As 2023 winds down, many are considering how they want to position their portfolios in 2024. One 2024 theme that many investors have heard throughout 2023 is artificial intelligence (AI). Lots of stocks related to AI have had a phenomenal 2023, and some look set to have a strong 2024 as well.

If you're looking for AI stock ideas, look at these four, as they could be fantastic investments in 2024.

1. Alphabet

Perhaps the biggest no-brainer on this list is Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL). It has long declared itself an "AI-first" company. While it might have lost some of the initial technological races out of the gate, it's no longer in that position.

Alphabet recently launched its latest Gemini generative AI model, which beats many competitors (like OpenAI's GPT-4) in multiple benchmark tests. It also has a strong cloud computing product, Google Cloud, poised to benefit from new clients signing on to rent out computing power and storage space to power proprietary AI models.

Lastly, Alphabet recently announced it is restructuring its advertising business in an effort to further integrate AI. This is a huge move for the company and is the beginning of monetizing AI.

Despite these tailwinds, Alphabet trades for a mere 21 times 2024 earnings, making it an absolute bargain compared to many big tech stocks.

2. CrowdStrike

CrowdStrike Holdings (NASDAQ:CRWD) is a cybersecurity company that deploys AI throughout its products. By using a branch of AI known as machine learning, its software continuously evolves to protect clients from the latest threats.

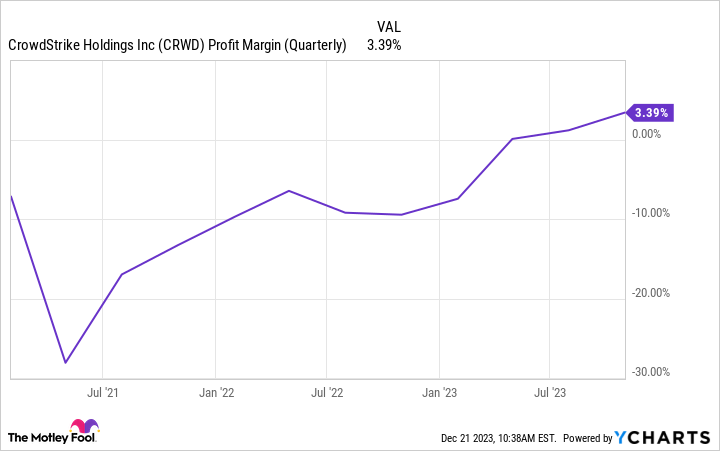

The company has quickly grown to become one of the largest cybersecurity providers, as its annual recurring revenue is $3.15 billion (up 35% in the third quarter of fiscal 2024, ending Oct. 31). Furthermore, it's becoming more profitable each quarter, and 2024 should be another year of improving margins.

CRWD profit margin (quarterly) data by YCharts.

The one drawback with the stock is its high price tag. After a strong year, its price-to-sales ratio has risen to more than 21 times sales. That's a lofty price tag for any company.

Still, with CrowdStrike operating in an industry estimated to be worth $100 billion in 2024, it has a long way to go before fulfilling its mission. Furthermore, that opportunity is expected to expand to $225 billion by 2028, so the company has plenty of growth left in front of it.

As a result, I'm willing to pay a premium to own one of the top cybersecurity companies in the market.

3. Airbnb

I know what you're thinking: Airbnb (NASDAQ:ABNB) isn't an AI company; it helps people book short-term rentals and travel experiences. While that's true, it also deploys AI throughout its platform.

One area is with crackdowns on parties, which gave Airbnb a bad reputation. So the company developed an AI model that determines the likelihood of the renter throwing a party at the property and blocks the booking if necessary.

It also recently acquired GamePlanner.AI, a company that hasn't publicly revealed what its AI model actually does. It will be interesting to see how Airbnb will use GamePlanner to create new or enhanced services for users.

Regardless, Airbnb is still doing well right now, with revenue rising 18% in its latest quarter. It's also incredibly profitable, posting a third-quarter operating margin of 44%.

Airbnb might not get widespread respect from the market, but it is a solid AI investment heading into 2024.

4. Adobe

Adobe (NASDAQ:ADBE) has been a leader in the digital media space for decades. But it has also nimbly integrated AI into its products. Most notably, its Firefly generative AI allows users to modify or create images with a simple text input.

The company just terminated its expensive acquisition plans with Figma, so its history of growing revenue at a low double-digit pace and growing earnings much faster is still intact. This leads to long-term market outperformance, which makes Adobe a tempting buy.

For example, in the fourth quarter of fiscal 2023 (ended Dec. 1), its revenue rose 12% year over year, with earnings up 29%. Management projections are about the same for 2024, with revenue rising 10% and earnings up 15%.

Adobe is a fantastic AI investment for 2024, and the execution of its dependable business model should drive it to be a market-beating stock.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Alphabet wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Adobe, Airbnb, Alphabet, and CrowdStrike. The Motley Fool has positions in and recommends Adobe, Airbnb, Alphabet, and CrowdStrike. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)