The silver (SIH26) market just offered up a perfect example of why analyzing both sides of the coin — and having a plan for both — is the only way to survive as a do-it-yourself investor.

In a matter of 48 hours, the silver rush of 2026 went south. The metal plunged nearly 33% from its historic peak of $121 to a low of $76 on Jan. 30. This was the most violent single-day drop since 1980, and it exposed the fragile nature of any trade built on pure momentum.

The iShares Silver Trust ETF (SLV) swelled to $41 billion in assets, even after Friday’s wrecking ball hit. That’s crazy. There’s no other word for it.

SLV hasn’t done anything to hedge against what happened the past few days. Nor should it. It is an exchange-trade fund (ETF) tracking an index. In this case, the price of silver.

It follows that if the ETF is going to always do exactly that, we DIY investors have to do the rest ourselves. Namely, position-size correctly based on what we want. And to take money off the table, at least in part, when spikes in price try to convince us we are infallible.

To understand why this happened and how to handle it next time, we have to look at the two competing forces that define silver's dual identity.

The Case For the Silver Rush

The bull case for silver in early 2026 was, and remains, built on a foundation of physics and industrial necessity. Unlike gold (GCH26), which is mostly stored in vaults, silver is consumed by the modern world.

Over 60% of silver demand now comes from industrial applications that are essential to the 2026 economy. From the massive expansion of solar capacity to the wiring in 15 million new electric vehicles (EVs), silver is a non-negotiable component. Silver has historically been the high-beta version of gold. When investors get nervous about the U.S. dollar or Federal Reserve independence, they buy gold. When they want to supercharge those gains, they buy silver.

The Case For the Silver Crash

The bear case, as we saw in full frontal fashion last week, is built on the reality of leverage and speculative mania. When a commodity goes parabolic, the exchanges eventually step in to cool things down. On Jan. 30, a massive hike in margin requirements acted as the “event.”

Investors who were trading on borrowed money were suddenly forced to either put up more cash or sell their positions immediately. This triggered a cascade of liquidations that wiped out weeks of gains in just hours.

Frankly, I find it borderline irresponsible that in the significant amount of news coverage about silver, rarely did I hear about this threat. I wrote about it on Barchart, but neither before nor after the margin hike was provided as the reason for the drop. It's like Wall Street is trying to hide something.

That said, the immediate catalyst for the crash was the nomination of Kevin Warsh as the next Fed chair. Perceived as a monetary hawk, his nomination signaled a potential end to the era of easy money. This sent U.S. Treasury yields higher and the dollar surging — the two natural enemies of non-yielding assets like silver.

The thrill of the silver trade was replaced by the cold reality of a rising opportunity cost for holding metals.

What’s Next for Silver?

Analyzing both sides of the coin matters here. Because silver is a series of disconnects between industrial physics and speculative fear.

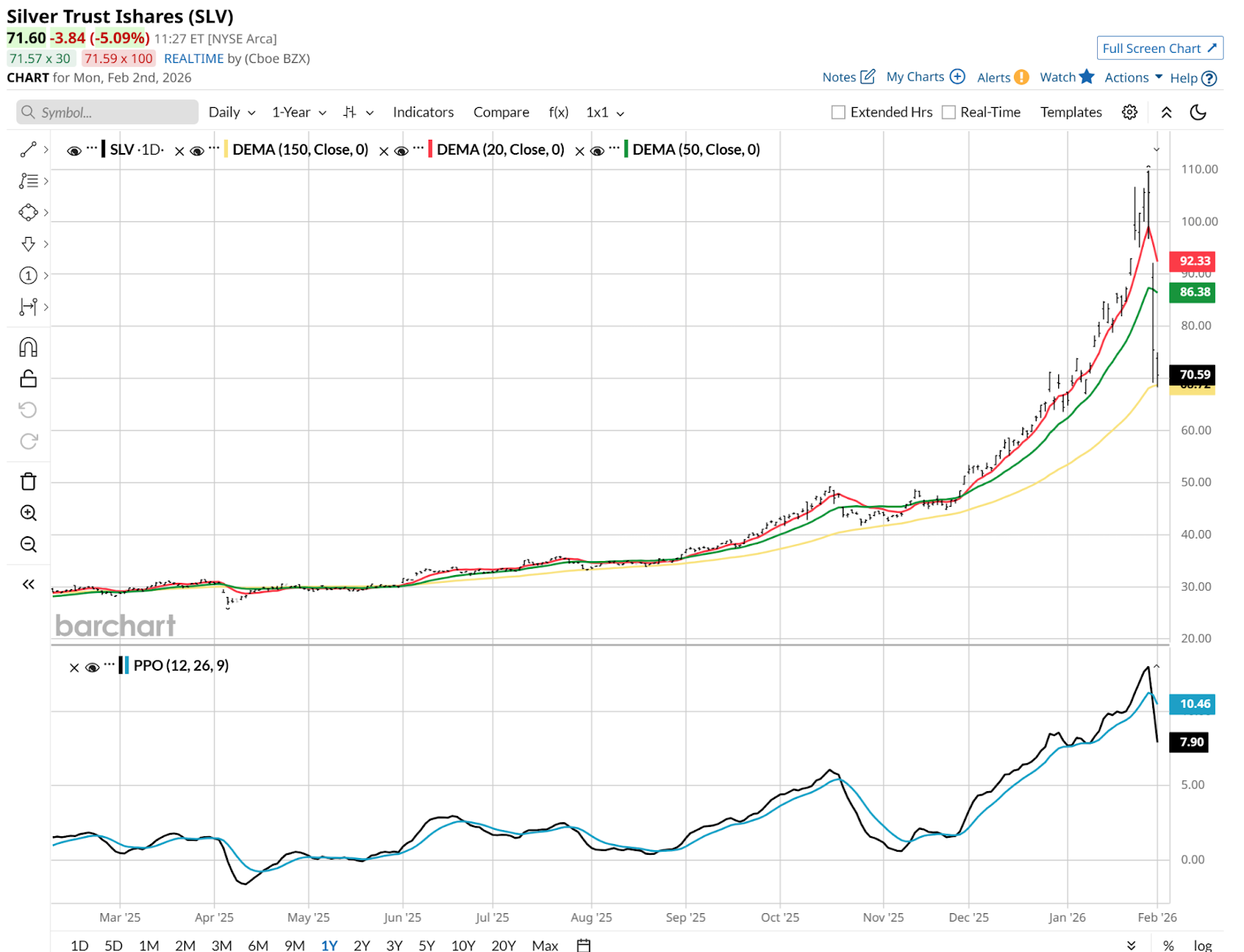

A quick, updated glance at the charts conclude this silver-colored update. The daily looks as we’d expect. Ugly, but still intact in the sense that the PPO is still positive. And that 200-day moving average could be a temporary line in the sand. But that’s for a bounce, not a full reversal to new highs.

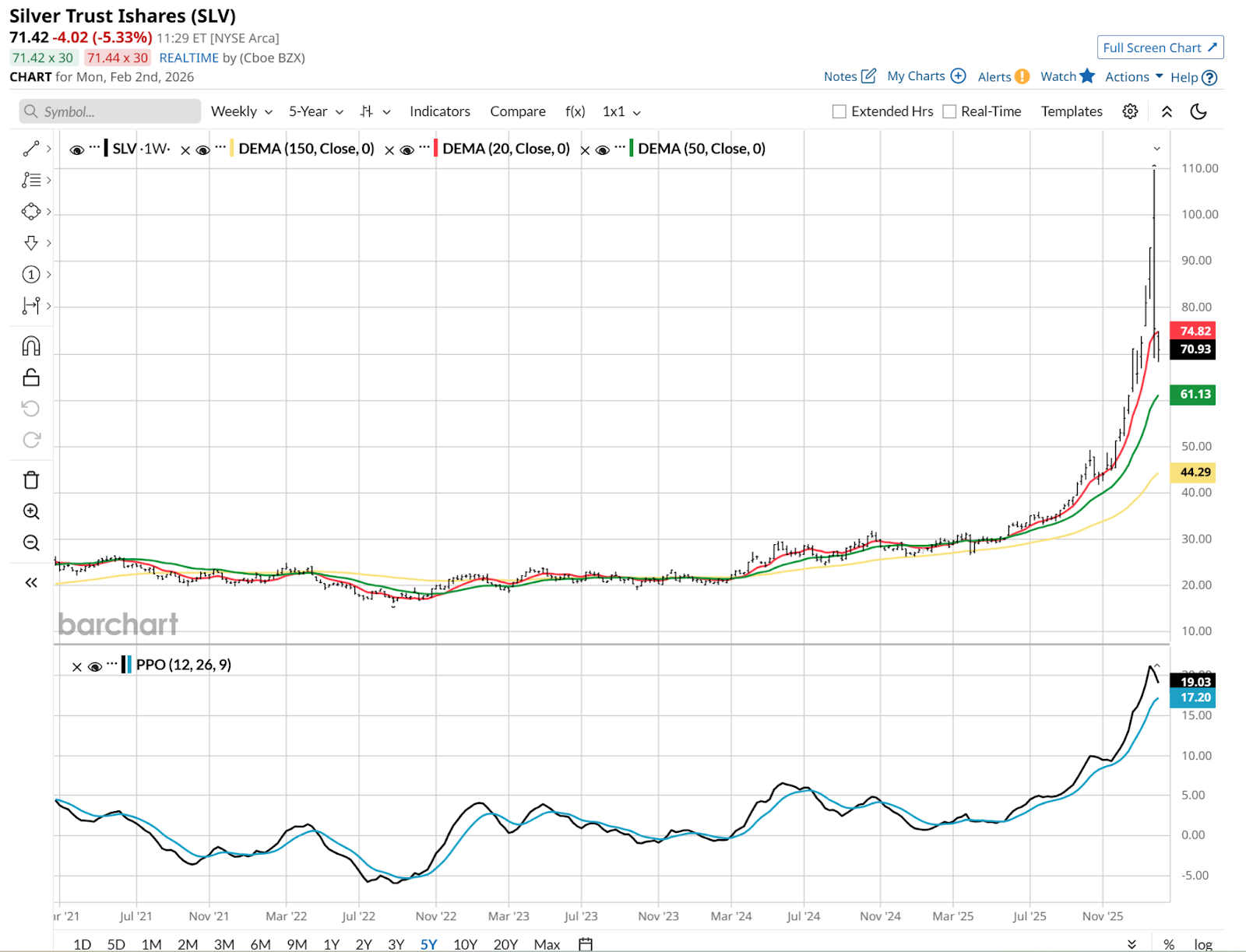

Now, below is the weekly. It is at an earlier stage — but an ominous one. That looks like an intermediate-term top to me. So the daily bounce potential is the potential for SLV, most likely. Beyond that, it's not so promising. That weekly PPO is telling us “enough’s enough” as it finally backs down from a skyrocketing move the past year.

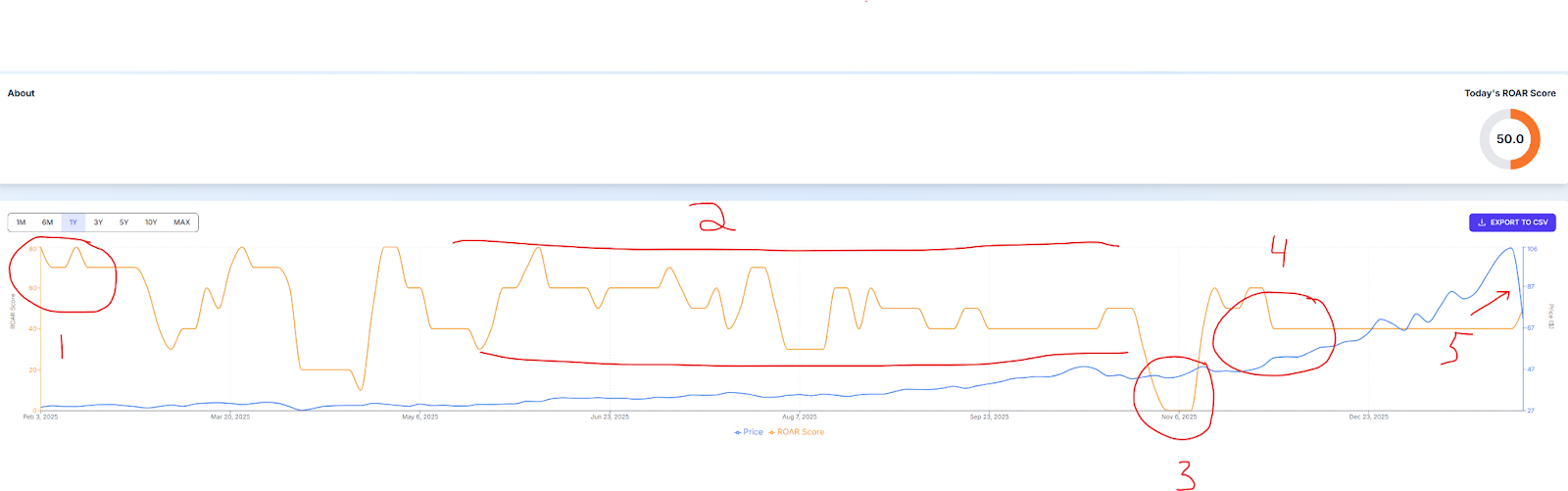

Lastly, on risk management, here’s your first glimpse of something I’ve developed with my friends at PiTrade. It is my reward opportunity and risk (ROAR) score, come to life for SLV.

I have marked the chart in five parts. Here’s what these five points say to me:

- Risk was quite low a year ago (high ROAR score, on its 90 to 10 top to bottom scale). The upside potential was well beyond that of the downside risk.

- As the price moved higher from May 2025 through October 2025, rising by about 50%, the ROAR score was happily trapped in a range, on either side of 50. That signifies that risk was neutral, neither elevated nor very low. A do-nothing signal.

- The dip last autumn was brief, so the ROAR score followed it down but quickly reversed. Remember, this is not about predicting the future with a crystal ball. It is about risk management throughout the investment process. ROAR is less about “do this now,” and more about “know what you own” when it comes to risk-taking.

- After that brief pullback, SLV returned to its happy-medium status. And if you had nerves of steel, you could have piled in. But built into the scoring system is a brake that activates when an ETF or stock is flying high. I can’t think of a better case of why that helps investors than the one we see here.

- After the FOMO crowd rushed in, all while ROAR was indicating that the past couple of months were not a sustained buying opportunity (swing traders only, please), SLV rallied. Then, in a flash, it crashed.

The bottom line is less about my personal creation in managing risk. It is about managing risk however it makes sense to you. Anything would be better than being last in, first out. Likely from a margin call.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)