Television broadcasting and production company AMC Networks (NASDAQ:AMCX) announced better-than-expected revenue in Q4 CY2025, but sales were flat year on year at $594.8 million. Its non-GAAP profit of $0.64 per share was 3.7% below analysts’ consensus estimates.

Is now the time to buy AMC Networks? Find out by accessing our full research report, it’s free.

AMC Networks (AMCX) Q4 CY2025 Highlights:

- Revenue: $594.8 million vs analyst estimates of $585.2 million (flat year on year, 1.6% beat)

- Adjusted EPS: $0.64 vs analyst expectations of $0.66 (3.7% miss)

- Adjusted EBITDA: -$19.68 million vs analyst estimates of $93.49 million (-3.3% margin, significant miss)

- Operating Margin: -8.6%, up from -42.4% in the same quarter last year

- Free Cash Flow Margin: 6.8%, similar to the same quarter last year

- Market Capitalization: $334.3 million

AMC Networks Chief Executive Officer Kristin Dolan said: "AMC Networks had a successful 2025. Streaming is now the largest single source of revenue in our domestic segment, a significant milestone and inflection point in the ongoing transformation of our business. We delivered free cash flow(1) well ahead of our previously increased forecast and once again achieved our financial guidance for the year. We look forward to continuing to take advantage of our independence and unique strengths as we drive the company forward during a time of change in our industry."

Company Overview

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

Revenue Growth

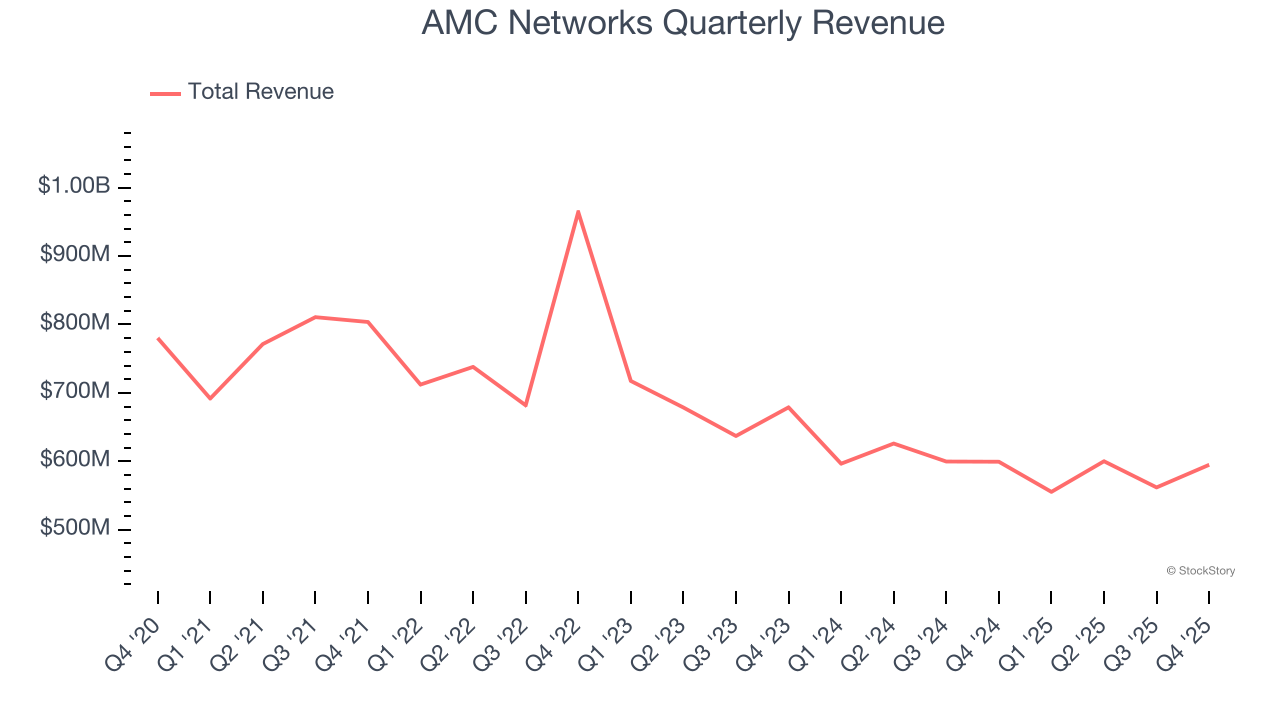

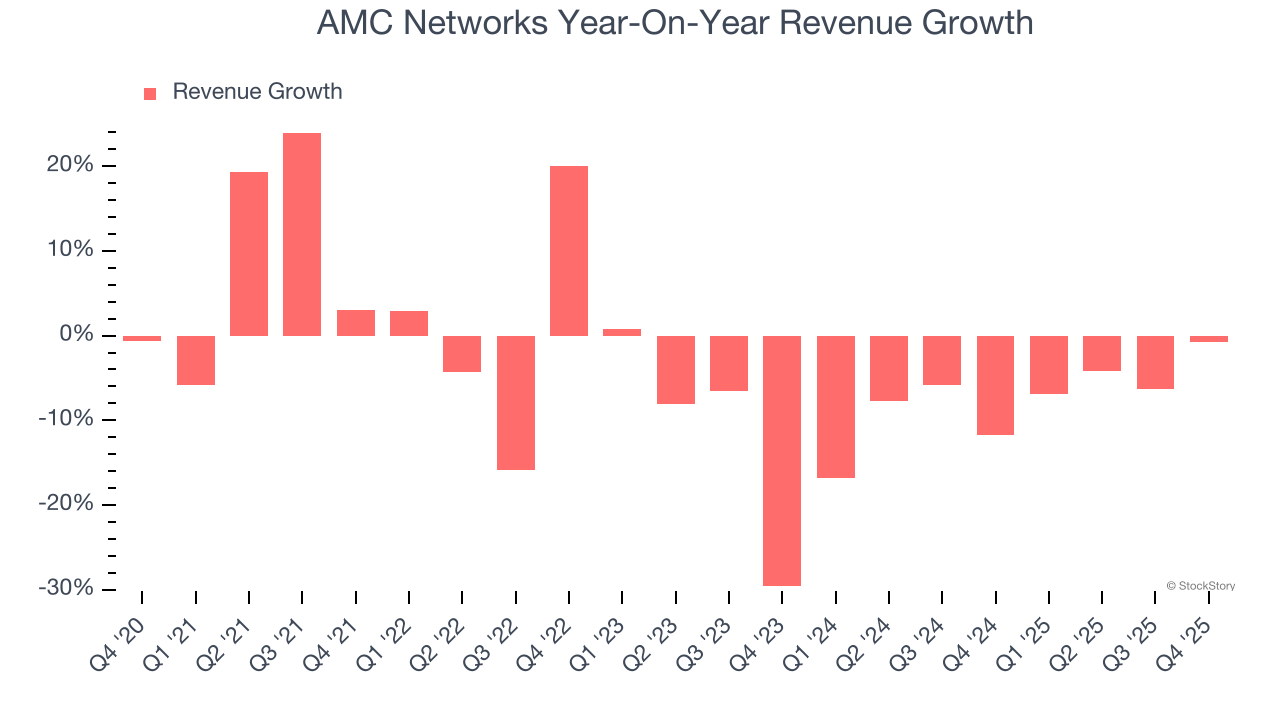

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. AMC Networks struggled to consistently generate demand over the last five years as its sales dropped at a 3.9% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. AMC Networks’s recent performance shows its demand remained suppressed as its revenue has declined by 7.7% annually over the last two years.

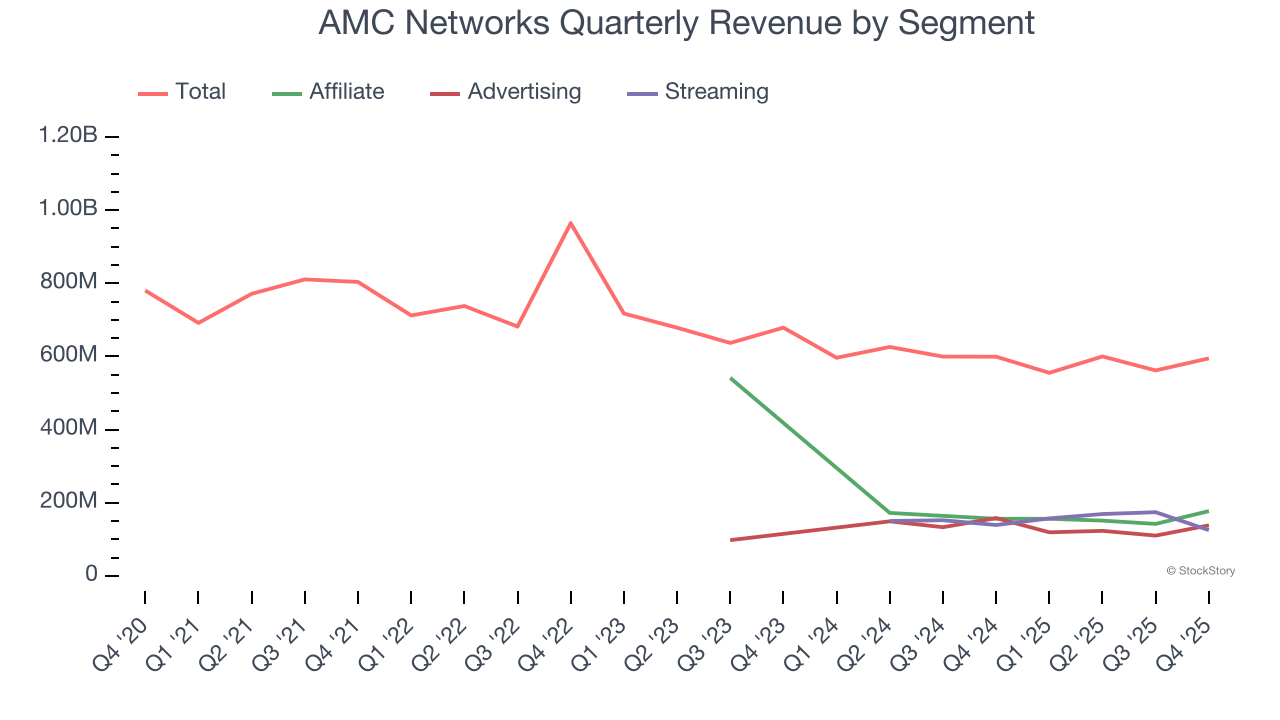

AMC Networks also breaks out the revenue for its three most important segments: Affiliate, Advertising, and Streaming, which are 29.8%, 23.2%, and 21% of revenue. Over the last two years, AMC Networks’s Affiliate (retransmission and licensing fees) and Advertising (marketing services) revenues averaged year-on-year declines of 20.5% and 2.8% while its Streaming revenue (subscription video on demand) averaged 5.7% growth.

This quarter, AMC Networks’s $594.8 million of revenue was flat year on year but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to decline by 2.3% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

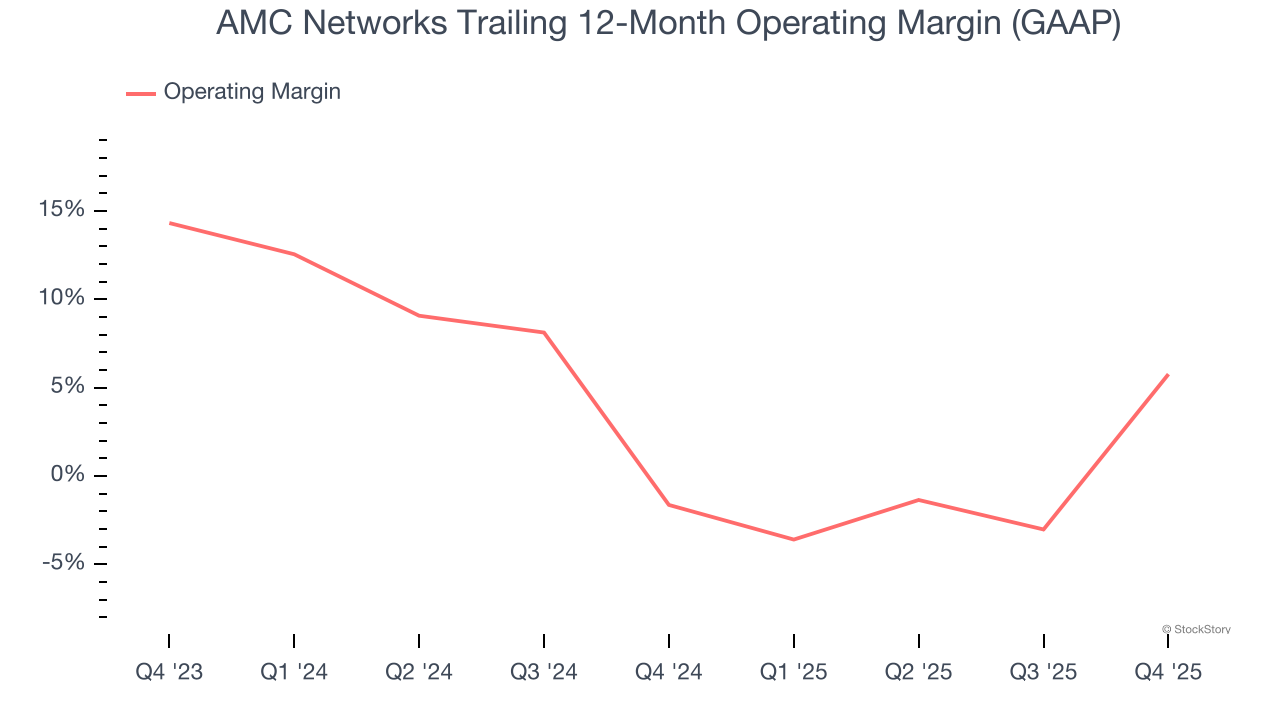

AMC Networks’s operating margin has risen over the last 12 months and averaged 2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, AMC Networks generated an operating margin profit margin of negative 8.6%, up 33.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

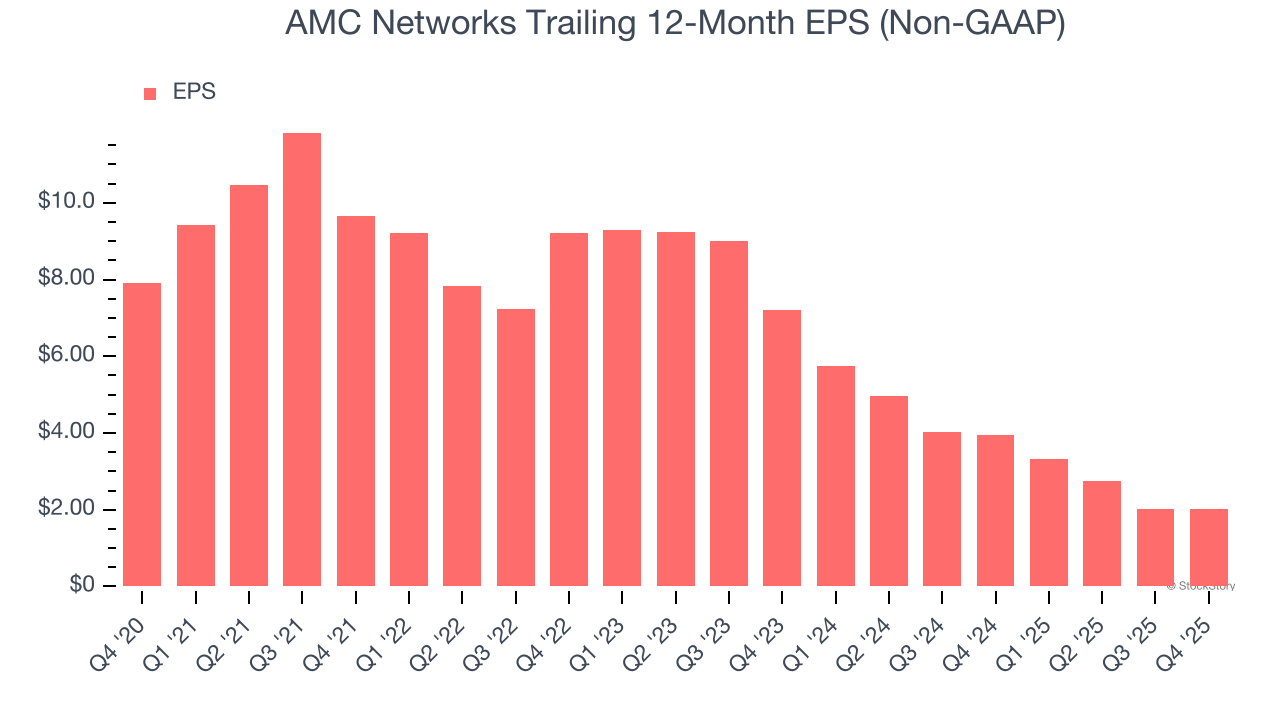

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for AMC Networks, its EPS declined by 23.8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, AMC Networks reported adjusted EPS of $0.64, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects AMC Networks’s full-year EPS of $2.03 to grow 3%.

Key Takeaways from AMC Networks’s Q4 Results

It was encouraging to see AMC Networks beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $7.46 immediately following the results.

AMC Networks may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)