/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)

Celestica (CLS) has been one of the hottest artificial intelligence (AI) stocks, rising 116% over the past year. Moreover, it has delivered an impressive gain of 2,145% over the past three years. While such a sharp rally raises concerns around valuation, the company’s prospects remain compelling.

Rising spending on AI infrastructure by major hyperscalers continues to create strong demand for Celestica. Moreover, its plan to invest $1 billion in capacity expansion to support demand further strengthens the long-term investment case.

What Does Celestica Do?

Celestica operates through two core segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS).

ATS serves customers in the aerospace and defense, industrial applications, HealthTech, and capital equipment sectors. CCS focuses on communications and enterprise markets, including servers and storage systems. Celestica supports data center infrastructure for AI, cloud, and hybrid cloud environments. It works with hyperscalers, original equipment manufacturers, and service providers, giving it diversified exposure to long-term technology spending trends.

AI Data Center Networking Is Driving Explosive Growth

One of Celestica's biggest tailwinds right now is the surge in demand from the communications end market, driven by data center networking. Hyperscalers are rapidly upgrading their infrastructure to handle AI workloads, and that has translated into strong demand for high-speed networking equipment. Celestica is directly benefiting from this trend as its switch programs continue to ramp.

This momentum was evident in the company’s recent results. Revenue from the communications end market jumped 79% in Q4, driven largely by strong demand and the scaling of 800G networking switch programs for its largest hyperscaler customers. At the same time, the enterprise end market also delivered robust growth, with revenue up 33%. That increase was fueled by the accelerated ramp-up of a next-generation AI and machine learning compute program for a major hyperscaler client.

A significant portion of its growth is flowing through Celestica’s Hardware Platform Solutions (HPS) business within its CCS segment. HPS generated $1.4 billion in fourth-quarter revenue, up 72% year-over-year (YOY), and accounted for 38% of total company revenue. Growth in this unit was largely attributed to rising volumes in 800G switch programs across multiple hyperscaler customers.

Looking ahead, management expects the current growth trajectory to continue, with revenue expansion accelerating into 2026. The company has also expressed increasing confidence in its longer-term opportunity pipeline, particularly within the CCS segment. Based on current visibility and engagement levels, management expects the growth momentum to extend into 2027.

Celestica’s $1 Billion Bet on Capacity Expansion

To support this demand, Celestica is stepping up its investment. The company now plans to allocate approximately $1 billion in capital expenditures in 2026. These investments will fund new capacity coming online throughout 2026 and 2027. Importantly, management expects to finance this expansion entirely through operating cash flow, limiting balance sheet risk.

The decision to increase capital spending is being driven by record bookings, expanding program scale with existing hyperscaler customers, and significantly improved long-term demand visibility.

Is CLS Stock Still Attractive?

Celestica's stock has already delivered a strong rally, but the investment case still looks compelling. The company continues to benefit from rising global spending on AI infrastructure, a trend that is driving demand for its HPS segment. Strong bookings, deepening relationships with hyperscale customers, and planned capacity expansions all suggest that Celestica is positioned to sustain robust growth in the coming years.

In addition, higher production volumes and productivity initiatives are translating into stronger margins, strengthening the company’s earnings.

From a valuation perspective, Celestica trades at 35.68 times forward earnings. It looks reasonable when viewed alongside the company’s growth outlook. Celestica’s earnings per share are expected to rise by about 49.9% in 2026, followed by another increase of over 45% in 2027.

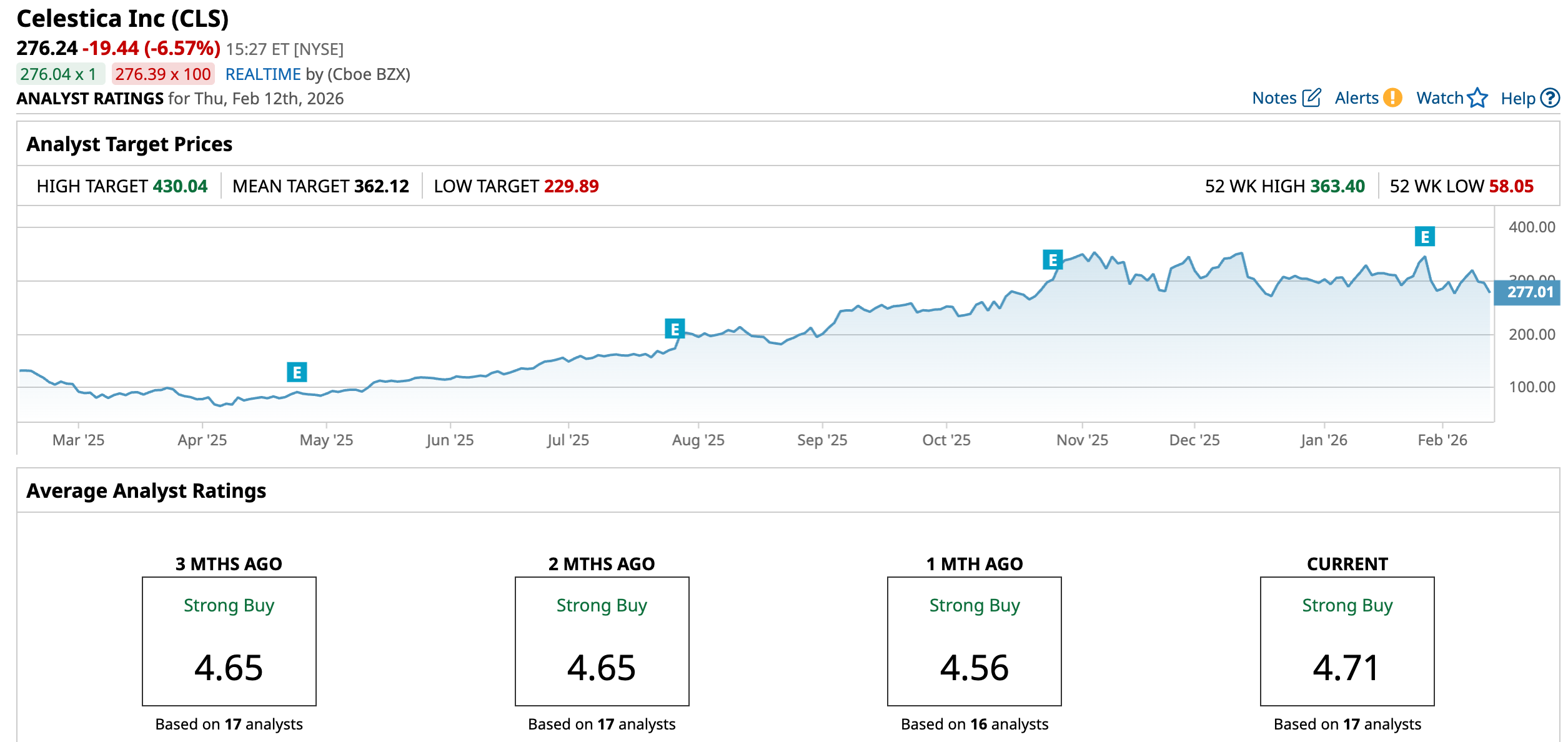

Wall Street is bullish on CLS stock. The consensus “Strong Buy” rating reflects Celestica’s ability to capitalize on long-term AI infrastructure spending.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)