The well-known used automobile company Carvana (CVNA) is facing a critical turning point in 2024, as investors and analysts alike look for signs of potential turnaround after the company dodged a seemingly inevitable bankruptcy in 2023.

A much-needed financial reorganization pushed the stock higher last year, as Carvana revealed a contract to lower its outstanding debt by more than $1.2 billion. Announced simultaneously with the release of its second-quarter profits, this news demonstrated Carvana's commitment to stabilizing its tenuous financial position.

The decision to sell up to $1 billion in stock was critical to Carvana's recovery strategy, and the move was positively received in the market, as some analysts had feared a bankruptcy was unavoidable.

This year, the bar for Carvana is set a little higher as it continues on the path to recovery. With the shares up a staggering 537% year-over-year, here's a closer look at what Wall Street expects next.

What's the Earnings Forecast for Carvana?

Carvana, a pioneer in the used car industry, isn't quite out of the woods yet. While the company beat EPS expectations in its most recent quarterly report, revenue fell short of consensus forecasts at $2.77 billion.

Fiscal year 2024 predictions aren't particularly encouraging, either. Analysts are targeting a wider full-year loss of $3.43 per share for fiscal 2024, even as revenue is expected to grow 4.6% to $11.41 billion, up 4.58% year-over-year. Profitability isn't expected on a full-year basis until fiscal 2027.

That said, the shares are reasonably priced for expected growth. CVNA's forward price/sales ratio is 0.44, a significant discount to the consumer discretionary sector median of 0.90.

Overall, the company's rising per-share losses indicate the need for careful financial management, notwithstanding its rising sales and market share potential. In the short term, Carvana's ability to achieve this balancing act will become clear, with the next quarterly earnings due in about a month.

What Do Analysts Expect For CVNA Stock?

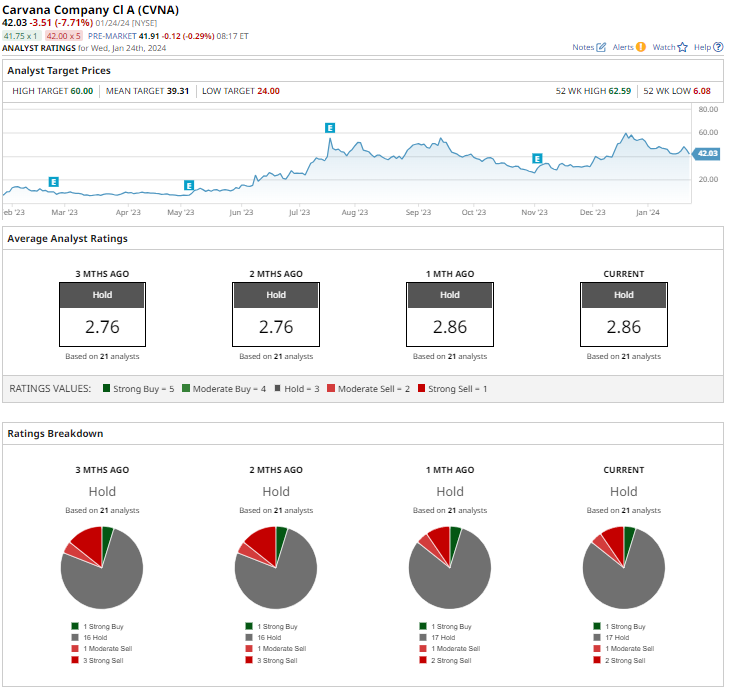

The general opinion among analysts on CVNA is to "Hold" the stock - a consensus that has remained virtually unchanged in recent months. Among the 21 analysts tracking the shares, only 1 says it's a “Strong Buy,” 17 say “Hold,” 1 says “Moderate Sell,” and 2 suggest “Strong Sell.”

The average price target is $39.31, which is a modest discount to the stock's current price.

Is CVNA Stock a Buy in 2024?

Carvana is at a key inflection point in 2024 as it looks to control costs. The company has done a great job of stabilizing its finances and growing its market exposure, as shown by its successful efforts to pay down its debt. But now that it's avoided bankruptcy, it faces a more challenging road to long-term viability.

Overall, Carvana (CVNA) still looks like a higher-risk play heading into 2024. Once the company demonstrates more disciplined financials over the long haul, it may eventually win over some of those tepid analysts - and investors, too. For now, it's best reserved for investors who have a healthier risk appetite.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)