Coffee chain Dutch Bros (NYSE:BROS) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 29.4% year on year to $443.6 million. On the other hand, the company’s full-year revenue guidance of $2.02 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $0.17 per share was 73.9% above analysts’ consensus estimates.

Is now the time to buy Dutch Bros? Find out by accessing our full research report, it’s free.

Dutch Bros (BROS) Q4 CY2025 Highlights:

- Revenue: $443.6 million vs analyst estimates of $424.7 million (29.4% year-on-year growth, 4.5% beat)

- Adjusted EPS: $0.17 vs analyst estimates of $0.10 (73.9% beat)

- Adjusted EBITDA: $72.64 million vs analyst estimates of $60.11 million (16.4% margin, 20.9% beat)

- EBITDA guidance for the upcoming financial year 2026 is $360 million at the midpoint, below analyst estimates of $365.2 million

- Operating Margin: 7.7%, up from 4.6% in the same quarter last year

- Locations: 1,136 at quarter end, up from 982 in the same quarter last year

- Same-Store Sales rose 7.7% year on year, in line with the same quarter last year

- Market Capitalization: $6.80 billion

Company Overview

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.64 billion in revenue over the past 12 months, Dutch Bros is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

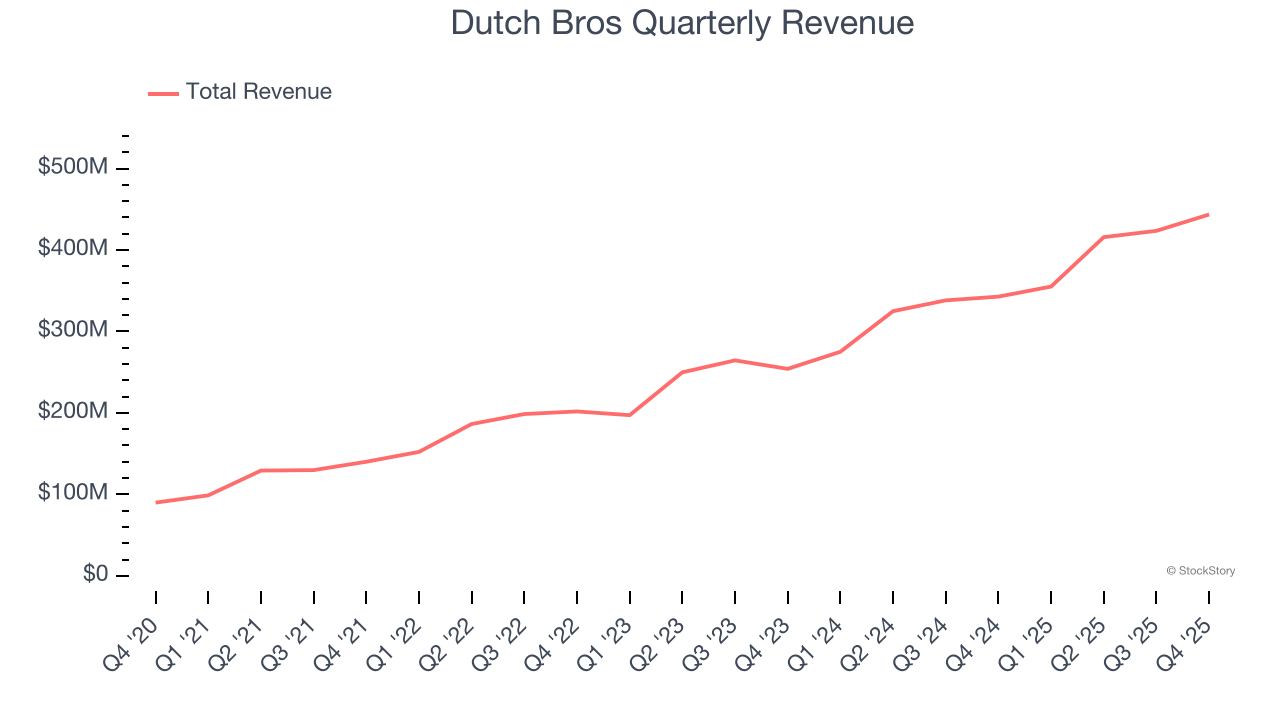

As you can see below, Dutch Bros grew its sales at an incredible 37.9% compounded annual growth rate over the last six years as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Dutch Bros reported robust year-on-year revenue growth of 29.4%, and its $443.6 million of revenue topped Wall Street estimates by 4.5%.

Looking ahead, sell-side analysts expect revenue to grow 24.4% over the next 12 months, a deceleration versus the last six years. Despite the slowdown, this projection is commendable and indicates the market sees success for its menu offerings.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Dutch Bros operated 1,136 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 17.6% annual growth, much faster than the broader restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

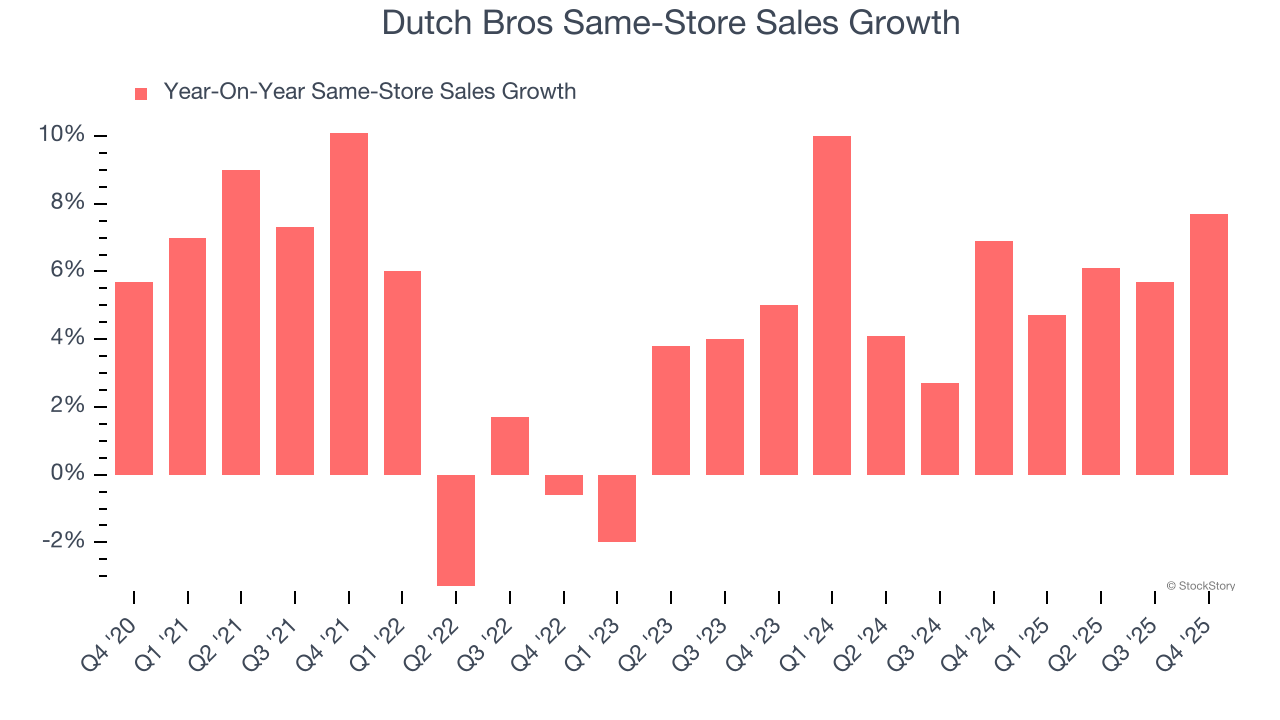

Dutch Bros has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6%. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Dutch Bros’s same-store sales rose 7.7% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Dutch Bros’s Q4 Results

It was good to see Dutch Bros beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance slightly missed and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 15.2% to $58.52 immediately following the results.

Dutch Bros may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)