Infrastructure and defense services provider Parsons (NYSE:PSN) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 7.5% year on year to $1.60 billion. The company’s full-year revenue guidance of $6.65 million at the midpoint came in 99.9% below analysts’ estimates. Its non-GAAP profit of $0.75 per share was 4.9% below analysts’ consensus estimates.

Is now the time to buy Parsons? Find out by accessing our full research report, it’s free.

Parsons (PSN) Q4 CY2025 Highlights:

- Revenue: $1.60 billion vs analyst estimates of $1.67 billion (7.5% year-on-year decline, 4.1% miss)

- Adjusted EPS: $0.75 vs analyst expectations of $0.79 (4.9% miss)

- Adjusted EBITDA: $153.3 million vs analyst estimates of $159.4 million (9.6% margin, 3.8% miss)

- EBITDA guidance for the upcoming financial year 2026 is $645 million at the midpoint, in line with analyst expectations

- Operating Margin: 6.6%, in line with the same quarter last year

- Free Cash Flow Margin: 8.5%, up from 6.2% in the same quarter last year

- Backlog: $8.72 billion at quarter end, down 2% year on year

- Market Capitalization: $7.48 billion

CEO Commentary“2025 was a successful year despite a dynamic federal government macroenvironment. We achieved double-digit revenue growth excluding our confidential contract, delivered record adjusted EBITDA and adjusted EBITDA margin, exceeded our cash flow expectation, and secured fifteen contract wins valued at over $100 million for the full year, matching last year's record. These accomplishments validate the strength and resilience of our diversified portfolio. Additionally, we achieved high win rates, maintained strong hiring and record retention rates, were recognized as the number one program manager in the world by Engineering News-Record, and continued to efficiently deploy capital through three accretive acquisitions and increased share repurchases, all while maintaining a strong balance sheet,” said Carey Smith, chair, president and chief executive officer.

Company Overview

Delivering aerospace technology during the Cold War-era, Parsons (NYSE:PSN) offers engineering, construction, and cybersecurity solutions for the infrastructure and defense sectors.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Parsons’s sales grew at a solid 10.2% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Parsons’s annualized revenue growth of 8.1% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Parsons’s backlog reached $8.72 billion in the latest quarter and averaged 1.3% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Parsons was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Parsons missed Wall Street’s estimates and reported a rather uninspiring 7.5% year-on-year revenue decline, generating $1.60 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Parsons was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.5% was weak for an industrials business.

On the plus side, Parsons’s operating margin rose by 3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Parsons generated an operating margin profit margin of 6.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

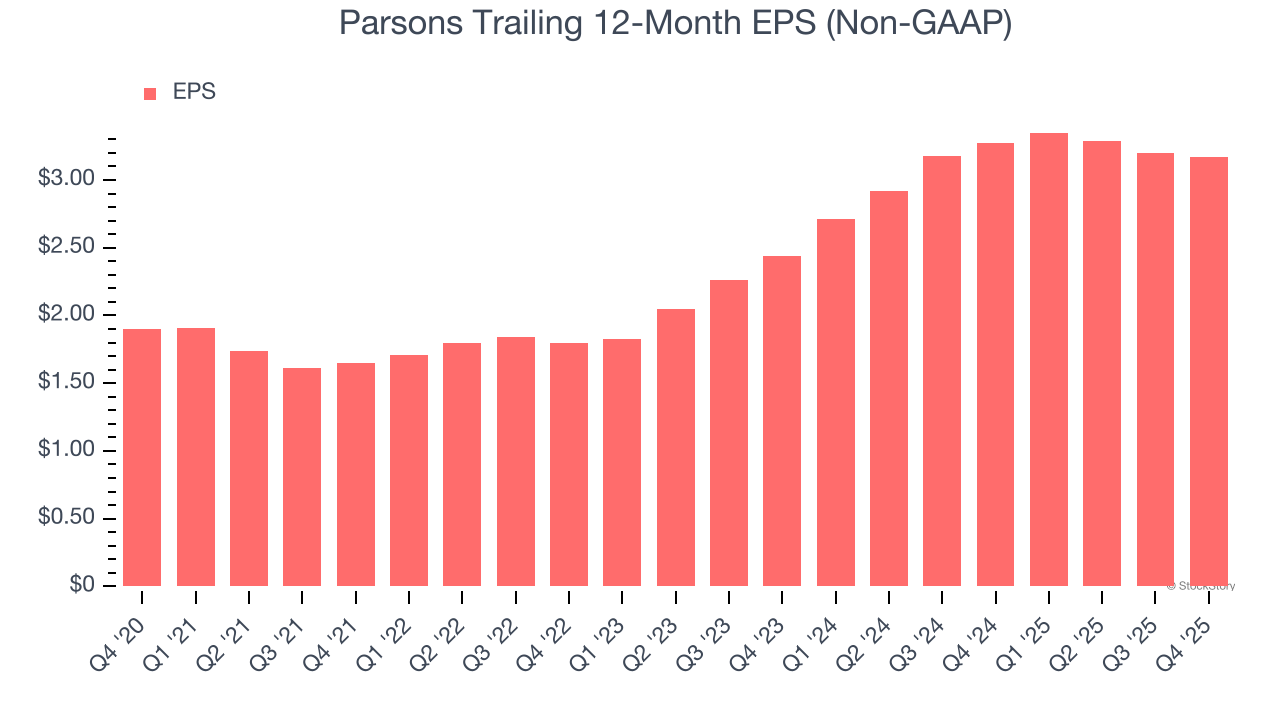

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Parsons’s solid 10.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Parsons’s two-year annual EPS growth of 14% was great and topped its 8.1% two-year revenue growth.

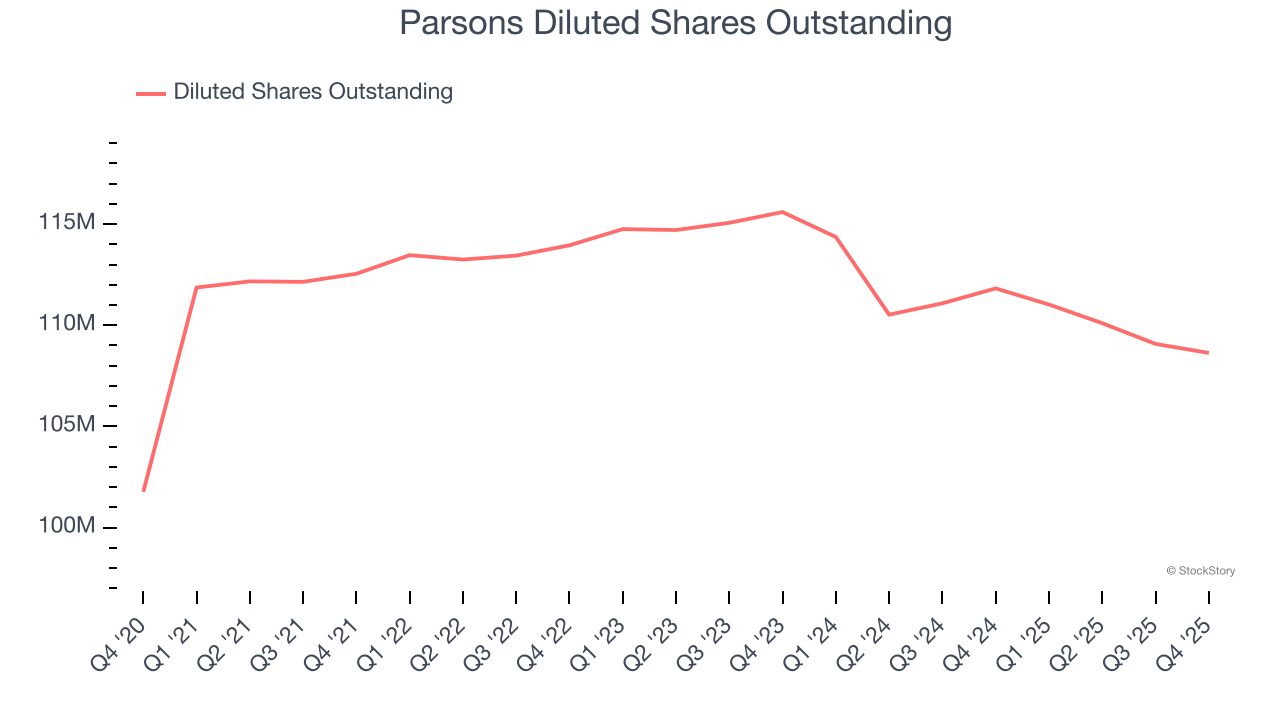

Diving into the nuances of Parsons’s earnings can give us a better understanding of its performance. While we mentioned earlier that Parsons’s operating margin was flat this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 6%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Parsons reported adjusted EPS of $0.75, down from $0.78 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Parsons’s full-year EPS of $3.17 to grow 6.4%.

Key Takeaways from Parsons’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.4% to $68.54 immediately following the results.

The latest quarter from Parsons’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)