Construction materials supplier Martin Marietta Materials (NYSE:MLM) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 6% year on year to $1.53 billion. The company’s full-year revenue guidance of $6.6 billion at the midpoint came in 11% below analysts’ estimates. Its GAAP profit of $4.62 per share was 7.2% below analysts’ consensus estimates.

Is now the time to buy Martin Marietta Materials? Find out by accessing our full research report, it’s free.

Martin Marietta Materials (MLM) Q4 CY2025 Highlights:

- Revenue: $1.53 billion vs analyst estimates of $1.62 billion (6% year-on-year decline, 5.1% miss)

- EPS (GAAP): $4.62 vs analyst expectations of $4.98 (7.2% miss)

- Adjusted EBITDA: $577 million vs analyst estimates of $574.1 million (37.6% margin, 0.5% beat)

- EBITDA guidance for the upcoming financial year 2026 is $2.49 billion at the midpoint, below analyst estimates of $2.53 billion

- Operating Margin: 22.2%, down from 24.4% in the same quarter last year

- Free Cash Flow Margin: 27.6%, similar to the same quarter last year

- Market Capitalization: $42.7 billion

Ward Nye, Chair, President and CEO of Martin Marietta, stated, "2025 was another year of strong growth for Martin Marietta. Our aggregates business once again delivered record profitability and meaningful margin expansion, reflecting strong strategic and commercial discipline and a consistent focus on what we can control. Our highly complementary Specialties business also achieved record revenues and gross profit, underscoring its differentiated value and strategic importance within our portfolio. Notably, we delivered these results despite single-family housing and nonresidential square footage starts, the two macro indicators most highly correlated with aggregates demand, remaining approximately 20% below their post-COVID peaks. Importantly, our heritage operations recorded their safest year ever, as measured by total reportable incidents, reinforcing that world-class safety remains the foundation of our long-term financial strength.

Company Overview

Operating one of North America's largest networks of quarries, including 14 underground mines, Martin Marietta Materials (NYSE:MLM) is a natural resource-based building materials company that supplies aggregates, cement, and other construction materials for infrastructure and building projects.

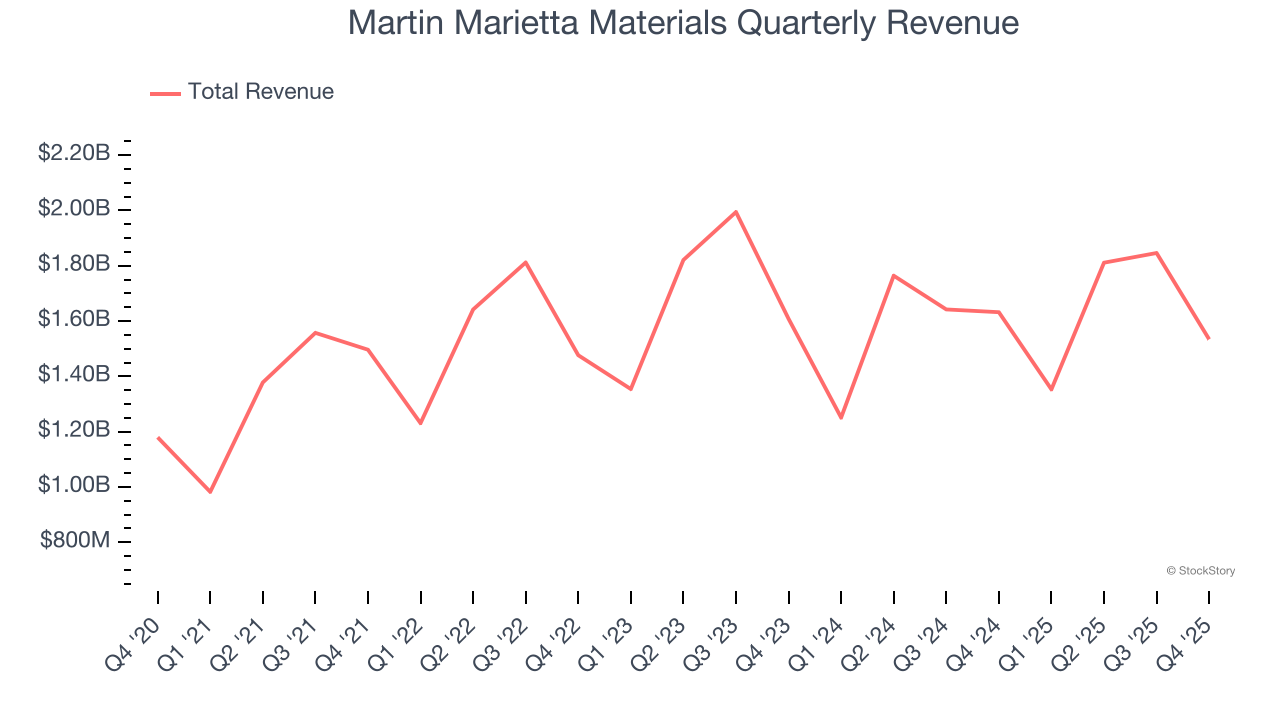

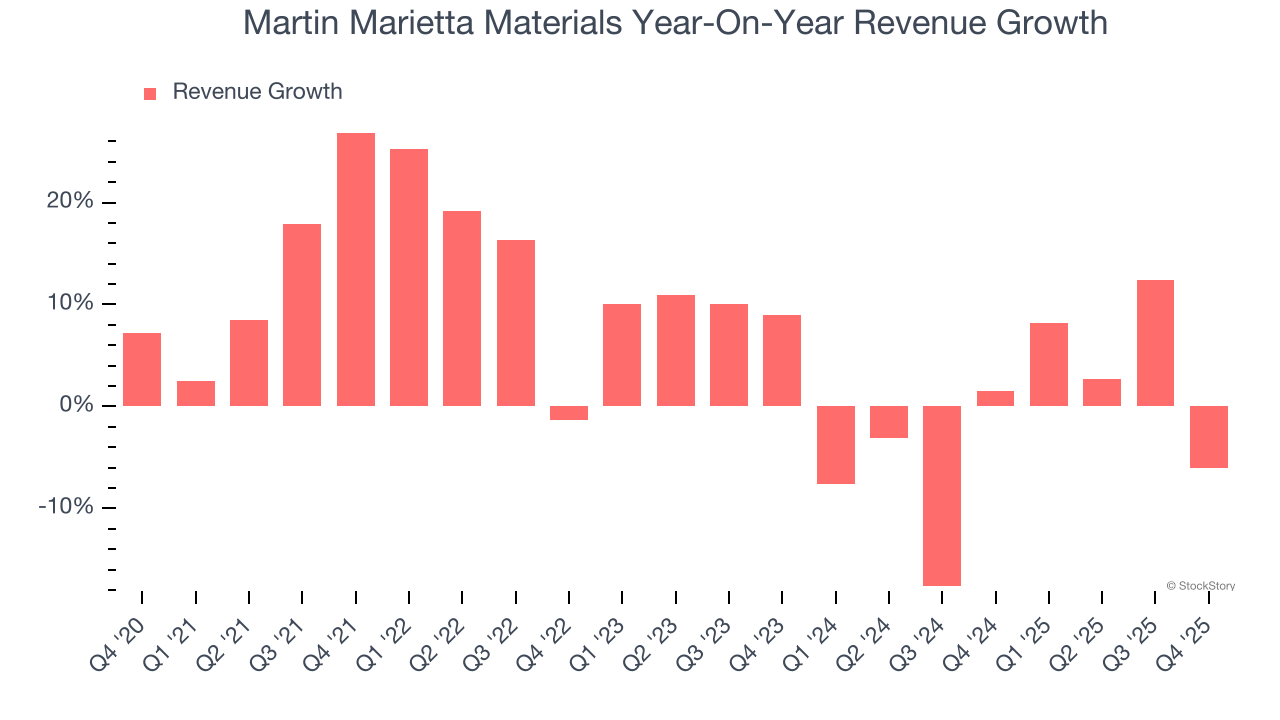

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Martin Marietta Materials grew its sales at a mediocre 6.7% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Martin Marietta Materials’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.7% annually.

This quarter, Martin Marietta Materials missed Wall Street’s estimates and reported a rather uninspiring 6% year-on-year revenue decline, generating $1.53 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

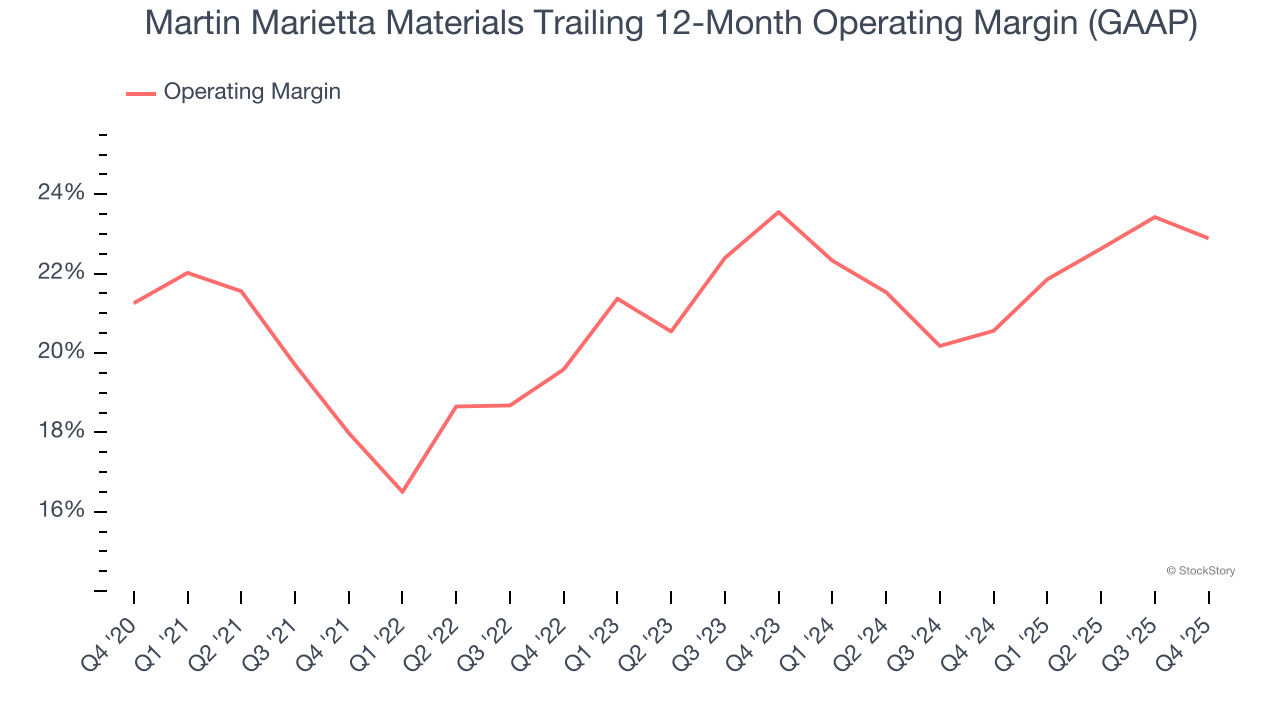

Operating Margin

Martin Marietta Materials has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Martin Marietta Materials’s operating margin rose by 4.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Martin Marietta Materials generated an operating margin profit margin of 22.2%, down 2.2 percentage points year on year. Since Martin Marietta Materials’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

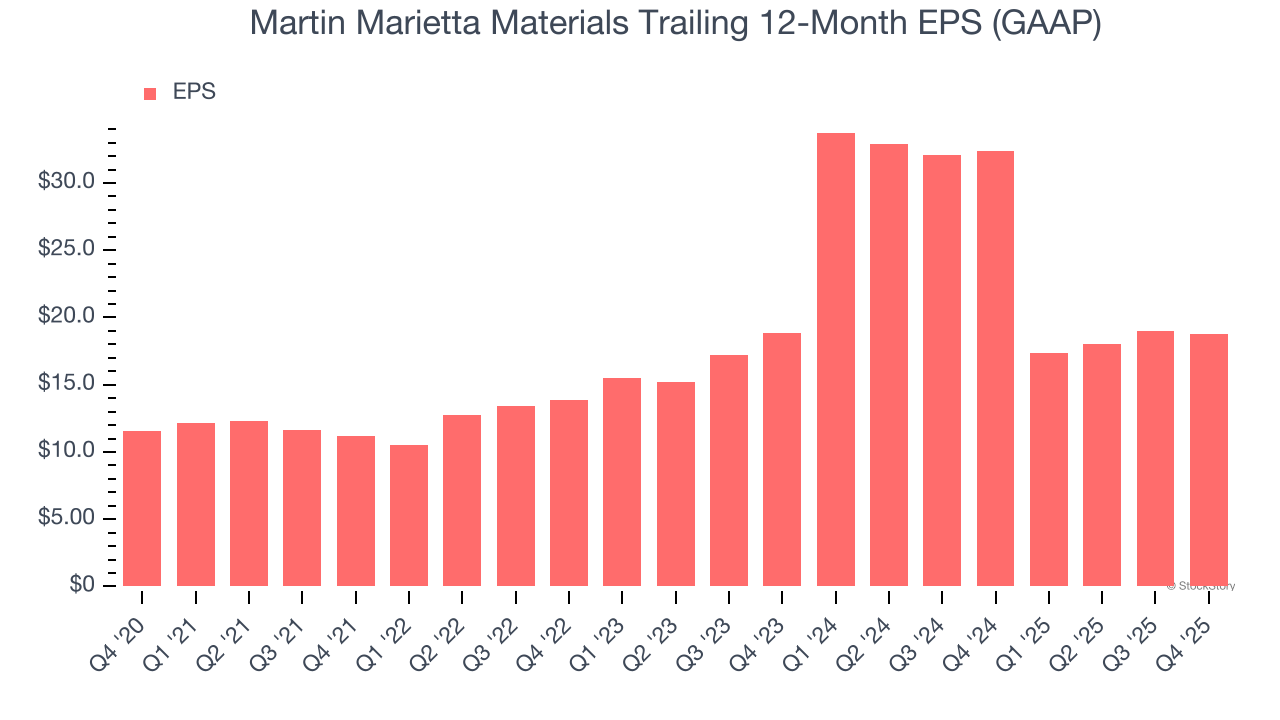

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Martin Marietta Materials’s EPS grew at a solid 10.2% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

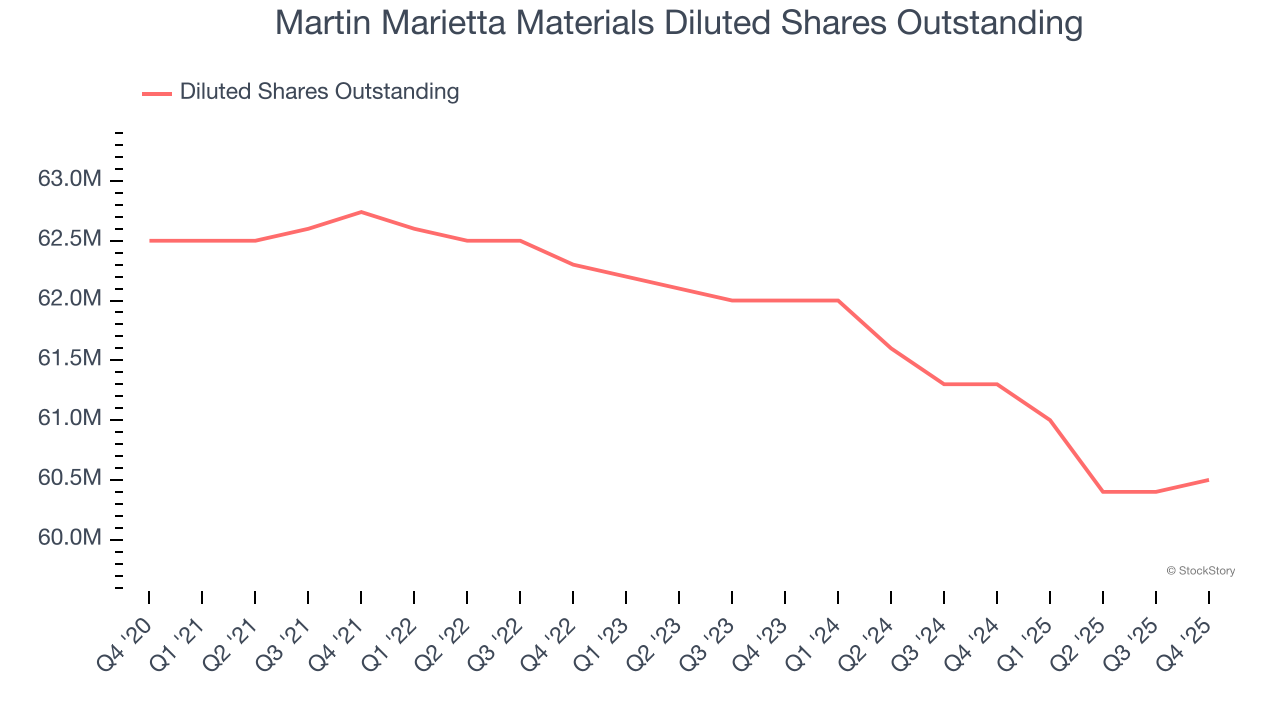

Diving into Martin Marietta Materials’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Martin Marietta Materials’s operating margin declined this quarter but expanded by 4.9 percentage points over the last five years. Its share count also shrank by 3.2%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Martin Marietta Materials, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, Martin Marietta Materials reported EPS of $4.62, down from $4.80 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Martin Marietta Materials’s full-year EPS of $18.81 to grow 17.3%.

Key Takeaways from Martin Marietta Materials’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.2% to $671.08 immediately following the results.

Martin Marietta Materials may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)