Barchart platform publishes everyday a new top stock pick. This pick is a buy signal and is based on a technical signal called 50-200 Day MACD Oscillator crossover. Jan10th pick is GNRC. So, here in this article I will do my chart analysis and also engineer a trade called earnings setup diagonal trade on GNRC. I will break down the trade and explain the risk and reward for this trade.

On the left is the weekly and the daily chart of GNRC. In Oct 2023, we made a new low in price compared to Dec 2022. The RSI indicator though during the Oct 2023 time frame actually made a higher low. While the price was making a new low, RSI was making a higher low. This is known as bullish divergence. This divergence sometimes takes time to play out. But usually we get higher prices when we see this divergence signal.

On the daily volume profile chart shows that the price is about to get above the point of control (shown as green line). A close over 124.5 which is the point of control means that we have 80% chance that GNRC tests the Value Area High at 131.33

The daily chart also shows that multiple times GNRC came close to the 131 price level and has gotten rejected. After a couple of tries if it gets over the value area high which is above 131.33 then we could potentially see, GNRC try to fill the earnings gap from Dec 2022.

So, we could buy calls because we think GNRC is going higher. This is the easiest way to trade with options our bullish bias.

GNRC has earnings coming up on 2/14/2024 before market open.

With the bullish divergence in GNRC and the potential of a pre-earnings run in this name, I plan on doing an earnings setup call diagonal.

As the name suggests that this strategy is done when we have earnings approaching. The expected move for Feb 16th expiration on GNRC is +/- $17 move.

So if I just bought 130C for Feb 16th expiration then I would be spending $6 per contract (means 6*100 - $600 per contract).

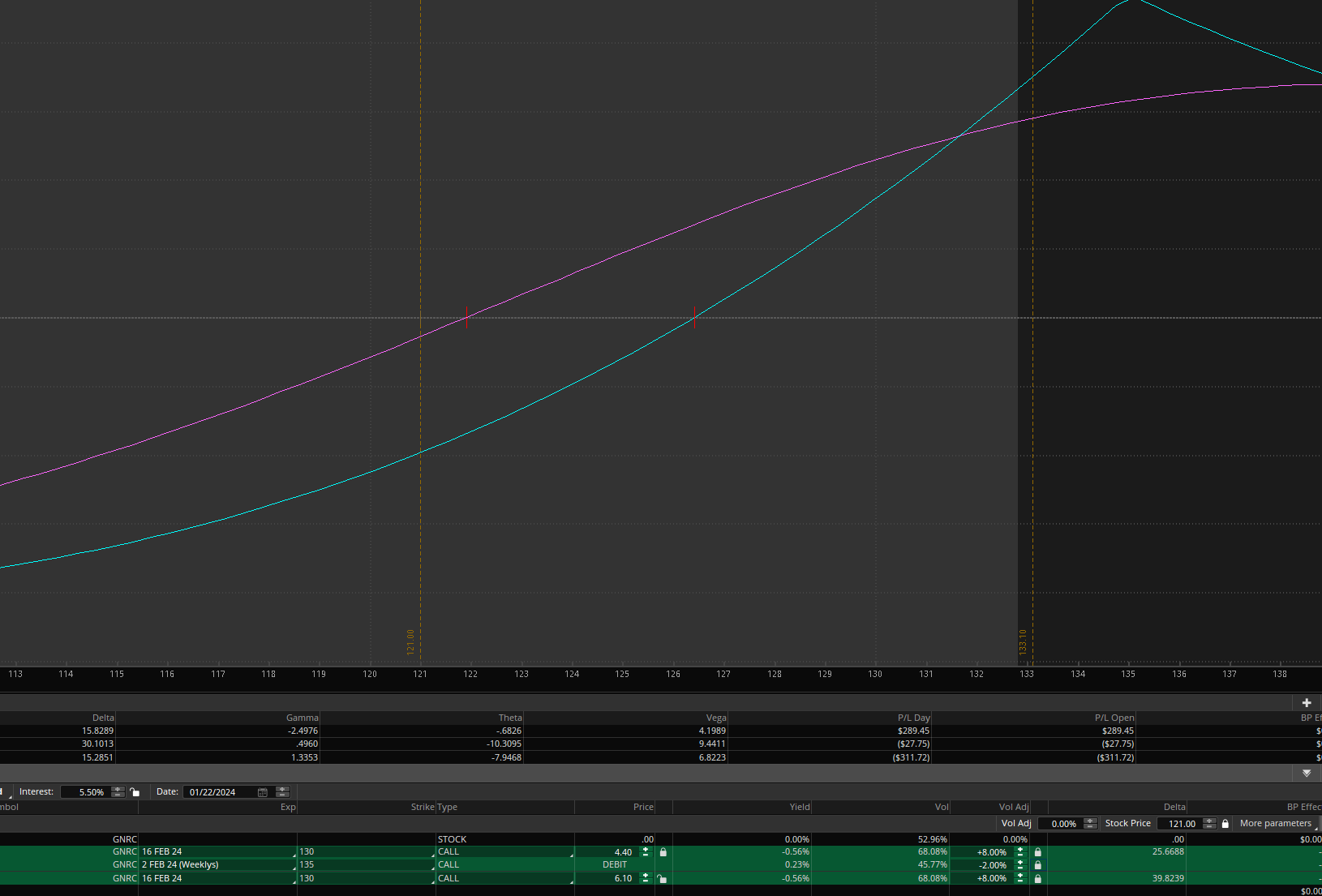

But I plan to sell some calls against this Feb 16th 130C to make it a diagonal. And the trade will be sell 2nd Feb 135C to buy Feb 16th 130C for a total debit of $4.4 (means $4.4 * 100 = $440 per contract).

What are the advantages of doing the bullish biased trade with this strategy?

1) The long call is in the expiration that includes earnings. As earnings date approaches the volatility in this expiration will rise. Hence the long call will hold the premium well and there will be less decay.

2) Since this trade also has a short call against the long call, this trade becomes a positive theta trade. This means that even if GNRC does not move up right away, I am not losing money on my overall trade. This gives me time to be right on this trade.

3) Another most important advantage is that my risk is $440 v/s $600 per contract. Less debit for a trade means less risk in my books.

4) This earnings diagonal also loses less money compared to only buying a call

Here on the right I am showing the risk profile of the earnings diagonal v/s the call.

I am assuming that 22nd Jan, there is a 8% volatility increase in the Feb 16th expiration because we are approaching earnings. This volatility will keep rising. But GNRC does not go higher but instead goes lower to 121 level then how does this diagonal fare compared to only a long call.

The risk profile shows that the diagonal would be probably down by $30 while if I took only a call then the trade would be down by $175 or so.

What happens if GNRC goes higher and GNRC is at 130 by 22nd Jan

Only doing Feb 16th 130 call, the trade is higher by $235 or so and the diagonal trade would be up by around $229

So, I am making almost the amount of money by putting less money in the first place. So % gain is higher in this trade if it does what I am expecting.

Is there a disadvantage to this trade? Yes.

If GNRC goes up very fast. The fast move up will make the short call to lose money faster than the long call can gain and hence in that scenario this trade would be a small winner.

In this case even though GNRC would be doing exactly I want but moving too fast in the desired direction is bad for the diagonal setup.

To counter this scenario, I am going a bit OTM (Out of The Money) for my long call and even further OTM for the short call.

So let's say GNRC goes to 136 by 22nd Jan then the diagonal would be up by $325 but here in this case the only long call trade is up almost up $600

So the diagonal would be around 73% up while long call would be up 100%

And if we GNRC by 22nd Jan went to 145 price level then the long call is up by $1200 while the diagonal is up only $316

After seeing a possibility of a gain $1200 if GNRC gets to 145, am I going to change my view and buy only a long call and not an earnings diagonal?

My answer is NO. I am still doing the diagonal.

I am looking at the chart : GNRC has failed multiple times at the 131-133 price level. Hence I am not counting on GNRC rallying by $20 in a straight line. And hence for a lower debit and a possibility of a higher % gain, I am going with the call diagonal trade.

This writeup is to highlight the advantages of a diagonal.

Disclaimer: Trading is risky. This is a setup that I like and this article is for educational purposes only.

Please do your own due diligence. This is not a recommendation to buy anything.

This is Archna Jagtiani. My Twitter handle is @archna2011. I write a daily paid pre-market Substack called www.indexincome.substack.com. I do teach advanced option strategies. Check out www.Archnatrades.com for options mentoring.

On the date of publication, Archna Jagtiani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)