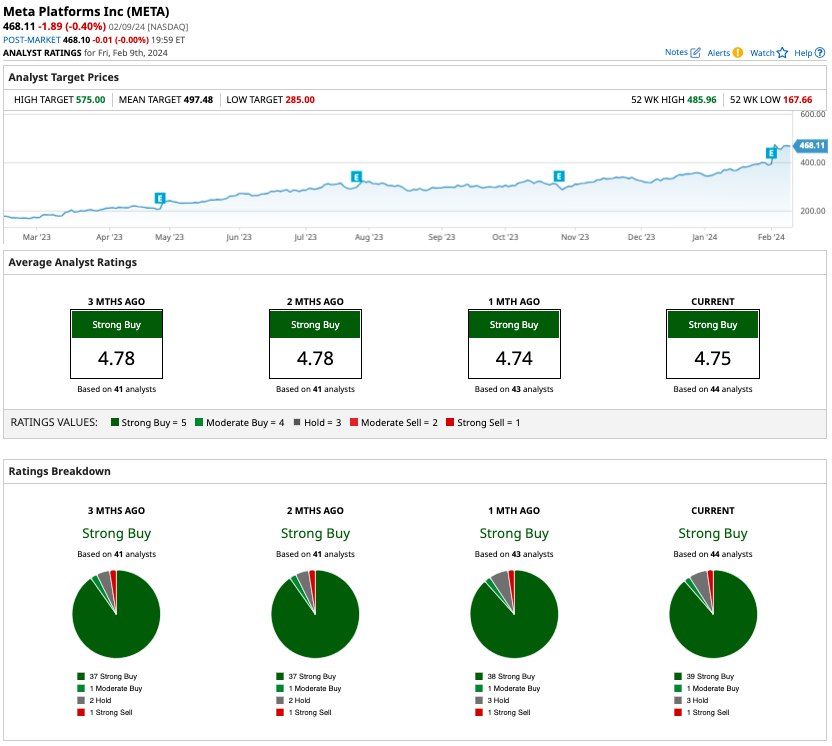

Out of the 44 analysts covering Meta stock, 39 recommend “strong buy,” one recommends “moderate buy,” three recommend “hold,” and one recommends “strong sell.” The average target price for Meta stock is $497.48, about 6% higher than the current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)