Macro Outlook and Recent Developments

The Dow Jones Industrial Average, tracked by the SPDR Dow Industrials ETF, is composed of 30 large capitalization companies such as Apple Inc., Microsoft Corporation, UnitedHealth Group, Goldman Sachs, and Caterpillar Inc.. Compared with the broader S&P 500 and the technology heavy Nasdaq Composite, the Dow tends to carry greater exposure to industrials, financials, healthcare, and multinational exporters.

In reflationary and cyclical expansions, the Dow often outperforms when capital rotates into industrial production, infrastructure, and financials. In late cycle or liquidity driven rallies, the Nasdaq may lead due to higher growth exposure. Correlation across indices remains elevated during broad risk on phases, yet sector composition can create meaningful divergence during shifts in macro expectations.

The broader uptrend that began in April 2025 gained traction as trade tensions eased and corporate guidance improved, helping reduce uncertainty around global supply chains. Through the second half of 2025, stronger than expected earnings from industrial and financial bellwethers reinforced confidence that margins were stabilizing despite higher input costs.

Into January 2026, price action turned more rotational as markets digested a hotter than expected Consumer Price Index print and Federal Reserve commentary that rate cuts would likely be delayed. At the same time, renewed geopolitical headlines surrounding Red Sea shipping disruptions and energy supply risks added crosscurrents. The February 12 snap back lower coincided with a sharp rise in Treasury yields following a stronger than expected payrolls report and hawkish remarks from Federal Reserve officials emphasizing data dependence. That repricing of rate expectations prompted responsive sellers to offer prices back from new highs.

What the Market Has Done

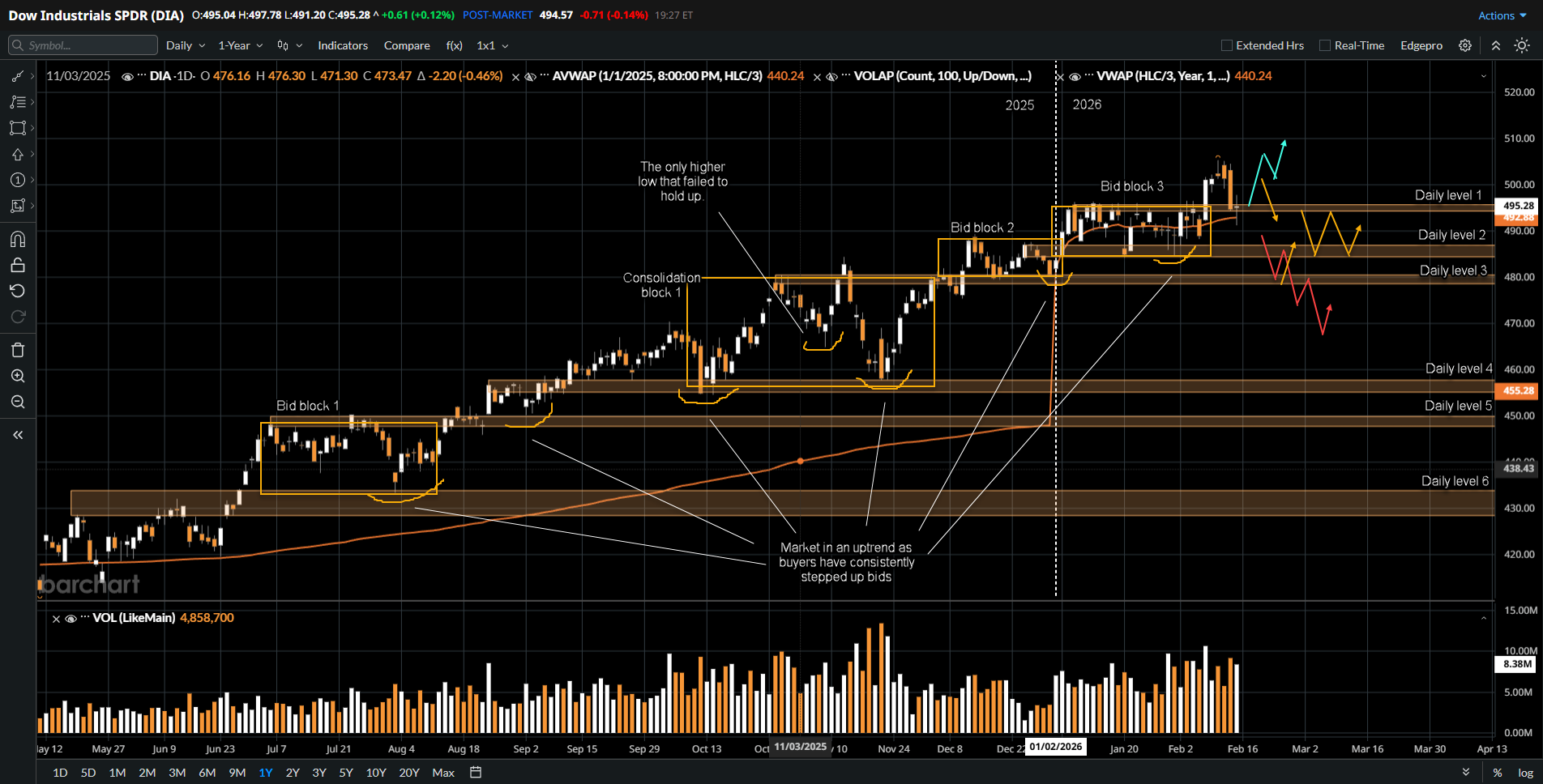

- The market has been in an uptrend since April 2025 after easing of tariffs from President Trump reduced uncertainty around global trade and improved forward guidance from multinational industrials.

- Buyers have steadily stepped up bids and have been able to bid prices to new all time highs in a block step manner, reflecting controlled acceptance higher rather than vertical excess.

- The market consolidated between 495 and 485 in January 2026 after making new all time highs, as hotter inflation data and repricing of Federal Reserve rate expectations slowed upside momentum.

- In the recent two weeks, buyers were able to bid up prices to 505.3 to make new all time highs again, but responsive sellers stepped back in on February 12 following stronger payroll data and rising yields, offering prices back down to the 495 level.

What to Expect in the Coming Weeks

Bullish Scenario

- If buyers are able to defend 495 (daily level 1 and high of bid block 1), expect a move up to revisit 505.3, the all-time high.

- If momentum persists above 505.3, expect the market to auction higher toward 510, where there is elevated positive gamma exposure. In that zone, option related flows may dampen volatility and attract responsive sellers looking to defend overhead supply.

Neutral Scenario

- If the market stalls before revisiting 505.3 and buyers are not able to hold their bids at 495, expect rotation back within bid block 1 for two-way balance.

- In this case, buyers would need to hold bids at 485 (bid block 1 low and daily level 2), to maintain structural integrity of the broader uptrend.

Bearish Scenario

- If bids slip and prices auction below 485 toward 480 and are not able to recover quickly back within bid block 1, that would be an early clue that buyers are vulnerable to long liquidation.

- If sellers step up and take control below 480 (daily level 3), the market could rotate down toward 470, which marks the midpoint of consolidation block 1 and a deeper test of prior value.

Conclusion

The Dow Industrials remain structurally bullish, supported by tariff relief, resilient earnings, and still solid macro data, but the path forward is increasingly sensitive to interest rate expectations and incoming inflation and labor market reports. Technically, the defense of 495 will be pivotal in determining whether this remains a controlled block step advance toward 510 or transitions into broader balance and potential liquidation toward 470. As macro headlines and options positioning intersect with clearly defined auction levels, traders have a well framed environment to express directional views.

For traders looking to express views in equity markets such as the Dow Jones Industrial Average, futures offer a more precise and capital efficient alternative to ETFs like DIA. Futures provide centralized pricing, deep liquidity, and transparent execution that exchange traded products do not always match. EdgeClear delivers direct access to global futures markets through trader focused platforms built for serious market participation. Learn more at edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional, if necessary, before engaging in futures or derivatives trading.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)