Crocs (CROX) shares closed more than 20% higher today after the footwear specialist reported a market-beating Q4 and issued exciting guidance for the full year.

The post-earnings surge pushed CROX’s standard relative strength index (14-day) into overbought territory — a technical setup that traders often read as a sign of a pullback ahead.

Versus its November high, Crocs stock is up nearly 40%, yet there’s reason to believe that it’s not out of juice for the remainder of 2026.

What Could Push Crocs Stock Higher in 2026?

Beyond headline numbers — $958 million in revenue and $2.29 per share of adjusted earnings — the Q4 print warrants investing in CROX stock as it confirmed the brand’s continuing appeal in foreign markets.

The company’s international growth came in at 11.9% in the fourth quarter, more than offsetting continued softness in North America, where sales declined 7.4%.

This suggests that Crocs can drive future growth through expansion in markets where brand penetration remains substantially below mature market levels.

Moreover, while the overbought RSI signals near-term weakness, CROX soared through its major moving averages (MAs) on the post-earnings momentum today, indicating a strong uptrend.

Buybacks Make CROX Shares Even More Attractive

Long-term investors should also consider loading up on Crocs stock because the company’s capital allocation priorities remain shareholder-focused.

In Q4, it repurchased $180 million worth of its stock, demonstrating conviction in continued upside ahead. With some $750 million in remaining authorization, CROX has flexibility for future capital returns as well.

Additionally, the Nasdaq-listed firm reduced its debt by $128 million last year, further diluting an overhang that’s haunted its share price in recent years.

According to Crocs’ management, its cost reduction initiatives targeting $100 million in efficiency will drive earnings per share to (EPS) to over $13 this year — miles ahead of the $11.89 consensus.

Finally, CROX has a history of gaining over 4% in March, a seasonal trend that makes it even more attractive to own in the near term.

How Wall Street Recommends Playing Crocs

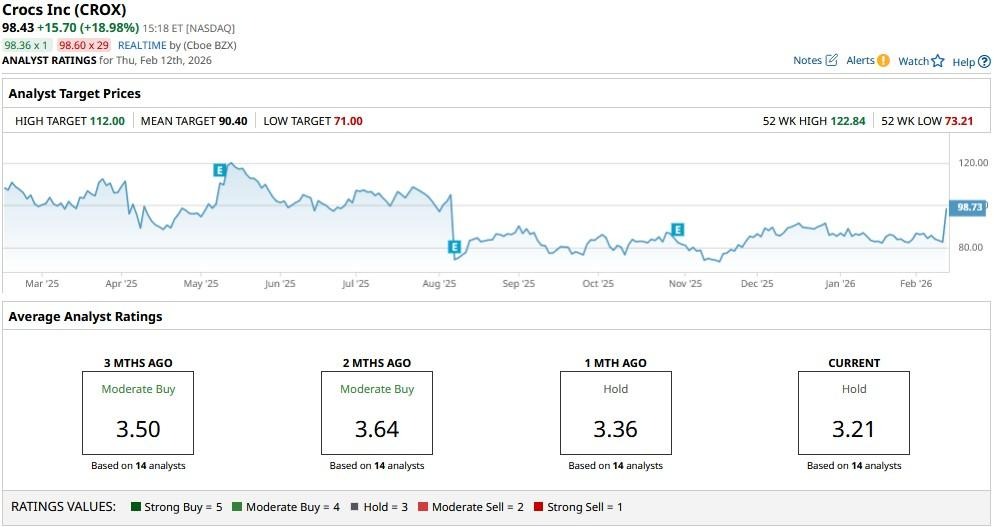

Despite aforementioned positives, however, Wall Street recommends caution in playing Crocs at current levels.

According to Barchart, the consensus rating on CROX shares remains at a “Hold,” with the mean target of about $90 indicating potential downside of roughly 10% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

/Amazon%20pickup%20%26%20returns%20building%20by%20Bryan%20Angelo%20via%20Unsplash.jpg)