The December FOMC meeting press conference sent sky banners announcing the worst is over for higher interest rates and to be prepared for multiple rate cuts in 2024. The reaction was euphoric in the equity markets and temporarily dampened the US dollar's strength as interest rates declined.

Since the launching of these sky banners, both economic data and the Fed members remain split on how interest rates will go. The unexpected decline in initial jobless claims to 187K, the lowest since September last year, and better-than-expected retail sales, beating all estimates to the upside in December, and the recent CPI report stating inflation was 3.4% and well above the Fed's target rate of 2% contributed to positive news for an uptick in yields and strengthening the US dollar.

Housing starts declining 4.3% during December, ultimately dragging down home furnishings and furniture purchases, resulting in less demand for these products. PPI for December came in -.01 after the consensus was .1%. Another factor potentially impacting interest rates is the upcoming 2024 general election. While the Fed claims to be politically independent, economies and interest rates have been affected during an election year.

Some Fed officials are trying to reign in market expectations of excessive interest rate cuts sooner rather than later. This week, Fed Governor Christopher Waller countered the prevailing sentiment of aggressive policy easing, emphasizing that the strength of the US economy provides policymakers with the leeway to proceed "carefully and slowly."

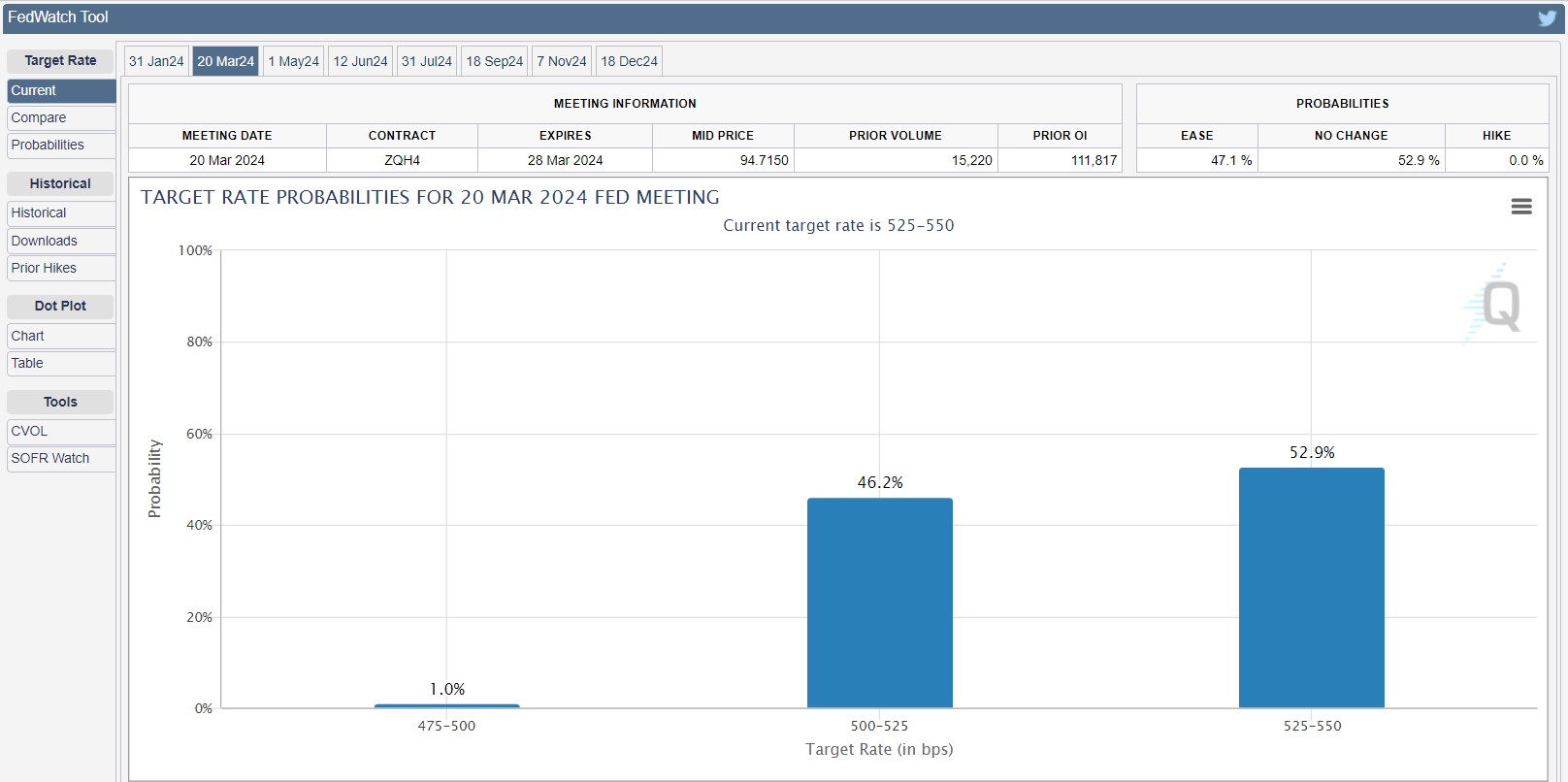

CMEGroup's Fed Watch Tool

Source: CMEGroup

As of this writing, the January FOMC meeting is expected to leave the Fed Funds rate at 5.25-5.50 with a 98% probability. The March meeting (above graph) has seen a drastic shift from a cut to leaving rates unchanged at a 53% chance. As recent as last week, the expectations were 75% for a rate cut. Today, that number is only 46%.

The Fed Watch Tool is much more accurate the closer we are to the next FOMC meeting. The tool's estimates are subject to change as new information impacting the Fed Funds markets arrives.

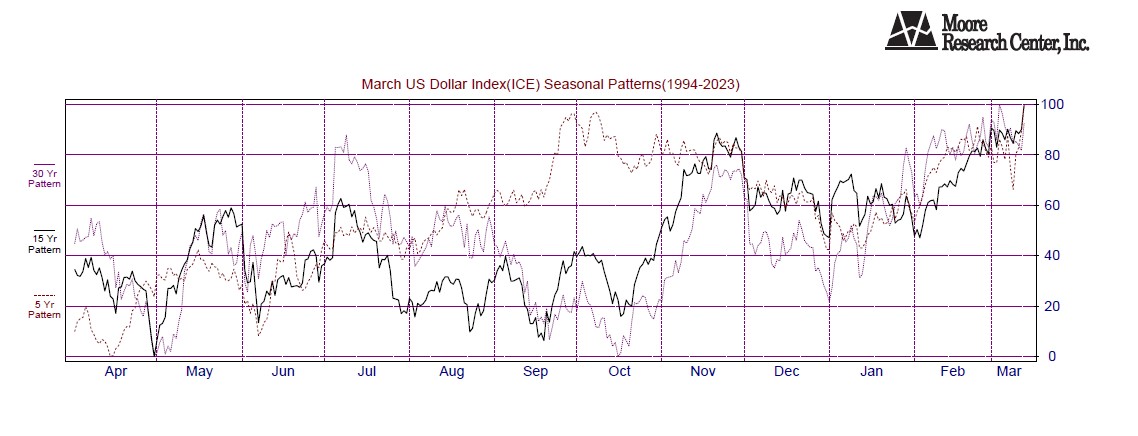

Seasonal Pattern

Source: Moore Research Center, Inc. (MRCI)

The March US dollar index futures contract has a seasonal 15-year (black line) pattern of bottoming in December or January and trading sideways until February, where a significant rally has occurred in the past.

Source: MRCI

An interesting seasonal correlation exists between the US dollar rally in February and the yield on the 10-year Treasury Note rally from February to the end of March. The US Government must issue more debt to raise cash for income tax refunds by the April 15 tax deadline. Higher yields - stronger dollar is a typical market correlation.

It's important to note that while seasonal patterns can provide valuable insights, they should not be the sole basis for trading decisions. Traders must also consider other technical and fundamental indicators, risk management strategies, and market conditions to make well-informed and balanced trading choices.

The Commitment of Traders (COT) Report

Source: Barchart

The weekly continuous US dollar index chart and the COT report show that commercial traders (red line) in the dollar index market are more bullish than ever in the past 52 weeks. The last time commercial traders were this bullish on the US dollar index was July 2023, resulting in an 8% price increase (green arrows). Another positive is the recent accumulation occurred at a higher price than in July.

In Closing

While the economic reports and Fed members remain indecisive about the future of interest rates, the Master appears to be speaking, and traders know that the Master is the market. Never argue with the market. You will never win.

The equity traders are pushing their markets to new highs after drinking the spiked punch that Chairman Powell offered at the New Year. Can the Fed lower rates once this year? Of course, being an election year, I would be surprised if they don't. After all, somebody has to appease the voters. Will the Fed cut rates six times this year? I seriously doubt it. Look at the potential supply chain disruption facing us in the Red Sea area that could reignite inflation again. And the Middle East conflicts are not showing signs of letting up anytime soon.

More Stock Market News from Barchart

- 3 'Strong Buy'-Rated Growth Stocks to Scoop Up Now

- Is Pfizer Stock a Buy Near 10-Year Lows for Its 6% Dividend Yield?

- Stocks Rally to Record Highs on Optimism about U.S. Economic Outlook

- This Cannabis Stock CEO Just Scooped Up Shares. Should You?

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)