Sporting goods retailer Dick’s Sporting Goods (NYSE:DKS) fell short of analysts' expectations in Q2 FY2023, with revenue up 3.57% year on year to $3.22 billion. Dick's made a GAAP profit of $244.3 million, down from its profit of $318.5 million in the same quarter last year.

Is now the time to buy Dick's? Find out by accessing our full research report, it's free.

Dick's (DKS) Q2 FY2023 Highlights:

- Revenue: $3.22 billion vs analyst estimates of $3.24 billion (small miss)

- EPS (non-GAAP): $2.82 vs analyst expectations of $3.81 (25.9% miss)

- Free Cash Flow of $577.8 million, up from $68.1 million in the same quarter last year

- Gross Margin (GAAP): 34.4%, down from 36% in the same quarter last year

- Same-Store Sales were up 1.8% year on year

- Store Locations: 860 at quarter end, increasing by 10 over the last 12 months

"We are pleased with our strong sales performance for the second quarter led by robust transaction growth and continued market share gains. Within the quarter, sales accelerated significantly in July, and we remain confident in delivering positive comp sales for 2023. While we posted another double-digit EBT margin, our Q2 profitability was short of our expectations due in large part to the impact of elevated inventory shrink, an increasingly serious issue impacting many retailers. Despite moderating our 2023 EPS outlook, the enthusiasm we have for our business and the confidence we have in our long-term growth opportunities have never been stronger" said Lauren Hobart, President and CEO of Dick's.

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

Sales Growth

Dick's is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

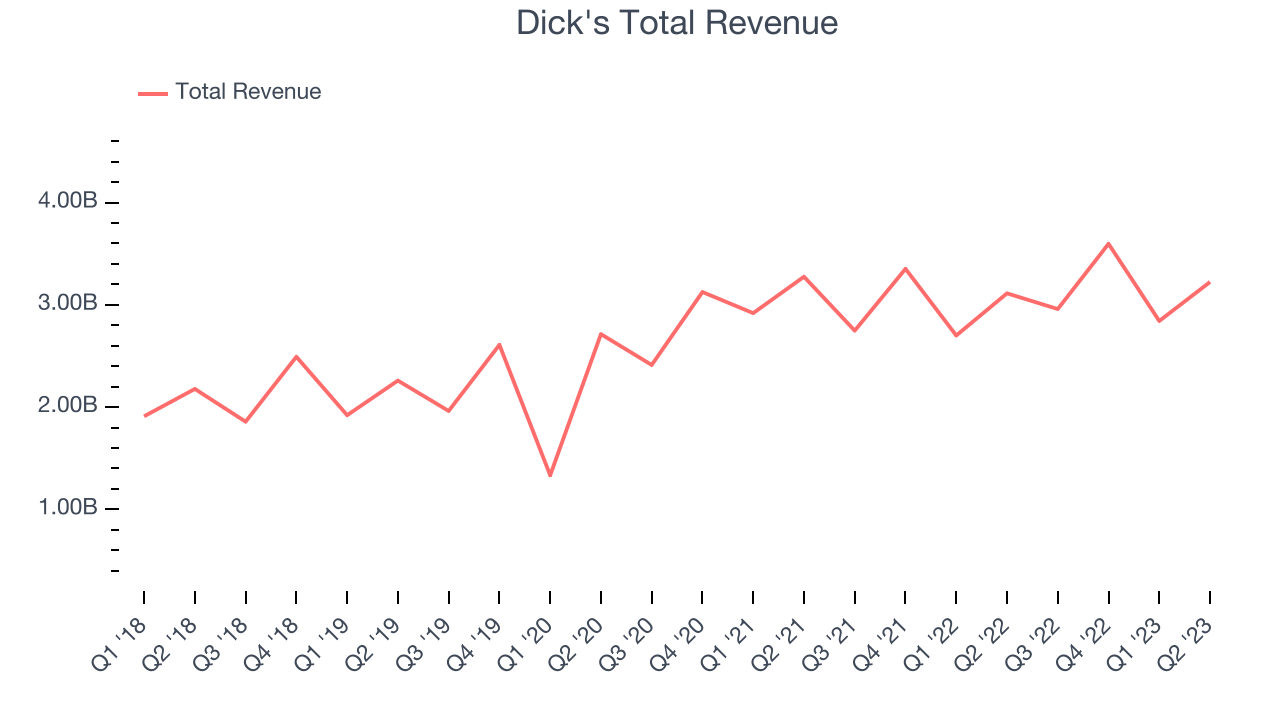

As you can see below, the company's annualized revenue growth rate of 10.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it opened new stores and grew sales at existing, established stores.

This quarter, Dick's grew its revenue by 3.57% year on year, falling short of Wall Street's estimates. Looking ahead, the analysts covering the company expect sales to grow 3.69% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

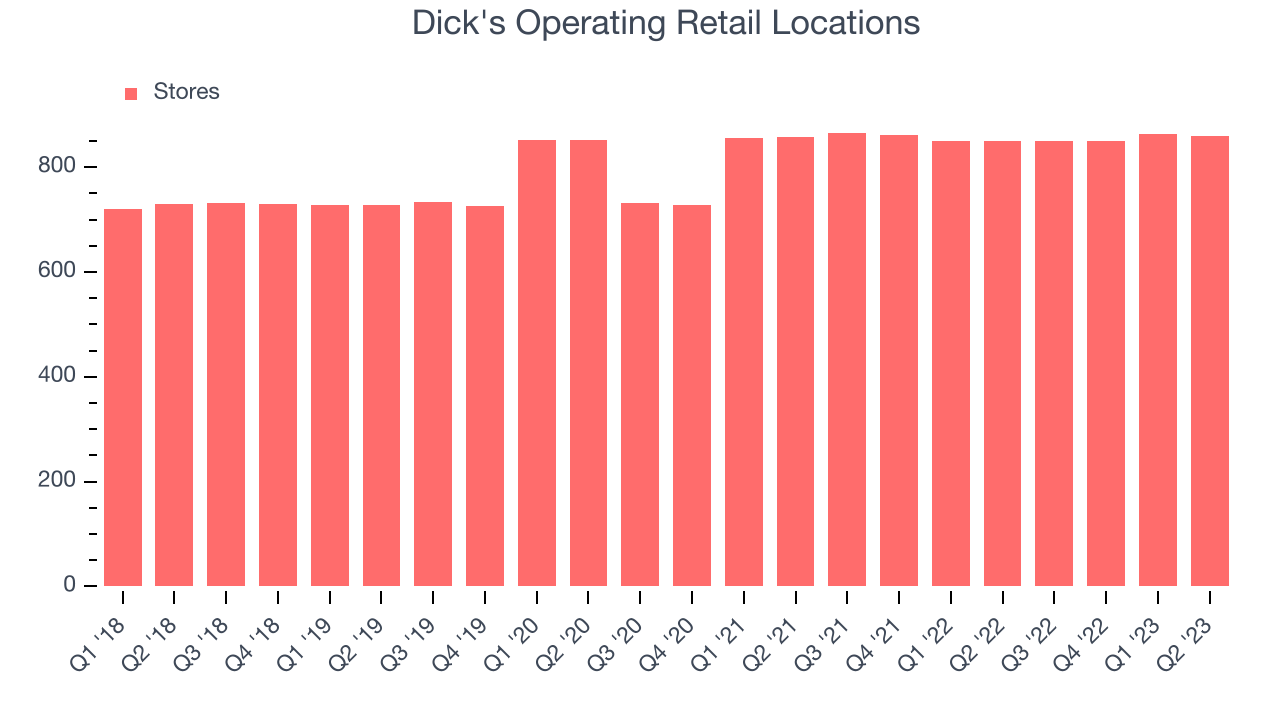

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like Dick's is opening new stores, it usually means that demand is greater than supply, and in turn, it's investing for growth. Since last year, Dick's store count increased by 10 locations, or 1.18%, to 860 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally opened new stores over the last eight quarters, averaging 4.34% annual growth in its physical footprint. This is decent store growth and in line with other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

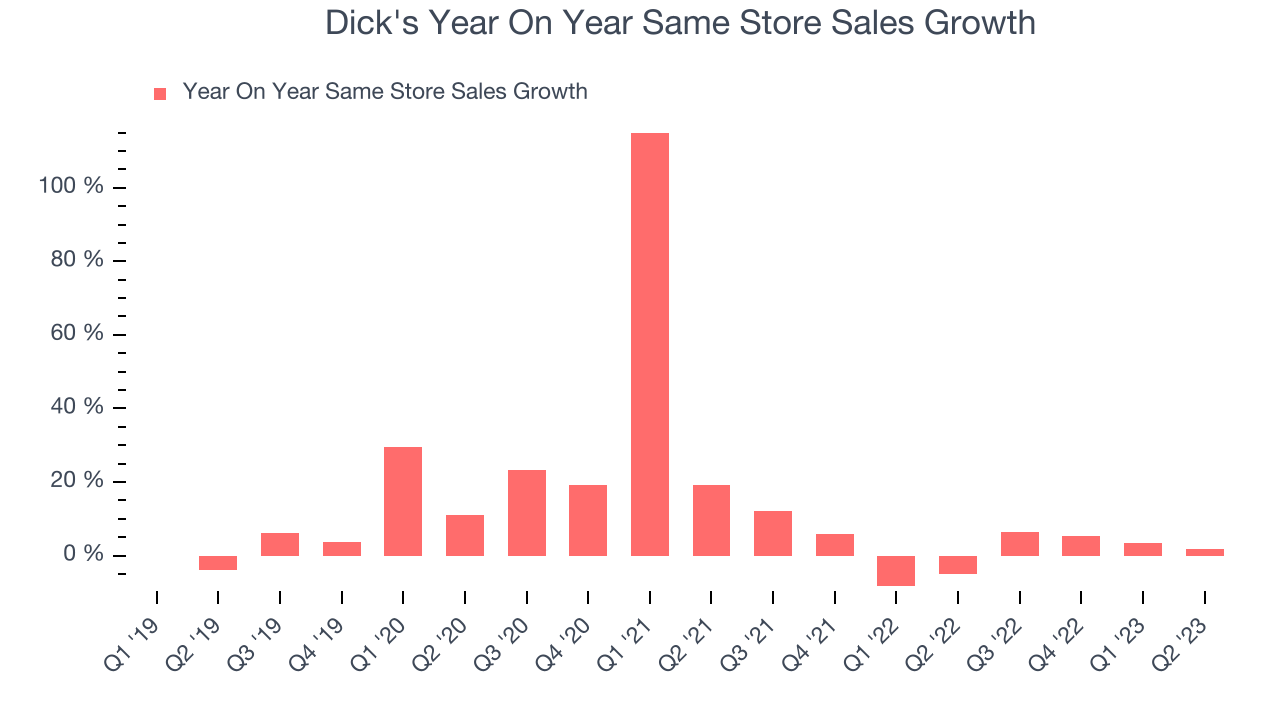

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Dick's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.7% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Dick's is reaching more customers and growing sales.

In the latest quarter, Dick's same-store sales rose 1.8% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from Dick's Q2 Results

Sporting a market capitalization of $12.7 billion, more than $1.9 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Dick's is attractively positioned to invest in growth.

We struggled to find many strong positives in these results. Dick's revenue fell just short of expectations while its EPS and EBITDA missed analysts' estimates by a wide margin due to inventory shrinkage (due to clerical error, goods being damaged, lost, or stolen), which decreases profits. Overall, the results could have been better. The company is down 20% on the results and currently trades at $117.56 per share.

So should you invest in Dick's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)