/Netflix%20LogIn.jpg)

Netflix (NFLX) stock is showing unusual options activity today based on a Barchart report. This is likely due to the stock's 11% surge today and the underlying higher value of NFLX stock based on its huge free cash flow (FCF).

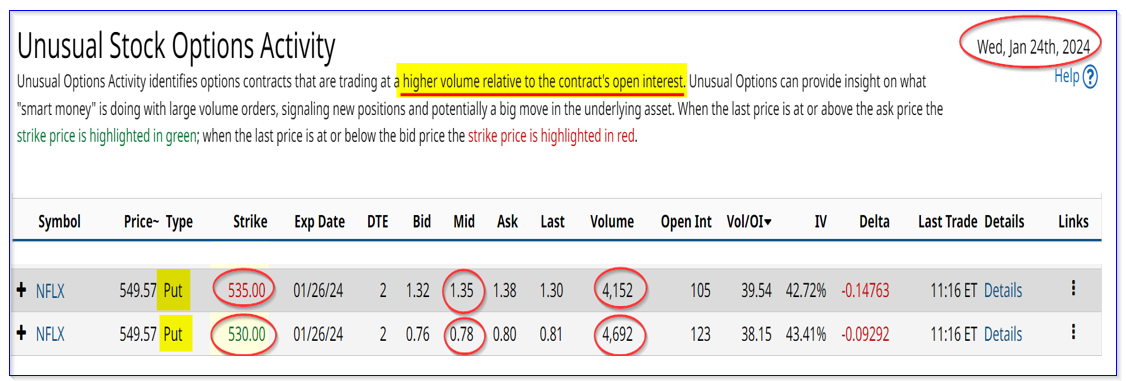

The Unusual Stock Options Activity Report published by Barchart today shows that large tranches in Netflix puts have been traded for the period ending Jan. 26, or two days from now. For example, over 4400 put contracts have traded at the $530 strike price and 3,684 put contracts have traded at the $535 strike price.

The volume of these put contracts is 38x to 39x the normal outstanding interest in these put contracts before today.

As of this writing, NFLX stock is at $550.21. In other words, the put buyers (i.e., bearish investors) believe that NFLX stock will fall $15 to $20 in just 2 days.

But the short sellers of these puts (i.e., bullish investors) think this is a good income opportunity if NFLX stock stays at its present price by the end of trading on Friday. This is because these puts are already out-of-the-money (OTM). The $530 strike price puts are trading 4.45% below the spot price and the $535 is 3.35% OTM.

Bullish Outlook May Prevail

For example, the $530 strike price puts have traded at 79 cents in the mid-price and the $535 strike price puts traded at $1.37. So, this means that the short sellers of these puts have made good yields.

The $530 strike price puts yield 1.49% (i.e., $0.79/$530) and the $535 strike price puts yield 2.56% (i.e., $1.37/$235). Moreover, the breakeven price for the $530 strike price is $529.21, which is 4.165% below today's price.

In other words, NFLX stock would have to give back almost half of its gains today for that strike price to be exercised by Friday and the trade would be unprofitable for the short sellers.

That does not seem likely. Here is why.

FCF Could Push NFLX Stock Higher

First, the company produced extraordinary results. I discussed this in my article today, “Netflix is Up 12% Post Results, But NFLX Stock Is Worth More Based on Its Huge FCF.”

I showed that the stock is likely worth considerably more, as much as $625 per share over the next year. This is based on the company's powerful free cash flow (FCF), its huge FCF margins, and the likelihood that revenue and FCF will continue to surge.

Moreover, another reason is that analysts are likely to come out with higher stock price targets over the next several days. This will help the stock hold up.

So, on balance, it seems that the huge activity in NFLX put options could be beneficial to the short sellers rather than the put buyers.

More Stock Market News from Barchart

- Will the U.S. Consumer Keep the Economy Growing in 2024?

- Stocks Climb on Economic Optimism and Strong Tech Earnings

- Netflix is Up 12% Post Results, But NFLX Stock Is Worth More Based on Its Huge FCF

- Skip the 'Trump Trade': Why Investors Should Avoid DWAC Stock This Election Season

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)