/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

Robinhood (HOOD) shares crashed more than 10% on Feb. 11, after the fintech firm came in short of revenue estimates in its fourth financial quarter of 2025.

As the stock crumbled under the weight of a downbeat earnings release, its relative strength index (14-day) slipped into the deeply oversold territory — a technical setup that often precedes a rebound.

Following the post-earnings plunge, Robinhood stock is down about 50% versus its October high.

Bernstein Recommends Buying Robinhood Stock

Gautam Chhugani, a senior Bernstein analyst, “sees no point in turning negative” on Robinhood, since much of its Q4 weakness was related to “temporary crypto jitters.”

In a research note on Wednesday, he recommended long-term investors to stick with HOOD stock also because it’s “closer to the bottom” now.

Chhugani expects Robinhood’s venture into prediction markets to “spring a big surprise” in 2026. Industry estimates suggest this new segment will soon become a billion-dollar business for HOOD.

As the fintech giant continues to diversify its revenue streams beyond cryptocurrencies, its stock price could more than double from here to $160, he told clients.

HOOD Shares Are Now Cheaper Than SOFI

Robinhood shares are also worth owning on the post-earnings dip because recent data suggests the company has pushed past softness in net new assets (NNAs).

Its latest offerings, including index options and Robinhood Cortex aim at capturing “sophisticated traders.”

Meanwhile, the management’s commitment to scaling the high-yield Gold Card to over 1 million users by year-end could unlock significant further upside in this fintech stock as well.

It's also worth mentioning that a relentless selloff over the past four months has cut HOOD’s valuation multiple to 34x forward earnings, which makes it relatively cheaper to own than peer SoFi Technologies (SOFI) .

What’s the Consensus Rating on Robinhood?

Note that Bernstein isn’t the only Wall Street firm that’s recommending buying HOOD shares on the post-earnings decline.

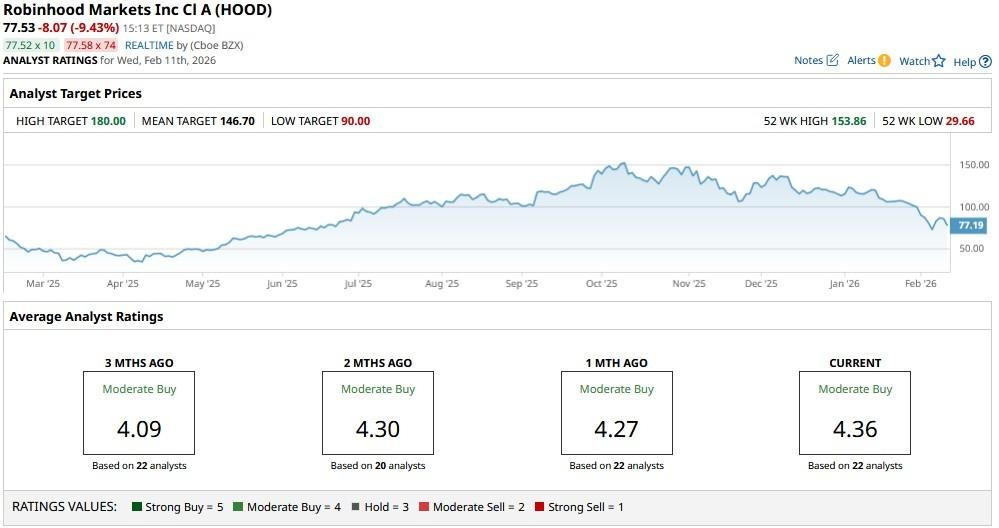

According to Barchart, the consensus rating on Robinhood remains at “Moderate Buy,” with the mean target of about $147 indicating potential upside of more than 87% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)