/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

Oracle Corporation (ORCL) is a global leader in enterprise software, cloud computing, and database management. It provides powerful tools like Oracle Database, Fusion Cloud ERP, and NetSuite for businesses to handle data, automate operations, and drive AI innovations. Known for reliable infrastructure, Oracle helps companies in finance, healthcare, and retail modernize with secure, scalable cloud services that blend legacy systems with cutting-edge tech.

Founded in 1977, Oracle is now headquartered in Austin, Texas. It operates in over 175 countries worldwide, serving millions of customers through a vast network of data centers and partners.

Oracle Stock Report

Oracle's stock has endured a tough stretch with high volatility. The five-day performance climbed about 15% from recent lows near $135. Over one month, it's down roughly 23%, six months about 38%, year-to-date (YTD) 20%, and 52 weeks 9% lower, far from its peak of $346 but above the low of $119.

Against the S&P 500 Information Technology Index (XLK), ORCL lags sharply as tech gained 26% yearly, ORCL dropped 12%, and short-term, its 21% monthly loss trails the sector's steadier uptrend amid broader market gains of 15%.

Oracle Reported Mixed Results

Oracle announced Q2 fiscal 2026 results on Dec. 10, 2025, showing mixed outcomes. Total revenue reached $15.9 billion, up 8-9% year-over-year (YoY) but missing analyst estimates by about 1-2% (expected $16.1-$16.2 billion). Non-GAAP EPS of $1.47-$1.50 beat expectations of $1.40-$1.44, thanks to strong cloud demand.

Cloud revenue shone at $8 billion, up 33%, now half of total sales; infrastructure-as-a-service soared (IaaS) 66% on 177% GPU growth. Remaining performance obligations (RPO) exploded to $523 billion, up 433% YoY and $68 billion quarter-over-quarter, with 40% converting in 12 months. Free cash flow plunged to ($10) billion due to $12 billion capex for AI data centers. Operating margin was pressured, but non-GAAP operating income hit solid levels, and cash reserves remain strong amid heavy investments.

Oracle kept FY2026 revenue guidance at $67 billion but added $4 billion in FY2027 revenue from quick-converting RPO.

Oracle Wins DAF Contract

The big news this week for Oracle is that it won an $88 million contract from the U.S. Air Force. The Department of the Air Force (DAF) awarded the firm-fixed-price task order to deliver Oracle Cloud Infrastructure (OCI) services for the Cloud One program.

Cloud One lets Defense Department customers tap into OCI's top-notch security, speed, and reliability across various security levels. It supports DoD security features like Secure Cloud Computing Architecture for stronger network protection. Users can also run Oracle AI Database 26ai on OCI to blend private and public data for secure AI workflows that deliver smart answers and automate tasks.

This deal covers OCI services for Cloud One users across the Air Force and wider DoD. Work happens at Oracle sites nationwide and runs until Dec. 7, 2028.

Should You Get ORCL Stock?

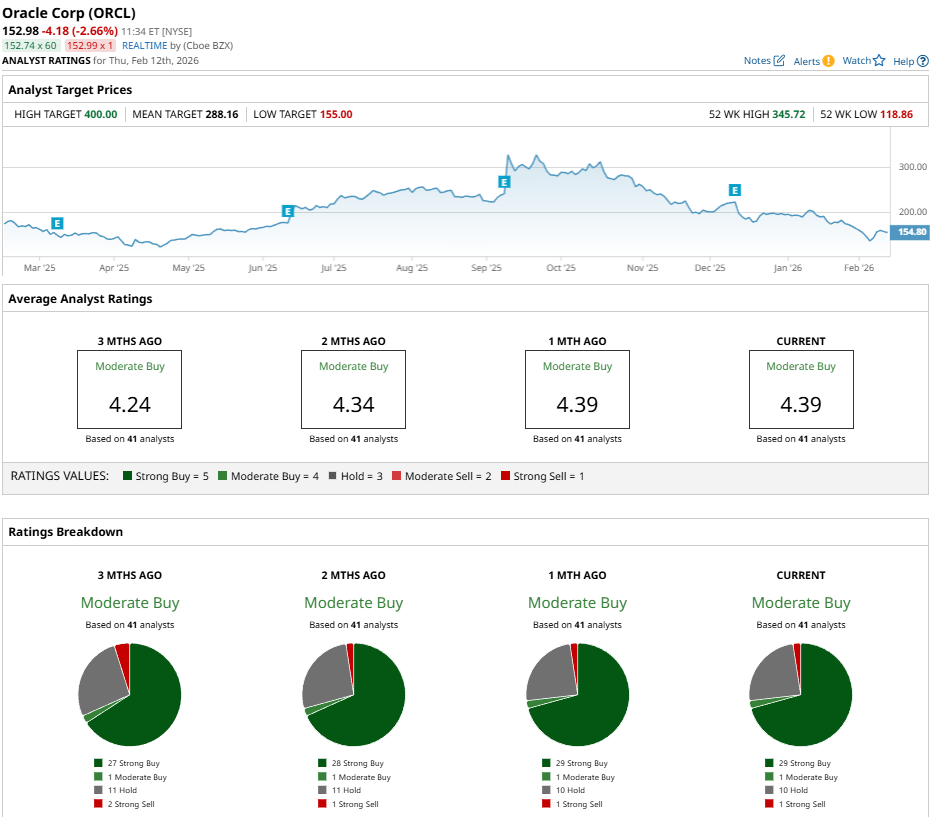

Now, despite its struggles, ORCL stock still has plenty of support in the market, as seen by a consensus “Moderate Buy” rating with a mean price target of $288.16, reflecting an upside potential of 89% from the market.

The stock has been rated by 41 analysts, receiving 29 “Strong Buy” ratings, one “Moderate Buy” rating, 10 “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)