As vertical software stocks’ Q1 earnings season wraps, let's dig into this quarter's best and worst performers, including Agilysys (NASDAQ:AGYS) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 17 vertical software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.61%, while on average next quarter revenue guidance was 0.07% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but vertical software stocks held their ground better than others, with the share prices up 14.1% since the previous earnings results, on average.

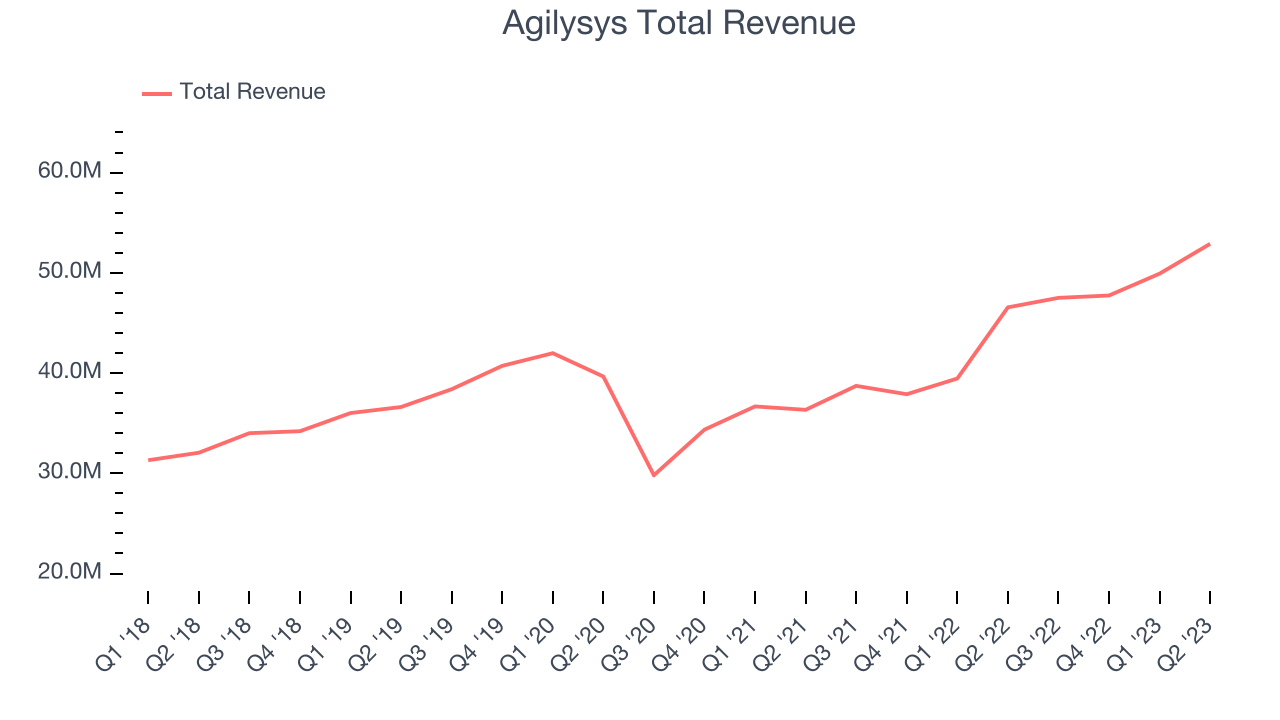

Agilysys (NASDAQ:AGYS)

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

Agilysys reported revenues of $52.9 million, up 13.6% year on year, beating analyst expectations by 1.57%. It was a mixed quarter for the company, with a decent beat of analyst estimates but a decline in gross margin. In addition, revenue and adjusted EBITDA guidance for the full year were below Consensus.

The stock is down 12.5% since the results and currently trades at $68.07.

Read our full report on Agilysys here, it's free.

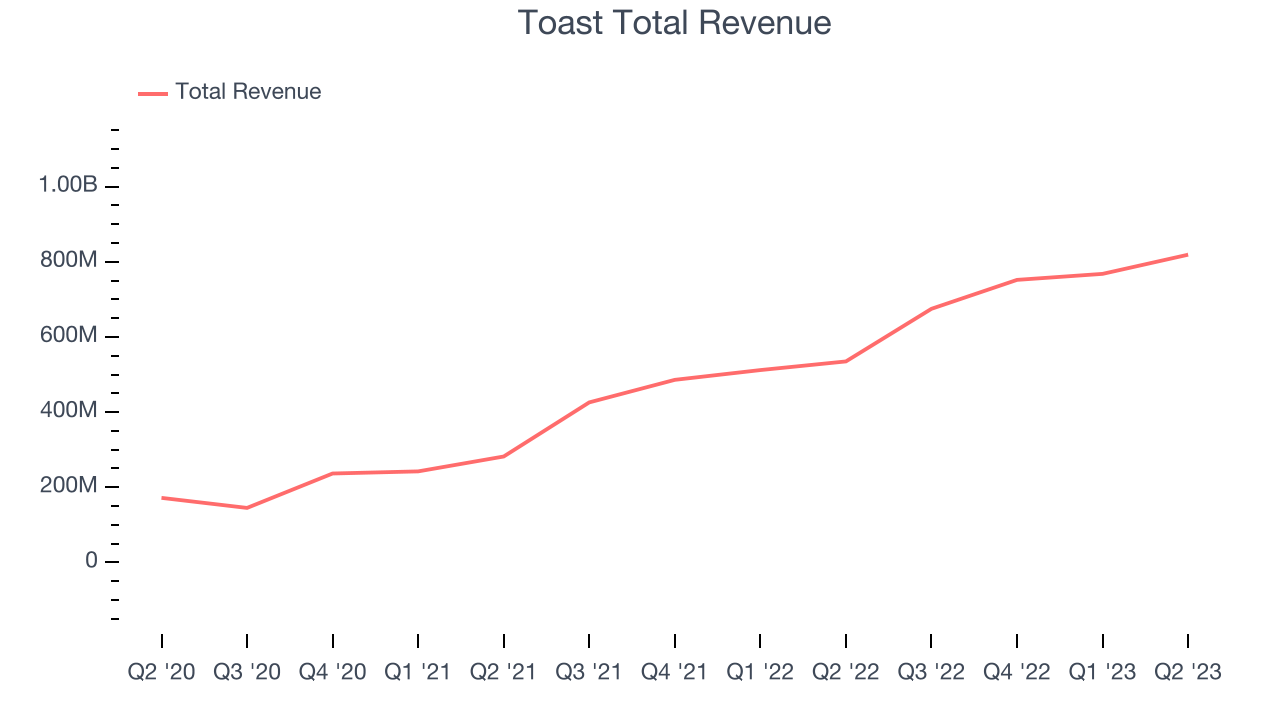

Best Q1: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $819 million, up 53.1% year on year, beating analyst expectations by 7.22%. It was a very strong quarter for the company, with a solid beat of analyst estimates and very optimistic guidance for the next quarter.

Toast pulled off the highest full year guidance raise among its peers. The stock is up 8.89% since the results and currently trades at $21.2.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: nCino (NASDAQ:NCNO)

Founded in 2011 in North Carolina, nCino (NASDAQ:NCNO) makes cloud-based operating systems for banks and provides that software as a service.

nCino reported revenues of $113.7 million, up 20.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for the next quarter missing analysts' expectations. The full-year revenue guidance was roughly in line.

The stock is up 7.32% since the results and currently trades at $29.46.

Read our full analysis of nCino's results here.

Veeva Systems (NYSE:VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $526.3 million, up 4.2% year on year, beating analyst expectations by 1.74%. It was a mixed quarter for the company, with a decent beat of analyst estimates but a decline in gross margin.

The stock is up 22.5% since the results and currently trades at $202.9.

Read our full, actionable report on Veeva Systems here, it's free.

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $52.2 million, up 22.2% year on year, beating analyst expectations by 2.92%. It was a strong quarter for the company, with a significant improvement in net revenue retention rate. In addition, revenue guidance for the next quarter came in above Consensus, while full-year revenue guidance was lifted.

The stock is up 1.03% since the results and currently trades at $6.88.

Read our full, actionable report on Olo here, it's free.

The author has no position in any of the stocks mentioned

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)