Home security and automation software provider Alarm.com (NASDAQ:ALRM) beat analysts' expectations in Q2 FY2023, with revenue up 5.18% year on year to $223.9 million. Alarm.com made a GAAP profit of $15.6 million, improving from its profit of $10.8 million in the same quarter last year.

Is now the time to buy Alarm.com? Find out by accessing our full research report, it's free.

Alarm.com (ALRM) Q2 FY2023 Highlights:

- Revenue: $223.9 million vs analyst estimates of $214.3 million (4.48% beat)

- EPS: $0.30 vs analyst estimates of $0.11 ($0.19 beat)

- The company lifted revenue guidance for the full year from $868.7 million to $880 million at the midpoint, a 1.3% increase

- Free Cash Flow of $35.8 million is up from -$5.92 million in the previous quarter

- Gross Margin (GAAP): 61.4%, up from 59% in the same quarter last year

“We’re pleased to report solid results in our second quarter and progress on our goals for this year,” said Steve Trundle, CEO of Alarm.com.

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ:ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

Sales Growth

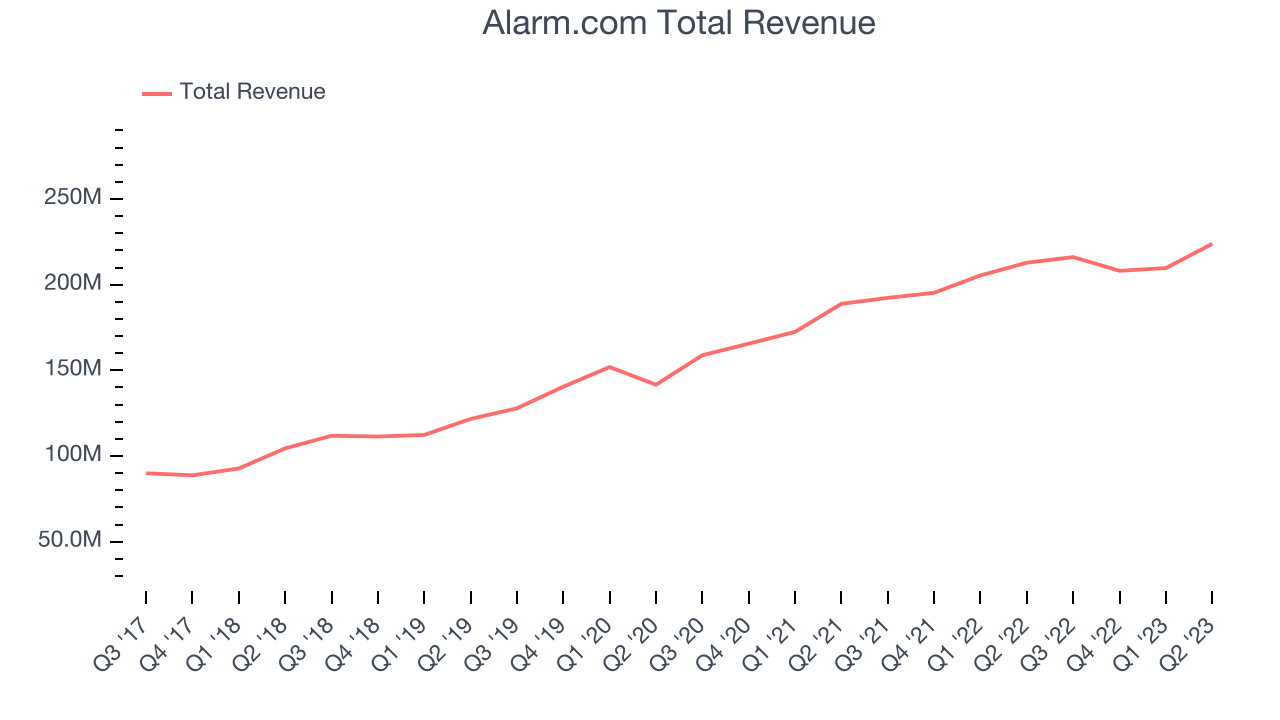

As you can see below, Alarm.com's revenue growth has been unremarkable over the last two years, growing from $188.9 million in Q2 FY2021 to $223.9 million this quarter.

Alarm.com's quarterly revenue was only up 5.18% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $14.2 million quarter on quarter, re-accelerating from $1.58 million in Q1 2023.

Ahead of the earnings results announcement, the analysts covering the company were expecting sales to grow 4.53% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Cash Is King

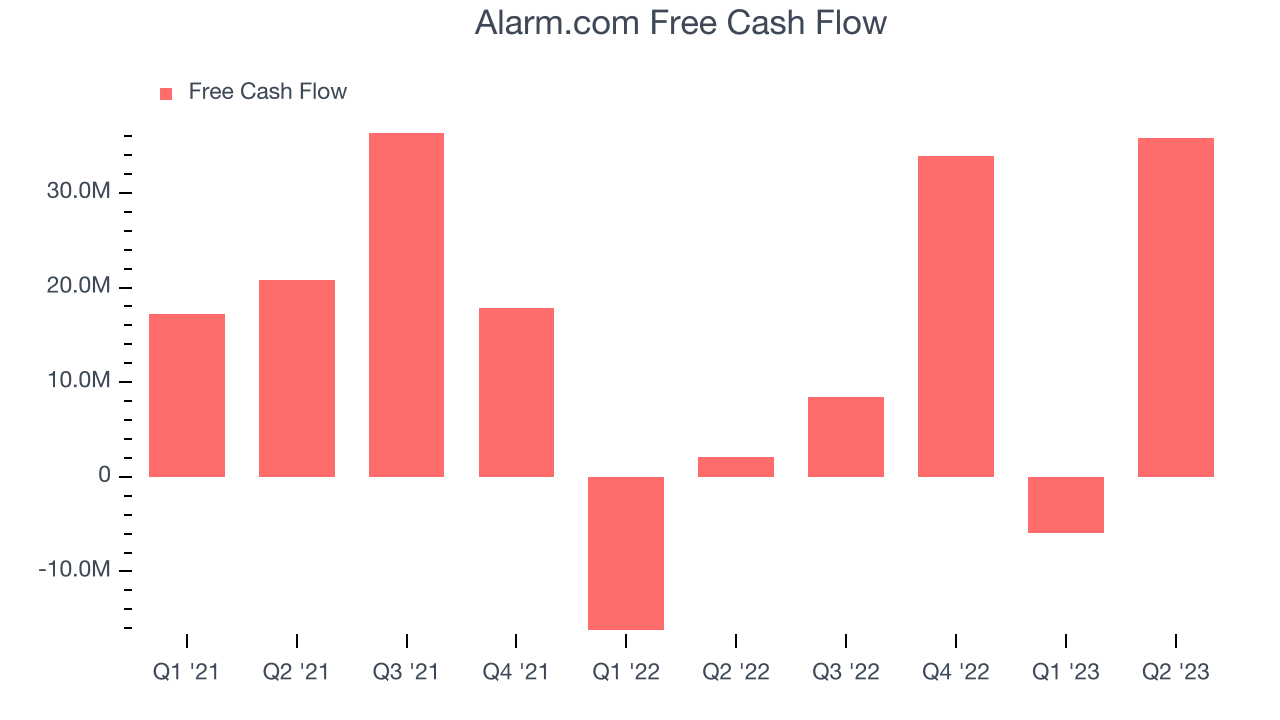

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Alarm.com's free cash flow came in at $35.8 million in Q2, up 1,614% year on year.

Alarm.com has generated $72.2 million in free cash flow over the last 12 months, a decent 8.34% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Alarm.com's Q2 Results

Sporting a market capitalization of $2.48 billion, Alarm.com is among smaller companies, but its more than $627 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was good to see Alarm.com beat analysts' revenue and adjusted EBITDA expectations this quarter. We were also glad that its full-year revenue and adjusted EBITDA guidance (both of which were raised from the full year outlook provided last quarter), came in higher than Wall Street's estimates. On the other hand, its gross margin declined. Overall, this quarter's results seemed positive and shareholders should feel optimistic. The stock is up 6.22% after reporting and currently trades at $52.27 per share.

So should you invest in Alarm.com right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)