/Amazon%20Holiday%20delivery.jpg)

Amazon.com (AMZN) stock still looks cheap to investors given its powerful free cash flow. AMZN stock could be worth $185 based on a 75x metric. Short-put income plays also are a good play here.

I discussed this possibility in my recent Barchart article on Jan. 1, 2024, “Amazon Is at a Peak But AMZN Stock Is Still Worth 22% More at $185.” AMZN stock was at $151.94 at the time, and today it is at $154.52 in morning trading.

The company will release its Q4 results on Feb. 1 after the market close. Analysts still project positive earnings of 79 cents per share for the quarter, compared to 94 cents last quarter.

This should also lead to another positive quarter and trailing 12 months of positive free cash flow.

Free Cash Flow Can Lead AMZN Stock Higher

For example, in the last 12 months, it generated almost a 4% FCF margin ($21.4b in FCF/$554b in sales = 3.8%). If analysts' estimates of $636.69 billion in sales for 2024 hold up, this implies FCF of $25.5 billion in FCF for 2024.

We can use a 1.333% FCF yield metric, which is the same as 75x FCF, a typical technology stock multiple. This leads to a projection of a market cap of $1,912 billion sometime in the coming 12 months.

That is 19.5% over today's market cap of $1,600 billion. In other words, the stock could rise almost 20% from here to $185 or so.

Analysts Project Higher Target Prices

Most analysts are still positive on AMZN stock. The average price target from Refinitiv's survey of 49 analysts is $182.45 per share (as seen on the Yahoo! Finance site). That is 18% over today's price and close to my estimate of $185, which is 19.5% higher.

Similarly, AnaChart.com, a new sell-side stock analyst tracking service, shows that the average of 47 analysts is $187.93 per share. In other words, the average sell-side analyst now projects a 21.6% higher stock price over the next 12 months or even earlier.

AnaChart also shows that the highest price target is $230.00 per share. In fact, looking at AnaChart's tracking of price targets to the actual stock price shows that a number of analysts have raised their targets to over $190 per share.

The bottom line is that analysts are very positive about AMZN stock. One way for existing shareholders to play this is to sell short out-of-the-money (OTM) put options as an income play.

Selling OTM Puts in AMZN Stock

I discussed this play in my last Barchart article. I suggested shorting the $146 strike price puts for Jan. 19., when the stock was at $151.94. That means the play was about 3.9% OTM and the put yield at $1.13 on the bid side was 0.774%.

Since the stock closed at $155.34 on Jan. 19, this was a successful short sale. The investor kept the income and had no obligation to buy more shares at $146.00.

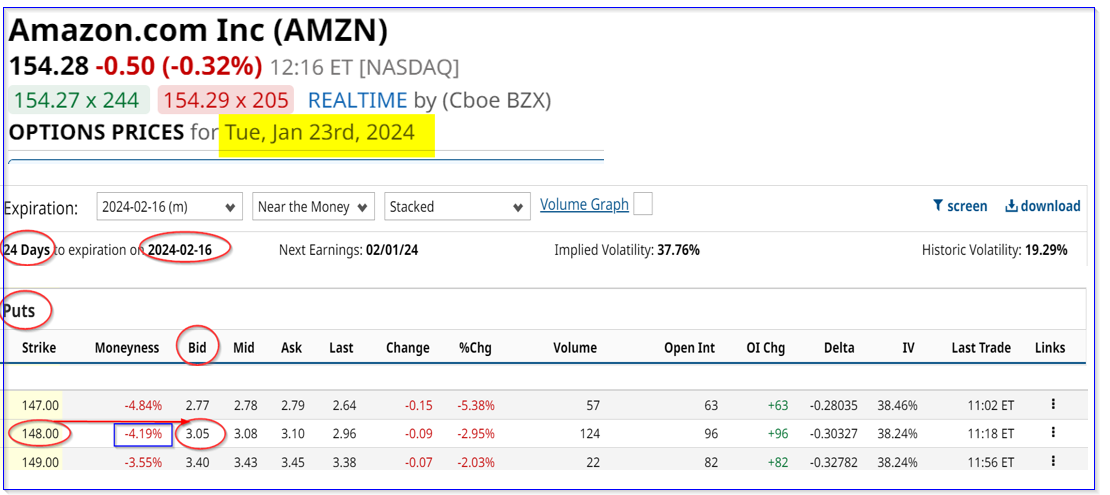

Moreover, this short-put play can be repeated. For example, the Feb. 16 expiration puts at the $148 strike price, 4% OTM, are trading for $3.05 per contract.

This means that the short-put trader can make an immediate yield of over 2% (i.e., $3.05/$148.00 = 2.06%).

If that trade can be repeated every 24 days for a year (i.e., 15 times), the annualized expected return (ER) is over 30% annually (i.e., 2.06% x 15 = 30.9%). This shows that this is a worthwhile income play for existing AMZN stock investors.

That is especially the case since Amazon still does not pay a dividend with its free cash flow. Given higher price targets for AMZN stock, the possibility of making extra income by shorting OTM puts is appealing to existing investors.

More Stock Market News from Barchart

- 2 Top Tech Stocks to Buy Right Now

- Stocks Waver on Mixed Corporate Earnings Results

- 1 Growth Stock Wall Street Expects to Soar 66%

- Tesla Q4 Earnings Preview: Should You Buy the Dip in TSLA Stock?

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)