/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

Cisco Systems (CSCO) just released an artificial intelligence (AI) networking chip that could reshape how the world's biggest data centers handle AI workloads. The Silicon One G300 delivers 102.4 terabits per second of switching capacity.

That's more than double what the previous generation could handle. The chip powers new systems designed specifically for massive AI clusters, where thousands of GPUs must constantly communicate.

Here's what investors should know about CSCO stock in light of the news.

Why This Chip Changes the Game

The G300 chip tackles AI's biggest infrastructure problem. When training large language models or running AI inference at scale, data must be constantly moved between GPUs. Any delays or dropped packets can stall entire jobs, wasting expensive compute time.

Cisco's chip uses something called Intelligent Collective Networking. Think of it as traffic management for data. The chip has an industry-leading buffer that can absorb sudden bursts of traffic without dropping packets. It also continuously monitors the network and reroutes traffic around issues before they cause failures.

The results speak for themselves. Cisco reports that the technology delivers 33% higher network utilization than traditional approaches. Job completion times drop by 28%. That means more AI tokens generated per hour from the same GPU hardware. For companies spending millions on AI infrastructure, those improvements translate directly to better returns on investment.

Cisco has built complete systems around the G300 that address AI's power and cooling challenges. The new Cisco N9000 and Cisco 8000 systems come in both liquid-cooled and air-cooled versions. The liquid-cooled systems achieve nearly 70% better energy efficiency. One new system delivers the same bandwidth as six older systems. That matters enormously as data centers struggle with power constraints, fitting more AI capacity in the same physical space while using less energy.

Cisco also introduced 1.6 terabit optics and new 800G linear pluggable optics that cut power consumption by 50% compared to older designs. Overall, switch power consumption drops by 30%, improving operational reliability and sustainability.

Market Traction Is Building Fast

Cisco's management shared compelling numbers during recent investor conferences. The company took in $1.3 billion in AI infrastructure orders during just the first quarter of fiscal 2026. That's from hyperscalers alone. The figure doesn't include sovereign cloud providers, neoclouds, or enterprise customers.

For fiscal 2026, Cisco expects to take in at least double the $2 billion in AI orders from fiscal 2025, while AI-powered revenue should increase to $3 billion. Even more impressive, Cisco now has design wins at five of the six largest hyperscalers. In Q1 alone, the company won four new design wins across four different hyperscalers. These aren't one-time purchases, as design wins can generate orders for three-plus years. Four hyperscalers increased their orders with Cisco by more than 100% year-over-year (YOY) in the first quarter. That shows deepening relationships beyond initial trials.

Silicon One gives Cisco real advantages. CFO Mark Patterson called it one of the company's "most strategic assets.” The chip is also highly programmable. Customers can upgrade equipment with new features even after deployment. That protects long-term infrastructure investments and creates stickiness. Cisco now has a variety of Silicon One product families, covering everything from AI data centers to enterprise networks.

Beyond Hyperscalers

The hyperscaler business receives the most attention, but Cisco sees significant opportunities elsewhere. For example, the sovereign cloud and neocloud pipeline exceeds $2.5 billion. These customers want AI infrastructure but need local control over their data and operations. Cisco's relationships with partners such as HUMAIN position it well.

Enterprise AI remains early, but could dwarf everything else. Cisco's partnership with Nvidia (NVDA) focuses on simplifying enterprise AI deployment. The companies offer validated reference architectures that remove complexity.

President Jeetu Patel noted at Cisco's AI Summit that token generation will become "one of the core currencies of every company and every country." Organizations that can generate AI tokens efficiently and cost-effectively will gain a competitive advantage.

While AI grabs headlines, Cisco's campus networking refresh provides steady growth. The company has billions of dollars worth of installed switches approaching the end of support. These older systems pose security risks and can't handle modern AI workloads.

Cisco refreshed virtually its entire campus portfolio in June. The new switches incorporate AI and security directly into the fabric. Campus networking orders accelerated in the first quarter compared to the fourth quarter of fiscal 2025. Adoption of new platforms is happening faster than previous product launches.

This isn't a one-quarter spike. The campus refresh will unfold over multiple years as enterprises modernize their networks to support AI-powered applications and agile workloads.

Financial Strength Supports Growth

Cisco generated strong cash flow while investing heavily in AI. The company bought back $2 billion in CSCO stock during Q1 at an average price of $68. That shows management's confidence while returning capital to shareholders.

Gross margins held steady at around 68% despite the inclusion of a lower-margin hyperscaler business. The company manages its diverse portfolio to maintain profitability while growing revenue.

Operating expenses are growing more slowly than revenue. Earnings are growing faster than the top line in every recent quarter and in the full-year guidance.

The Verdict on CSCO Stock

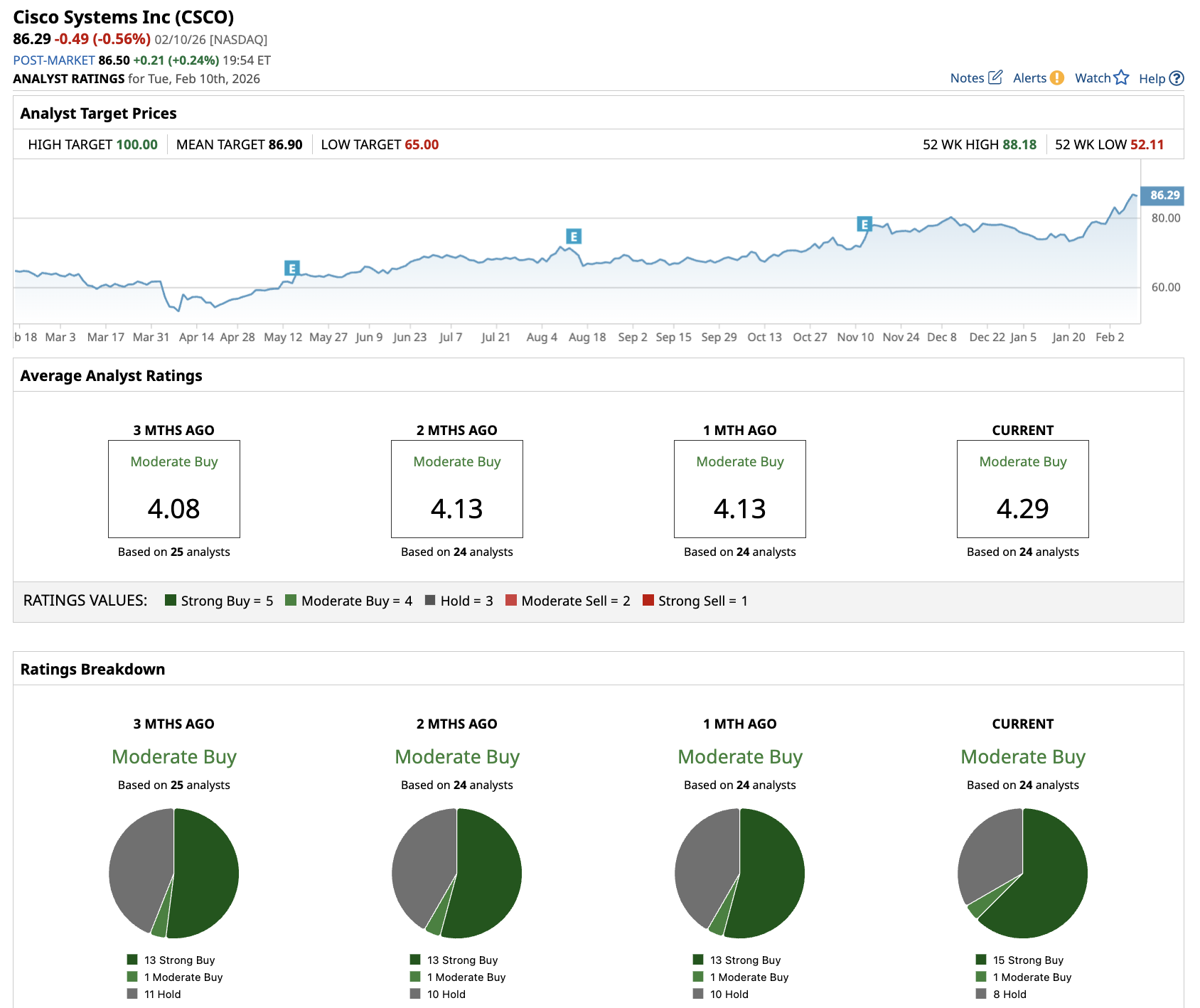

Out of 24 analysts covering Cisco stock, 15 recommend a “Strong Buy,” one recommends a “Moderate Buy,” and eight recommend a “Hold” rating. That makes for a consensus “Moderate Buy” rating. The average CSCO stock price target is $86.90, which represents 16% potential upside from current levels.

The AI networking opportunity is massive, and Cisco has real technological advantages. Design wins at multiple hyperscalers validate the technology and create multi-year revenue streams.

The sovereign cloud and enterprise markets are just beginning. As AI moves beyond hyperscalers into broader deployment, Cisco's full-stack approach becomes even more valuable. Cisco's campus refresh also supports steady growth as the company scales its AI infrastructure. Security through Splunk adds another growth vector as customers prioritize protecting AI deployments.

Near-term volatility is possible if AI spending pauses or memory costs spike. But Cisco's diversified business model and strong balance sheet can handle bumps. For investors who can handle some volatility, Cisco offers exposure to AI infrastructure growth at a reasonable valuation with dividend income while you wait.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)