With Arm Holdings plc’s (ARM) fiscal third-quarter earnings report set to drop after the market close on Feb. 4, investors are bracing for a pivotal update that could reshape sentiment around this high-profile chip architecture designer. ARM shares have experienced weak momentum recently as the broader semiconductor sector oscillates and analysts reassess growth prospects, yet the company’s expanding footprint in artificial intelligence (AI)-enabled designs and new strategic initiatives keep market focus sharp on its upcoming results and guidance.

As Wall Street digests licensing trends, royalty growth trajectories, and outlook into next year, Feb. 4 will be one of the most important dates on the calendar.

About Arm Holdings Stock

Arm Holdings is a semiconductor and software design company best known for developing the ARM architecture, a family of energy-efficient central processing unit (CPU) designs widely licensed across the technology industry. Headquartered in the United Kingdom, Arm doesn’t manufacture physical chips itself but instead generates revenue by licensing its processor designs and related intellectual property to semiconductor companies and original equipment manufacturers, while also earning royalties on chips shipped by its partners. Arm went public on the NASDAQ in September 2023, and its market cap is around $111.8 billion.

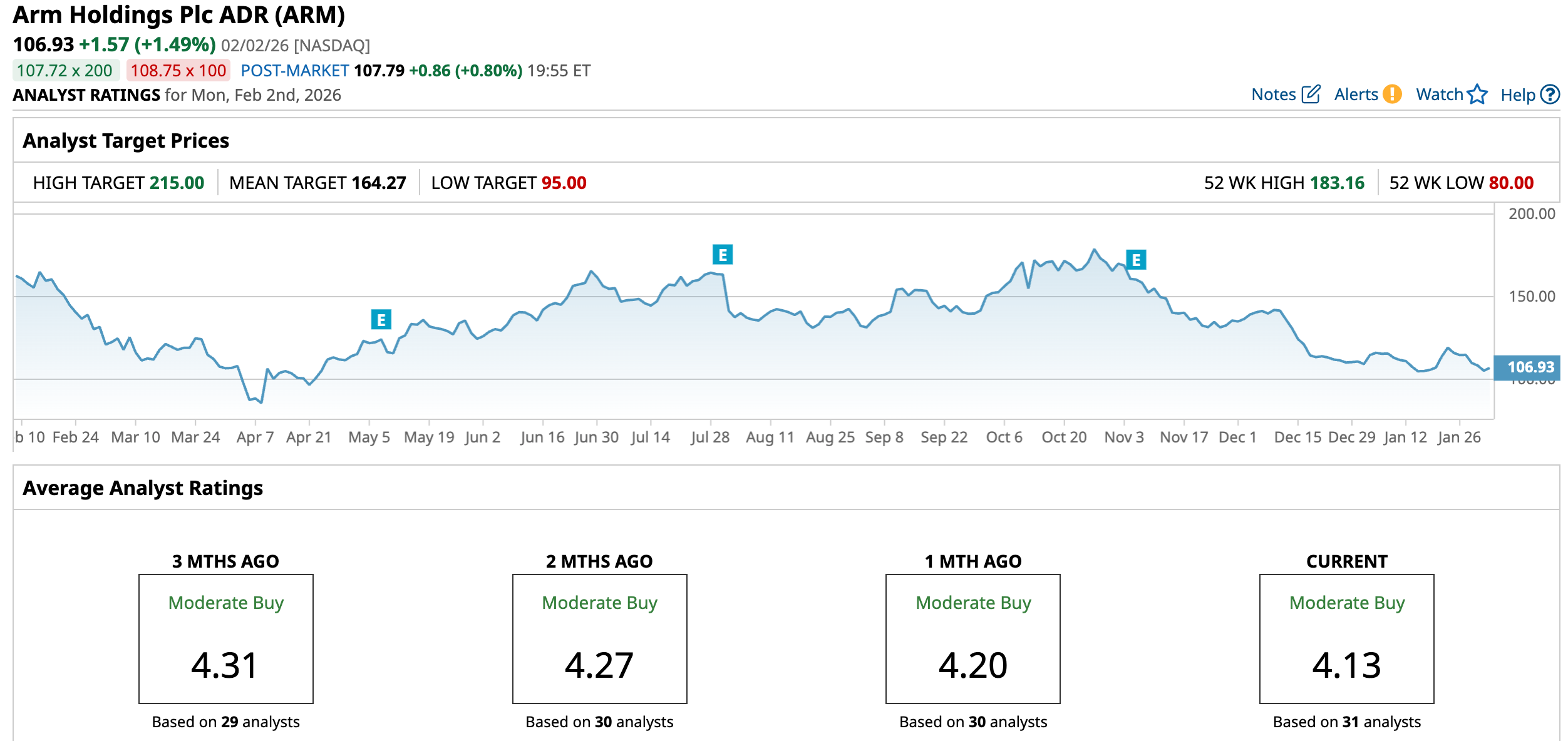

Over the past year, Arm Holdings has experienced pronounced volatility that reflects shifting investor sentiment. The stock had registered a high of $183.16 in October 2025, but is down by 42.5% from that peak as concerns around macroeconomic headwinds, higher memory prices affecting markets and competitive developments tempered sentiment. The stock has dropped 32.98% over the past 52 weeks.

Year-to-date (YTD), ARM’s performance has been muted to modestly negative, with the share price down by 3.6%, reflecting a retracement of the strong gains seen earlier and investor caution ahead of key catalysts like the upcoming February earnings release.

Despite the declines, the stock is trading at a significant premium compared to industry peers at 122.75 times forward earnings.

Robust Top Line Performance

Arm’s second quarter fiscal 2026 results, released on Nov. 5, 2025, delivered strong operational performance. The company reported record quarterly revenue of $1.14 billion, up 34% year-over-year (YOY), driven by robust growth across its core businesses and marking its third consecutive quarter above the $1 billion threshold.

Royalty revenue reached a record $620 million, up 21% YOY, reflecting increased adoption of higher-value Armv9 designs and expanding data center, smartphone, automotive, and IoT deployments, while licensing revenue climbed 56% YOY to approximately $515 million, underscoring strong demand for next-generation compute technologies.

Non-GAAP EPS was $0.39, beating the high end of guidance, and compared with $0.30 in the same period a year ago. Its non-GAAP operating income grew about 43% YOY with an expanded operating margin of around 41%.

ARM Investors, Circle Feb. 4 on Your Calendar

Arm Holdings will report its third-quarter fiscal 2026 earnings after the market close on Wednesday, Feb. 4, a release that could serve as a pivotal catalyst for the stock as investors look beyond the headline numbers to licensing momentum, royalty growth trends, and forward guidance amid a volatile semiconductor backdrop.

Analysts currently expect Arm to deliver revenue of $1.2 billion, a 24.8% rise, while non-GAAP EPS is expected to come in at $0.21 for the quarter, marking a decline of 12.5%. Notably, the company has surpassed or met estimates in each of the last four quarters.

Management’s guidance for the third quarter projected revenue around $1.225 billion (±$50 million) with royalty growth above 20% and licensing growth of roughly 25–30% YOY, and expected non-GAAP EPS near $0.41 (±$0.04).

Analysts predict EPS to be around $0.88 for fiscal 2026, a decline of around 17% YOY, but again rise 67.1% to $1.47 in fiscal 2027.

What Do Analysts Expect for Arm Stock?

Last month, BofA downgraded Arm to “Neutral” from “Buy” and cut its price target to $120 from $145 ahead of the company’s Q3 FY26 earnings on Feb. 4, citing near-term smartphone unit headwinds, rising reliance on majority owner SoftBank, and still limited exposure to data center and AI royalties.

On the other hand, Susquehanna upgraded Arm Holdings to “Positive” from “Neutral” while maintaining a $150 price target, despite recent pressure on the stock.

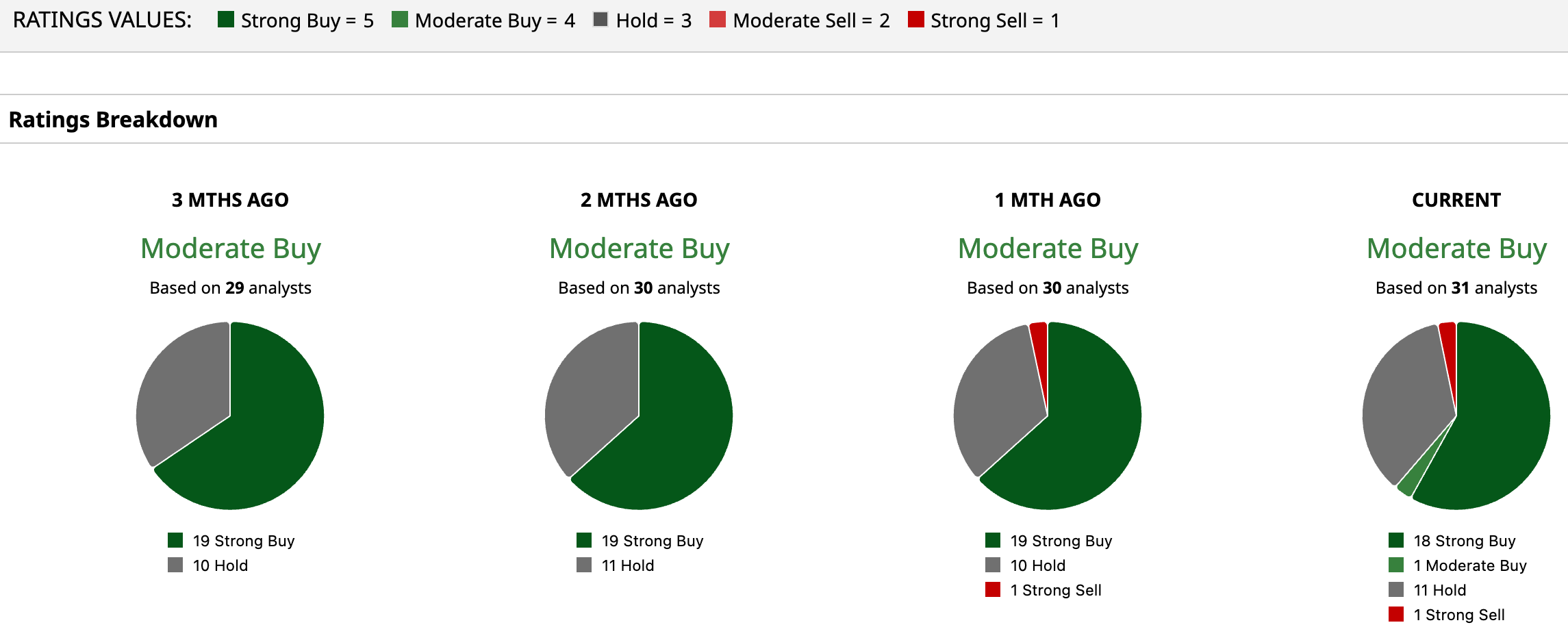

The stock has a consensus “Moderate Buy” rating overall. Out of 31 analysts covering the stock, 18 recommend a “Strong Buy,” one gives a “Moderate Buy,” 11 analysts stay cautious with a “Hold” rating, and one has a “Strong Sell” rating.

ARM’s average analyst price target of $164.27 indicates a 53.6% upside potential, while the Street-high target price of $215 suggests 101% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)